2023-7-27 15:00 |

This is an opinion editorial by Marc Taverner, CEO of XEROF, a digital-asset-focused financial services provider.

At long last, we’re entering the era of bitcoin financial products. After several attempts at regulatory approval from numerous financial firms, players like BlackRock may finally get their U.S. bitcoin ETF approved, while global firms like Deutsche Bank are seeking their own crypto licenses.

These institutional movers could be looking to hold bitcoin on their balance sheets ahead of the next halving. But make no mistake: I believe their larger play is to develop financial products for accredited investors and their “normal” customers to access bitcoin.

It’s important to note here that I said “financial products.” They are unlikely to pursue these licenses and approvals only to make it possible for their customers to buy bitcoin directly. This is for several reasons, all of which I hear regularly in my work as a licensed digital asset provider in Switzerland. Here’s why these large banks, investment firms, family offices, etc., won’t just “buy bitcoin.”

Why Financial Firms Won’t Buy Bitcoin For Their Balance SheetsFirst, most customers don’t know how to open or manage their own bitcoin wallets. By “customers,” we’re not just referring to retail customers, but also to sophisticated money managers and institutions. Wallets are still an unforgiving and complex element of bitcoin management. Offering direct bitcoin purchases at scale requires infrastructure and education that these institutions are behind in cultivating. Not to mention that they would need to compete with the established dominance and captive market of companies like Coinbase.

Second, financial firms won’t be investing in bitcoin directly because holding the asset itself securely (unless you have a dedicated bitcoin security team) is hard to manage. And that is before they consider how to manage it for thousands or millions of customers. Holding direct bitcoin in wallets makes their institution a target for hackers, criminals or internal bad actors. I have seen an influx of consultancies helping these institutions create their own highly-secure cold storage processes and procedures. However, like the bank heist movies tell us, no system is completely immune to infiltration.

Third, buying bitcoin could reflect a “loss” of assets under management (AUM). If these institutions were to help their family offices or wealth managers directly buy bitcoin, that is no longer an asset they “manage.” This amount of AUM is a critical metric for banks, investment managers and other institutions. In contrast, by creating products, they would remain in management control.

The fourth reason relates to fee structure. Financial products bring convenience and also make it easier for the institution creating the product to make money. The next wave of bitcoin investors won’t be actively trading (so, there won’t be exchange fees), they’ll be buying and HODLing alongside their larger portfolio. How can you make your fees if bitcoin doesn’t move accounts? By charging a percentage fee of AUM.

Fifth, and perhaps most importantly: The upcoming halving will slice the supply of bitcoin itself, which based on the past, will be outmatched by demand. The current price of bitcoin, approximately $29,000 at the time of writing, has not yet built in the effects of the halving, but I’m sure it will and I fully expect the price to rise above $100,000 after the halving. And at that point, demand will increase.

How The Next Halving Changes ThingsInvestors and institutions wishing to capitalize on this opportunity will see lower bitcoin liquidity, 50% to be exact, which will increase competition for access to this limited resource. They will do what they’ve done in years past: look to invest in privately-held and publicly-listed Bitcoin miners or use a Bitcoin financial vehicle.

When I worked at European bitcoin miner Bitfury, we saw this influx of interest every four years as the halving drove up demand and prices and watched it wane as the price steadied itself to match demand.

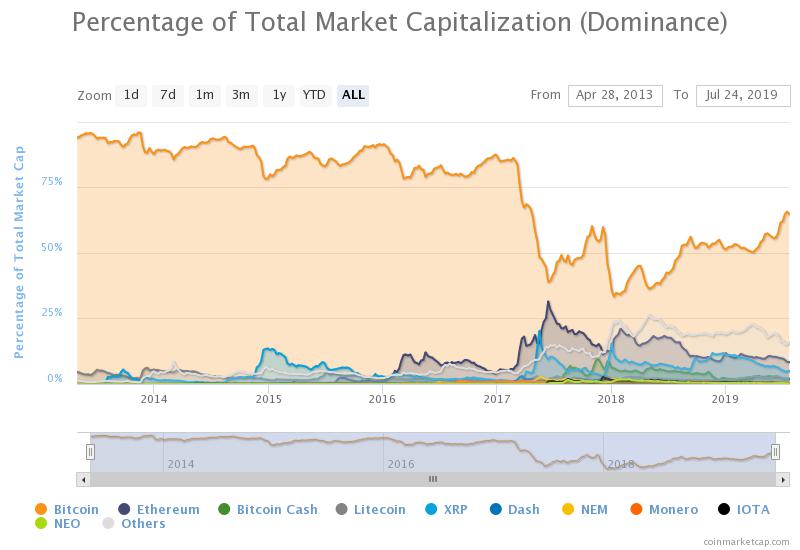

But this coming halving, only the fourth ever, will be different. If any ETF manages to be approved by then, it will join the ranks of other bitcoin financial products (like Europe’s ETPs and active-managed certificates), which will see their star power rise alongside bitcoin demand.

I’d like to note that the Bitcoin halvings have always represented economic opportunity. Twelve months after the first halving, the price of bitcoin had increased by over 9,000% when rewards dropped from 50 to 25. Similar surges in price were seen following the second and third halvings as well. Still, without corresponding, easy and low-friction avenues to access bitcoin (besides buying bitcoin or investing in miners), the price didn’t fully reflect its increasing scarcity. Now, with greater awareness and easier/lower friction methods to access bitcoin, I believe it will.

So, why celebrate these entrants if they’re just adding layers of complexity and their pricing structure to what is already a stupendous asset? Because it’s great for the bitcoin price. More Bitcoin financial products mean more people (including people with a lot of money) can confidently access bitcoin.

The rise of bitcoin and its sister products is a significant victory. After years of persistence, we have convinced even the most skeptical that a lack of bitcoin reflects a weaker portfolio and an even weaker understanding of digital wealth.

This is a guest post by Marc Taverner. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) íà Currencies.ru

|

|