2024-10-27 21:46 |

Follow Nikolaus On X Here

At the tail end of yesterday, MacroScope, a financial analyst focusing on Bitcoin, revealed a new SEC filing stating that Microsoft is voting this December on whether it should invest in bitcoin.

At first I thought there is no way this happens right now, and figured it will just be a short lived hype, especially after noticing a detail in the filing stating that Microsoft’s board recommends its shareholders to vote AGAINST the proposal of “Assessment of Investment in Bitcoin”.

But then Macroscope came with another update that revealed something promising. Microsoft is urging its shareholders to vote against the proposal because their management “already carefully considers this topic.”

If Microsoft were to follow in the footsteps of MicroStrategy (a wild thing to even type out and say to myself) it would mark an historic milestone for Bitcoin: Microsoft is the third largest company in the world by market capitalization at $3.208 trillion.

Will this actually happen? It’s anyone's guess at the moment. But Michael Saylor has himself reached out to Microsoft’s Chairman and CEO Satya Nadella to discuss the possibility. If there’s one man who can speak Nadella’s language and get the job done, it’s Saylor. And there are plenty of reasons why Microsoft should invest in bitcoin… like having $75 billion in cash on hand that is just melting away like an ice cube.

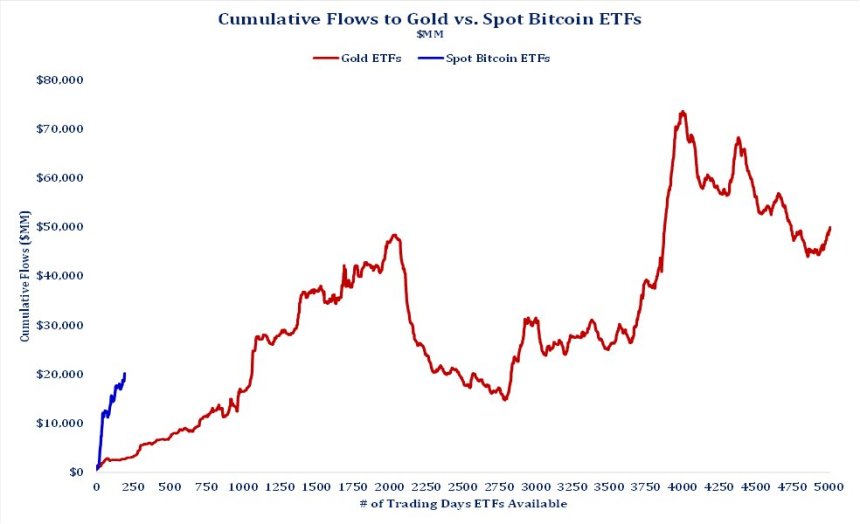

Having said that, just because Saylor understands the importance of holding actual BTC on their balance sheet, he also knows that other large corporations interested in investing in Bitcoin might prefer a different method of exposure (like purchasing shares of spot Bitcoin ETFs). So if Microsoft were to invest into Bitcoin, I think they will likely just buy shares of BlackRock and others Bitcoin ETFs. (I would love to be wrong though, and have them actually buy the BTC and hold it themselves on their balance sheet.)

In any case, one thing for certain after reading all this: Bitcoin is now too large to ignore, even for the biggest companies in the world.

This article is a Take. Opinions expressed are entirely the author's and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

origin »Bitcoin (BTC) на Currencies.ru

|

|