2020-4-21 02:00 |

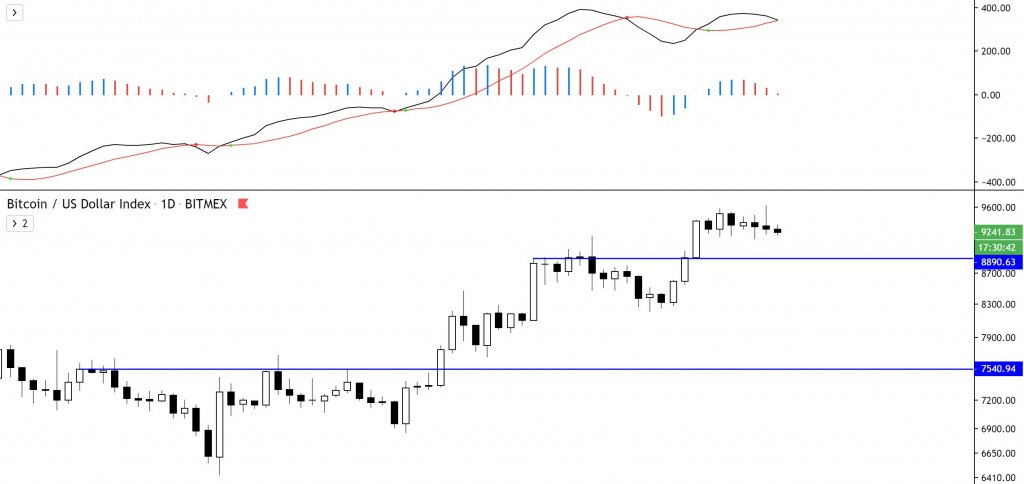

Bitcoin has been caught within a steady uptrend throughout the past month, with the benchmark cryptocurrency’s overtly bullish reaction to its capitulatory drop to lows of $3,800 looking increasingly like a long-term bottom. The bullishness of Bitcoin’s “V-shaped recovery” from these lows has significantly boosted investor sentiment, leading many market participants to forecast imminent upside in the mid-term. This positive shift in sentiment is elucidated by massive growth seen on one of BTC’s fundamental indicators, which suggests that the crypto could soon see a breakout rally – assuming that history rhymes. Bitcoin Investors Grow Bullish as Crypto Shows Signs of Forming a Long-Term Bottom The capitulatory decline seen on March 12th was unprecedented and led the crypto to plummet from the lower-$8,000 region to lows of $3,800. This decline was perpetuated by the cascade of liquidations seen on Bitmex that placed an insurmountable level of selling pressure on the cryptocurrency. As soon as Bitmex halted trading on the platform due to a “hardware issue,” the selling pressure quickly vanished, and Bitcoin was able to start rebounding. BTC’s subsequent climb from these lows formed what appears to be a V-shaped bottom, signaling that these levels may not be revisited for a long time. This has led investors to grow increasingly bullish – an occurrence that is indicated while looking towards Bitcoin’s Net Unrealized Profit/Loss indicator from research platform Glassnode – which shows BTC is entering the “optimism” zone. Image Courtesy of Glassnode What Does This Mean for BTC’s Imminent Price Trend? Glassnode explains that the implications of the NUPL reaching the “optimism” zone are quite bullish, as a similar pattern as the one seen on the above chart was flashed just prior to Bitcoin’s rally in April of 2019. “NUPL is approaching the ‘optimism’ zone as BTC passes the $7k mark. We saw a similar pattern in April 2019 – a breakout into this zone usually signifies increased investor confidence and can lead to further price gains,” Glassnode explained. In April of last year, the benchmark cryptocurrency was trading within the $5,000 region before incurring some explosive parabolic momentum that sent it shooting up to highs of over $13,000 in early-July. Should history repeat itself in the coming months, Bitcoin could soon repeat a similar price trend to that which sent it up nearly 200% in April of 2019. The global backdrop that Bitcoin is currently trading against, however, is significantly different than that seen in 2019 and could hamper BTC’s upside potential. Featured image from Unsplash origin »

Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|