2018-11-21 15:00 |

There is still a lot of Ethereum tied up in ICO projects and the fear is that a mass liquidation could send the token back below three figures in price or, even worse, to early 2017 levels.

ETH Back to The Stone Age?Ethereum is already in a world of pain, falling to an 18 month low this week of $126. The colossal dump added to the 11 month long slide represents an epic crash of 91% from its all-time high over just over $1,400 in January.

The latest selloff has been blamed by some on the SEC ruling against two minor players in the ICO world. A week or so before that EtherDelta founder, Zachary Coburn, was also charged by the SEC for operating an unregistered national securities exchange. However, the US regulator has thrown its weight around before so the news is unlikely to be the primary catalyst for Ethereum dumping nearly 40% in just a week.

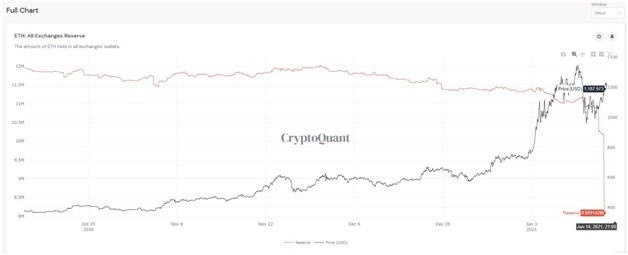

Research by The Block indicates that ICO treasuries now hold a little over 3.57 million ETH, which equates to roughly 3.5% of the total Ethereum supply. Most companies that held an ICO raised funds in ETH and still hold a fair portion of it. A growing concern now is that further action or clampdowns by the SEC on ICOs could force them to reimburse funds in USD. In order to do that, they would have to liquidate their ETH reserves.

Back in April, ICO treasuries held 4.65 million ETH, or 4.5% of the supply. This suggests that they may have already liquidated or moved around 23% since then. According to the research, ICO reserves were holding $1.76 billion, whereas today they hold a fraction at around $475 million. Overall ICO projects have moved or liquidated 64% of the amount that they initially raised so it appears the primary selloff has already happened. In the past two months only 2% has been sold off indicating that the recent purge cannot be blamed on ICO projects just yet.

As Ethereum has become a falling knife lately it stands to reason that ICOs will not sell any more unless they absolutely must. It is currently priced at around $130 which is back at the level it was before the big ICO boom took off in late 2017.

However, a greater concern is that most ICOs are not generating any revenue yet so may need to sell ETH to cover their operating expenses. Add to this the looming threat of further SEC rulings against ICOs and unregistered securities and Ethereum, it seems, may not be out of the woods yet. On the flip, side Ethereum still has a lot of progress to make and plenty of scalability improvements are due in 2019. These will lead to greater adoption which should inject the life back into the ‘world computer’.

Image from Shutterstock

The post ICOs Yet to Liquidate All of Their Ethereum, Could Another Drop be Imminent? appeared first on NewsBTC.

origin »Bitcoin price in Telegram @btc_price_every_hour

Ethereum (ETH) на Currencies.ru

|

|