2022-4-27 20:00 |

On-chain analysis is an important part of the bitcoin ecosystem. It helps to show activity on the network and can give a good indication of how investors are feeling about the digital asset. In the early days, on-chain analysis commanded a lot of respect in the space. However, there have been various things that have muddied the waters that are on-chain analysis. These give rise to questions about the on-chain analysis and if they are truly as accurate as they used to be.

Wrapped Bitcoin And TradFi Are Overlooked?When it comes to pure on-chain analysis, the data that is analyzed is very important to the credibility of the report. This becomes a problem when these on-chain analyses do not take into account new investment avenues that could affect the liquidity of bitcoin. Not only that but the activity of investors in regards to the digital asset. Things such as traditional finance (Tradfi) and Wrapped Bitcoin (WBTC, BTCB) have moved into the bitcoin stage, calling for changes to the way these analyses are performed.

Related Reading | Private Capital Buying The Dip Keeps Crypto Market Afloat

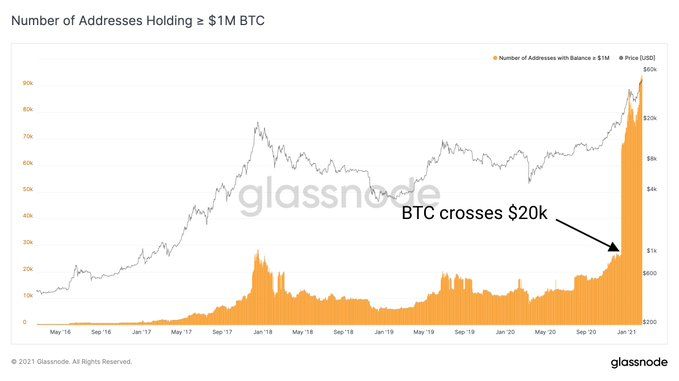

An example of a way that traditional finance metrics are left out is in trading activities being carried out on bitcoins that are under custody. Arcane Research notes that are about 1.1 million BTC that is being held by funds, public companies, and other chains since January 2020. This means that these are all various liquid alternatives for investors to trade BTC and the activities carried out on these alternatives also play a role in bitcoin’s price discovery.

Bitcoin public investment vehicles grows | Source: Arcane ResearchWith Tradfi, BTC can be held in funds, and traders can then sell and buy these ‘paper bitcoins’, basically trading by speculating on the price of the digital asset itself without having to purchase it. Given the volume in these markets, they can greatly impact the price discovery of the digital asset. It is far beyond the reach of the spot market but remains important nonetheless.

These coins held in these avenues can often be marked as illiquid by on-chain analysts because the BTC themselves remain unmoved, even though coins also sitting unmoved in exchanges are not labeled the same way.

Related Reading | Some 340 Robinhood Employees Are About To Lose Their Jobs – Here’s Why

“In essence, relying on macro on-chain data becomes less relevant with time. Traders should be very careful to rely too relevant with time. Traders should be very careful to rely too current market structure. This does not mean that these metrics are entirely useless, but they should always be interpreted with a solid pinch of salt.” – Arcane Research

Using Bitwise’s lead-lag analysis and its internal multi-dimensional information flow analysis, Arcane Research concludes that these realists indicate that linear cash-settled CME futures play a major role in bitcoin’s price discovery.

BTC trading above $39,000 | Source: BTCUSD on TradingView.com Featured image from NewsBTC, charts from Arcane Research and TradingView.com origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|