2023-1-3 16:14 |

Cryptocurrencies have been in the news quite frequently of late, and all for the wrong reasons. There have been price crashes across the board, and exchanges have been wiped off the face of the planet after declaring themselves insolvent. So it begs the question, how did the gambling industry manage to avoid the whole crypto fiasco?

When crypto came on the scene, one of the first suggestions people made was that cryptocurrencies such as Bitcoin, the blockchain technology behind it, and the online gambling industry are very much a perfect fit. Crypto and its technology could offer a lot of positives to gambling operators, but for some reason, the latter has always been very slow in taking an interest, displaying a lot of caution. It led to criticism from some quarters, but now it appears these operators were right to be cautious.

When we talk about operators in this instance, we mean all licensed gaming services which adhere to strict guidelines, and regulated sports betting operators. In some ways, being licensed and regulated gave these reputable companies a reason not to adopt cryptocurrencies, and this was confirmed when speaking to a spokesperson from the global brand, PartyCasino.

As most people will know, unlike these respected services, most cryptos aren’t regulated. They’re decentralised, and as Warren Buffet once said, “they’re worthless.” And this not only went against legislation, but it also meant they were too big of a risk to take on board for operators.

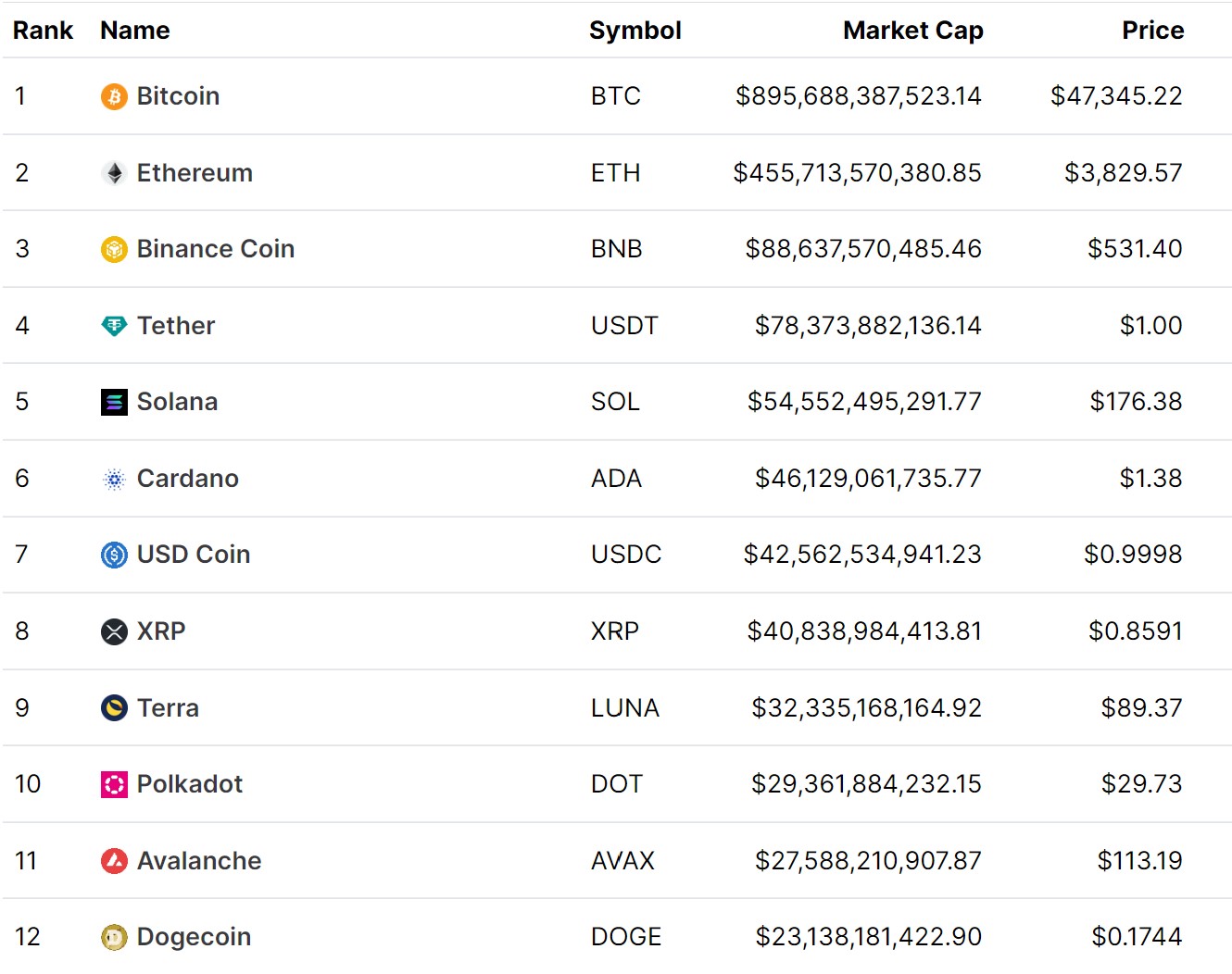

Bitcoin, the market leader on the crypto front, has lost nearly 80% of its value in the last twelve months, which tells you everything you need to know about how unpredictable cryptocurrencies are. In the past, you could have argued that there were suggestions they could be volatile, but because of price recoveries and so on, gambling operators began to warm to the idea of cryptos and their supposed benefits. However, with the real story laid bare, it will only strengthen the concerns many had in the first instance.

You can’t argue against the gambling industry being one that is keen to move with the times and embrace the latest technology and trends. If this wasn’t the case, it wouldn’t be thriving today, even though it’s an industry with a history that stretches back centuries.

But, where currencies and payment methods are concerned, it’s always been guarded in its approach, not only to protect itself but customers too, which has proven to be the right way to go about things.

So, in reality, it is this approach which has enabled the gambling industry to avoid the cryptocurrency fiasco. And you could also suggest that recent events such as the Bitcoin price crash, which has had a knock-on effect on other coins, and the FTX saga, will prevent the gambling industry from ever getting involved with crypto in its current guise. Many will be disappointed at this, but sometimes it’s better to be safe than sorry.

The post How The Gambling Industry Managed To Avoid The Cryptocurrency Fiasco appeared first on CaptainAltcoin.

origin »Bitcoin price in Telegram @btc_price_every_hour

ETH/LINK Price Action Candlestick Set (LINKETHPA) на Currencies.ru

|

|