2021-1-29 16:27 |

Oracles are necessary to bring off-chain data and information into the blockchain Money’s Oracle blockchain technology is building the mechanisms used in the legacy financial system for the cryptocurrency space Money is also working on the Decentralized Finance equivalent of a credit score, which delivers a user’s DeFi history to lending protocols Leveraging trust in legacy finance.

In the legacy financial system, there are safeguards and measures which mitigate risk accordingly to prevent financial institutions from issuing loans to overleveraged borrowers. A borrower’s credit score, along with their benchmark rating, determines the likelihood of their ability to repay a loan. This is true for personal loans, mortgages, lines of credit and all other products offered by the legacy banking infrastructure.

Currently, the advent of DeFi in the cryptocurrency space has sparked an entirely new way to interact within a financial system that is intrinsically separated from the legacy system, which for so many years has kept its thumb firmly pressed on the public which engages with it. This has led to what is being referred to as the DeFi revolution. At the time of writing this article the total value locked (TVL) as indicated by DeFi Pulse (defipulse.com/) in DeFi measured in USD is sitting at just over $22 Billion dollars. That would mark a 3190% growth year-over-year. The majority of that growth over 100%, moving the bar from $11B to over $22B, occurred in the last 90 days. There hasn’t been a sector that has experienced anything remotely close to this amount of growth, ever.

Of course, it’s normal that when anything grows at such a rapid rate — be it an industry, sector, organization or otherwise — would experience oversights or shortcomings to the infrastructural scaffolding that holds it up. In the case of DeFi, we clearly see the desire to engage with protocols. However, the Collateralized Debt Position ratio is still quite uneven and arbitrary. A user with an exceptional history of repaying loans on time, avoiding defaults and engaging in trustworthy and prudent behaviour is grouped in the same category of DeFi user that partakes in the absolute opposite behaviour.

Enter Bird.Money, its Oracle and the Trust Network.

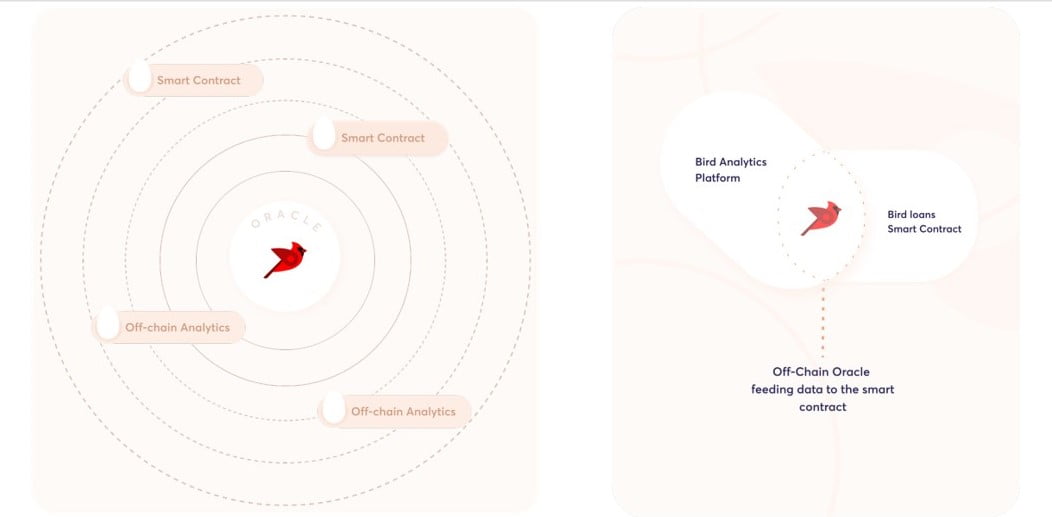

There are Oracles. Then there are Bird Oracles.For those just entering the fascinating world of cryptocurrency and Decentralized Finance, an Oracle delivers data from outside of the blockchain to within the blockchain. This may seem like a rudimentary explanation, however it is more nuanced than what may appear from the onset. Reason being that blockchains themselves operate as silos, in that it is actually difficult to factor in data from outside of the blockchain without the presence of a delivery source that can communicate with the blockchain itself. In this case, Oracles provide that necessary function of delivering information and data from outside of the blockchain, such as prices, scores, analytics and other information, to within blockchain infrastructures in a tamper-proof way.

1.Bird.Money Oracle 2.Off-Chain AnalyticsBird.Money’s blockchain Oracle is developing the tools and mechanisms required to advance DeFi to the next stage in its evolutionary progression as the newest, trustless financial system. By creating an Off-Chain Oracle Data analytics platform for the Ethereum blockchain, the Bird Oracle connects external services and investors to the decentralised loans and finance market with low risk and guarantees. Bird analytics are used to aggregate and validate off-chain metrics in order to bring forth consensual data from multiple data points. Borrowers are then able to leverage “good” behaviour while traversing their interactions with DeFi protocols — loans paid back on time, not being overleveraged, not engaging in scams or “rug pulls” where liquidity is quickly removed from decentralized exchanges, causing a crash in token price and overall being fiscally prudent with their digital assets. That good behaviour could then be used to borrow more assets for less upfront collateral, effectively reducing your collateralized debt position (CDP).

Bird.Money is also establishing the Trust Network to provide a Trust Score to lending protocols. The DeFi equivalent of the legacy banking system’s credit score, which delivers a user’s DeFi history associated with their ETH address to the lender or lending protocol. This would provide a much-needed risk mitigator in order to ensure that borrowers with a less than favourable Trust Score would be required to put up more collateral thereby increasing their CDP to ensure against defaulting. It is a win-win situation for both sides. Borrowers who exhibit good behaviour throughout their DeFi history are rewarded by having to put up less collateral for interactions with a lending protocol. Lending protocols receive a form of assurance for that user’s good behaviour, which will in turn attract more well-behaved DeFi users to the protocol while enabling them to take the necessary safeguards against those who display the opposite.

Blurring the linesIt cannot be overstated how important a role the Bird.Money Oracle and Trust Network will play in the bridge between the legacy and decentralized financial systems. This is particularly true when we consider the recent amendments being made to US government regulations, now allowing for legacy institutions to partake in the use of public blockchains. The lines between the two spaces, both centralized and decentralized are continually being blurred. Bird.Money is well positioned to lead the way into this next frontier of a fairer, more inclusive financial infrastructure.

You can see more on their recently updated 2021 roadmap which uniquely positions Bird.Money’s Oracle platform as well their Trust Network with a tangible and necessary use-case for the DeFi sector.

RoadMap: https://link.medium.com/KzD8cCdJMcb

Dextools: https://www.dextools.io/app/uniswap/pair-explorer/0x6d76f7d16ca40dd13e52df3e1615318f763c0241

Uniswap: https://info.uniswap.org/pair/0x6D76F7d16CA40dD13E52dF3E1615318f763c0241

Demo:

Off-Chain Oracle Analytics (testnet): https://oracle-analytics.bird.money/

Walk Through Video: https://vimeo.com/495795587

Lending Platform: https://lend-beta.bird.money/

They are currently in the process of auditing the underlying smart contracts and then will move to mainnet.

Similar to Notcoin - Blum - Airdrops In 2024

TrustPlus (TRUST) на Currencies.ru

|

|