2019-8-2 13:57 |

US president Donald Trump thinks he’s being smart but it could be that China ends up denting his re-election prospects and boosting bitcoin.

The US Federal Reserve not playing ball doesn’t help either – and the more he pushes the harder he makes it for Jay Powell to maintain his institutions independent standing – or at any rate its perceived independence.

All of this could be good news for bitcoin and crypto more generally.

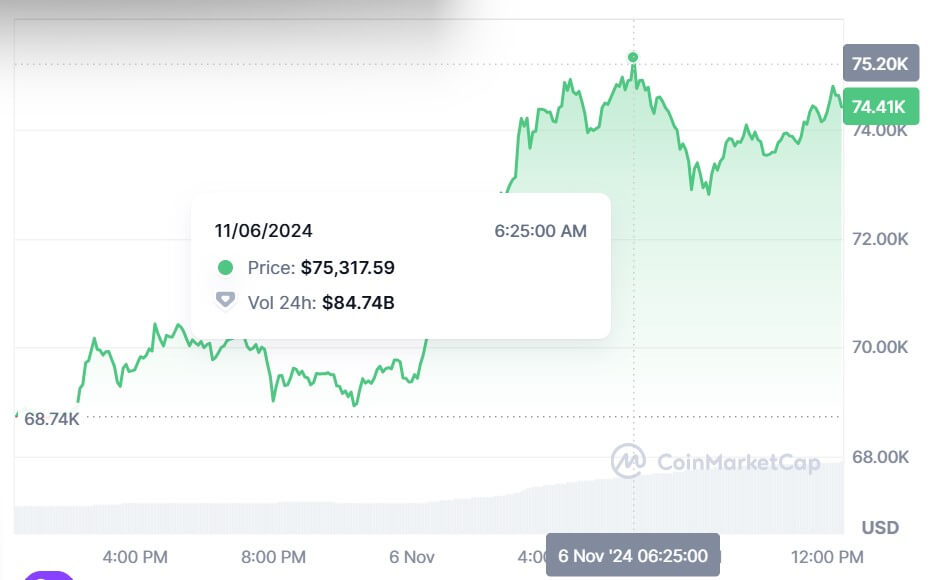

Bitcoin has again pushed past $10,000, just when the balance of analyst opinion was predicting a struggle to stay above that level.

If nothing else it would appear to confirm the notion that the key driver of the bitcoin price of late has been the Fed, trade wars (the plural is necessary) and mounting geopolitical and economic uncertainties more generally.

In case you hadn’t noticed, we’ve had 10 years of “unconventional” monetary policy that has created a low-yield environment. Indeed, yields on quality sovereign debt has been negative in a number of countries. To get a return investors are being pushed into riskier assets and bitcoin has been a beneficiary of this.

Central banks inflating away the value of the dollar and the country itself indebting itself to the rest of the world are exactly the sort of worries, especially in the US, that led to the birth of bitcoin in the first place.

Trade war the new normal for marketsThose worries will be mounting outside the world of crypto with Trump’s latest tariff hike Twitter missive likely a dangerous misreading of China. The US president still thinks he’s doing real estate deals where he holds all the cards. It is leading him to compound his miscalculations and that’s probably good for bitcoin.

Far from bullying China into a corner, Trump is likely to discover that nationalism works both ways. China is already accelerating its “Made in China” efforts – expect that to lead to expedited chip development and manufacturing for one.

Also expect China to guard its lead in digital payments and in that context to be studying and following closely Facebook’s Libra journey.

China already includes blockchain as one of the key industries in what it sees as the Fourth Industrial revolution that is already upon us, with 5G at its centre.

Policymakers in China are not going to be in a hurry to do a trade deal with the US with a presidential election looming.

That means the realisation will dawn in equity and other markets that the trade war could be the new normal and will likely spread, notably in a fight between the US and the European Union over autos and US Big Tech (Europe pretty much only has “small tech” although German cars have conquered the world).

Then there’s the situation of sanctioned countries and individuals, which is behind the massive upsurge in usage of Tether as a proxy for the US dollar in trade over the Chinese-Russian border – it is another fissure in the global system into which crypto is seeping.

Bitcoin loves economic and political uncertaintyAnd we have to mention Hong Kong as it seems to be the elephant n the room. Many commentators are reluctant to see a US hand behind protests in Hong Kong. That’s fair enough as the evidence – beyond protesters waving the stars and stripes – may appear scant. But in ruling circles in China and the media it controls, it is the main theme for understanding what’s going on.

Hong Kong is emerging as the most dangerous front in the China-US trade war. There are a lot of high net worth individuals in Hong Kong who will be thinking through how to protect their wealth and bitcoin will part of the conversation for an increasingly minority.

Trump wants to talk down the dollar but it is continuing to strengthen giving US exporters another headache to contend with. It also throws fuel on to the trade war fire. The yuan rose from 6.90 to 6.95 against the dollar yesterday.

If it touches 7.0 then the Chinese authorities may intervene (as they have done in the past) to stop the value falling further. At that point Trump could start tweeting about China being. Currency manipulator (he already has the euro in his sights). Incidentally, for Chinese investors a weakening yuan will add to the attractions of using bitcoin to store value and to get round capital controls.

This moment in history may not exactly turn out to be the end of globalisation but it is certainly one in which countries are starting to put up trade barriers while at the same time trying to protect established global supply chains or reconfigure them – what better environment and time for a world digital money cryptographically secured in a distributed architecture (bitcoin not Libra) to show what it can do?

Bitcoin loves uncertainty – economic, geopolitical you name it. However, the regulatory kind is a different matter and the hammering that Libra has been getting is thought by some to have taken the shine off the June lift it gave to the crypto market.

Doesn’t matter what happens to Libra – the cat is now out of the bagBut here too we should be careful not to fall in with perceived wisdom that sees Libra’s woes weakening the general crypto outlook.

On the contrary, whatever happens with Libra the cat is now out of the bag. It doesn’t really matter whether Libra launches in the form envisaged in the whitepaper or if it even launches at all (although I think it will, somewhere in some form).

Zuckerberg has thrown a hand grenade into the laps of regulators, governments and corporates.

The reaction to the Libra announcement is the telling thing.

To the uninitiated and sceptical it has shown the potential (and risks) of crypto, even if stablecoins are something of a detour along the long and winding road to the adoption of full-blown distributed, permissionless value exchange networks.

Walmart to launch stablecoin?Todays’ news that Walmart may lunch its own stablecoin will be just one of many such examples of other corporations being forced to respond to Facebook’s Libra as they look to leverage distributed ledger technology in their own businesses.

Facebook might be forgiven for seeing Walmart’s stablecoin patent application with the US Patent and Trademark Office as an instance of flattery through imitation.

Taken together, loose money policies, trade wars, the prospect of actual wars in the Middle East alongside the Libra effect and improving tech and adoption prospects of crypto itself, means a bullish.

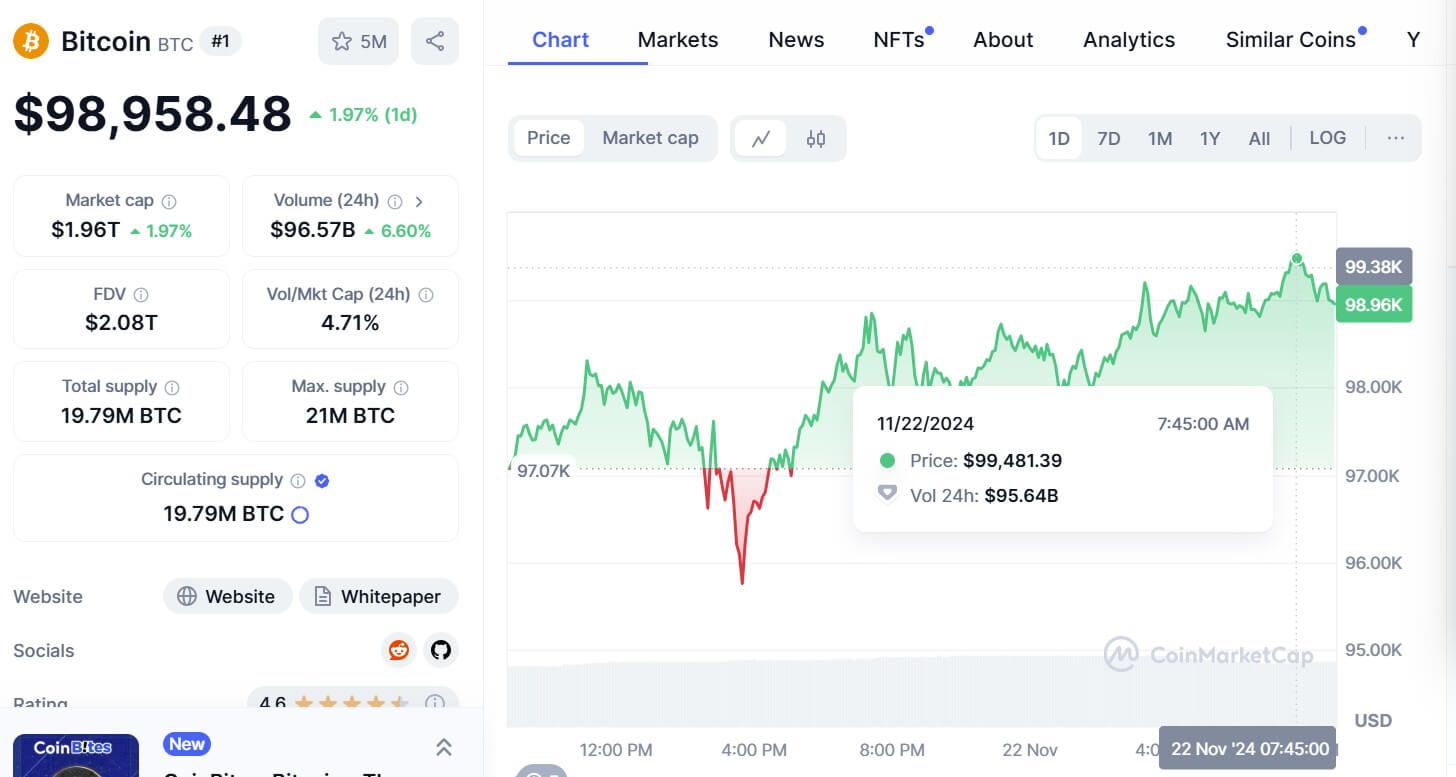

Bitcoin (BTC) price targetCurrently trading at $10,500 on Coinbase, target price going forward for bulls is $11,120, last seen on 20 July.

BTC/USD 4-hour candle, Coinbase (courtesy TradingView)Similar to Notcoin - Blum - Airdrops In 2024

Bitcoin (BTC) íà Currencies.ru

|

|