2021-10-14 09:06 |

Horizon Finance has introduced a new stage of decentralized market evolution through the launch of the decentralized interest rate markets option to solve the issue of payment shortfalls. The launch comes after the project received a major injection of liquidity from leading investors.

Horizon Finance is launching a decentralized interest rate markets protocol, after having raised over $1.3 million in investments from prominent fintech market players. Among the participants of the financing round were such major global investing giants as Framework Ventures, DeFiance Capital, Mechanism Capital, Spartan Group, Alameda Research, NGC, Ruby Capital and Incuba Alpha Capital, and others.

The decentralized interest rate markets protocol by Horizon Finance is a blockchain protocol that allows users to deposit their assets with a fixed or floating interest rate in exchange for rewards. The rewards are calculated based on the interest rate the users choose in accordance with the ratio of the assets they had deposited. As a protocol specialized in the interest rate market, Horizon Finance offers new values and innovation to TradFi, bringing floating and fixed decomposition of yields in a unique way.

“We seek to enhance the trading toolkit available to DeFi participants who are engaged in key yield streams across the ecosystem and reward our users in the process. We aim to achieve this goal via rolling auction markets across various tenors where participants can compete for preferential payment in return for capping their yield, on a fair and transparent playing field,” as stated by the official representative of Horizon Finance.

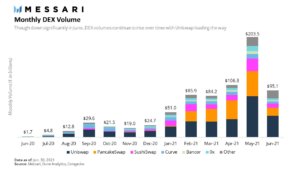

The main problems of the DeFi market that have led to the development of the solution are a lack of sufficient margins and the inefficiencies inherent to currently existing protocols regulating the interactions between market participants. Another major issue is that borrowing activity on the market is occurring on a floating basis, and as such, there is an inability to form a term structure for interest rates.

When formulating the concept of the protocol, the Horizon Finance team considered factors surrounding the formation of fixed interest rate markets without the use of decentralized exchanges of order books. The proposed decentralized interest rate markets protocol is a novel system that incentivizes participants to collectively set interest rate expectations for a given revenue stream. The protocol allows users to select one of two options. Under the first, users can act as a floating rate liquidity provider – effectively the interest rate maker. Under the second option, users can participate in a rolling auction, effectively acting as an interest rate bidder. Horizon’s payoff mechanism ensures that there’s no counterparty risk. Underlying income for the whole pool is paid from lowest IR bidder to highest IR bidder until it runs out. Such a mechanism ensures the minimum yield for all participants is floored at 0%, eliminating any need for liquidation mechanisms.

The founders of Horizon Finance believe that the launch of the decentralized interest rate derivative markets will diversify the composition of the decentralized trading market and add much-needed balance and risk-hedging options. The nearest plans of the project include the launch of automated yield configuration, as well as a robo-advisor-like features, using which market participants can construct their portfolio yield based on their preferences amongst different pools, tenors, and fixed or floating choices.

Similar to Notcoin - Blum - Airdrops In 2024

Horizon (HZ) на Currencies.ru

|

|