2021-1-14 23:00 |

The debate on Bitcoin being money or not rages on. The world’s original, and current biggest, cryptocurrency was initially founded in 2009 by its pseudonymous creator Satoshi Nakamoto to replace fiat money, but price gyrations have since made it an asset class akin to “digital” gold.

But despite that, popular crypto influencers, builders, and developers are propelling the notion of Bitcoin still being money, one whose deflationary nature, fixed supply, and lack of centralized state actors give it its superiority.

Today, Cryptonites, the edutainment channel run by crypto investing app Swissborg, dove into why some personalities consider Bitcoin money. Featuring host Alex Fazel, the show features snippets of past interviewees like Ray Youssef, Girl Gone Crypto, Dan Held, Max Keiser, and several more.

Here’s what they all said.

Dan Held, growth lead at KrakenI think Bitcoin’s mission is massive, like if you look at so there’s a terminology in tech called TAM, [for] total addressable market. So when you build a product or service, how big could you get, for example, like Amazon could get as big as all things sold, right, which is a huge TAM.

“So with Bitcoin, the TAM is $250 trillion. Like that it’s that’s its total potential value. It could be because you’ve got real estate, gold stocks, and bonds, and Fiat, those all represent store value.”

He added, “And so when people go, oh, it’d be really boring if Bitcoin only did goals like if it was only digital gold, and like, that use case is 30 x larger than all the other ones combined. So you know, I think Bitcoin blockchain technology is built to build Bitcoin. Bitcoin solves a fundamental problem in society that I think is ultimately a human rights issue.”

MM Crypto, trader and YoutuberBitcoin is not only decentralized and not only peer to peer, but it’s also censorship-resistant, but you can also send whenever you want money from A to B and you can set stored data on it like you have nice secondary solutions and no one can prevent you from doing all of that and taking advantage from all of that and, YouTube is centralized banking is centralized.

And I mean “central” banking, it’s the word that already gives it away. So I think crypto and Bitcoin especially, is really here to stay and to disrupt all different kinds of industries

That Martini Guy, Bitcoin news YoutuberPeople are struggling to buy watches at the moment because nobody is really wanting to sell and that’s keeping the prices quite high. Now eventually all these luxury goods, they’re going to decline. And Bitcoin may get lumped in with that. So that’s a big concern of mine. Is Bitcoin a store of value or is it a speculative asset that will only be decided at the point when the luxury market starts crashing?

“Only time will tell is Bitcoin speculative or is it digital gold. I don’t think it’s digital gold. I’d much prefer it to be cash.”

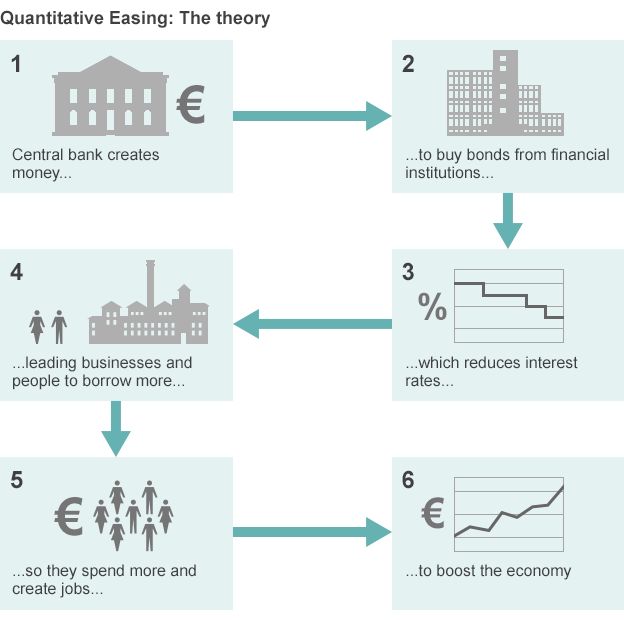

Not only that, but they offered up $3 trillion of worthless government bonds that the public could buy to essentially loan the government money because they can’t print any more money because, at that point, you’d have hyperinflation essentially devaluing the nation’s currency.

Lark Davies, The Crypto LarkBitcoin dominance has been falling. It’s been falling steadily for a couple of months. Now basically, since Bitcoin has flatlined, which has been happening since a little bit before the Bitcoin halving the price of bitcoin not moving has meant that altcoins are now able to finally breathe again and we’ve seen just massive moves in the altcoin market and the more that altcoins gain the more Bitcoin dominance falls.

“Now, a lot of people are under the false perception that a falling Bitcoin dominance is somehow bad for Bitcoin but that’s absolutely not true.”

We have to remember that Bitcoin hit its all-time high at the height of an altcoin season. So a falling Bitcoin dominance is actually good for Bitcoin because it means that the entire crypto-economy is seeing a lot of activity and if we know one of Bitcoin’s main use cases right now, well outside of just huddling your Bitcoin is actually trading Bitcoin and what people trade Bitcoin for.

Charles Hoskinson, founder of CardanoThe first thing everybody tells you is a warning is don’t roll your own crypto. But unfortunately, we don’t have that luxury because we’re inventing the crypto as we go along to make these protocols work.

This is like complex heart surgery on very delicate protocols that if you screw up, you introduce all kinds of attacks, like side-channel attacks and other things. So you need a special breed of a developer who’s very elite to be able to do this type of work.

And people say, Oh, well, no, you don’t Well, then, you know, look at all the hacks and flaws. And you know, how many things have occurred over the last 10 years in our space as a consequence of people not knowing what they’re doing?

And it’s just common sense. You know, when you get sick and you need surgery? Do you want your butcher to do that? Or do you want your surgeon to do that? Why do you trust the surgeon with your life? Because that person spent more than a decade of his life or her life studying to become worthy of that?

So similarly, why would you trust an amateur with your privacy, your identity with your money, these types of things, you should aspire to say that the system that you’re using was built on bedrock?

“It was built by really smart people who knew what the hell they were doing.”

The Moon Carl, Bitcoin trader and YoutuberI think that in 2020 (recorded last year), halving will be the biggest story, for sure, it is such a huge thing to see the supply, the newly created supply gets cut in half the stock to flow.

“And I think that this will further create more and more attention towards Bitcoin as a form of money and make more people aware of this inflation schedule that will eventually reach zero.”

As I said, this is the first time in history, we’ve seen something have absolute scarcity, nothing else in the world has 0% inflation, it’s not possible, except in the digital world. So it is the first time we’ve seen something being digitally scarce, absolutely scarce.

Crypto Finally, cryptocurrency marketerI understand the concept of the market cap, and the idea of someone really large getting involved, you know, all it’s gonna really take to see major price movement is like a billionaire to, you know, put all of their assets into Bitcoin, we’re gonna see big price movement, that’s really where we’re at, there’s a very small percentage of people who are invested.

And the more that we grow, I can see it growing larger, you know, it’s all speculative. So again, you know, it’s gonna go up, or it’s gonna go down. And I am not a technical analyst. I’m not someone who does price predictions. So I will just preface with all that. I’m not someone who necessarily does those things.

But I do understand the reasoning as to why people believe that it would grow in the future. I also think that the Goldman Sachs incident was a little strange and its own nature. I think that email was very emotional. I think that there was a lot of stuff that was written in it that you know, well, maybe being true isn’t untrue of other traditional assets.

Girl Gone Crypto, crypto educator and influencerBitcoin and crypto just fit into my whole world philosophy. So much in terms of self-sovereignty, personal freedom, personal responsibility. And so when I found crypto, it just was really the, it just makes a lot of sense.

“It’s a tool that I think we can use to help get closer to the type of world and the type of society that I would actually want to live in.”

Ray Youssef, CEO of Paxful(Regarding Africa’s crypto adoption.) [They said] there’s no way they’re going to figure out Bitcoin. Now Africa is actually leading Bitcoin adoption. A number of Google searches and the sheer number of peer to peer transactions as well. Yes, this is happening right now.

“It was the people of Africa that taught us what the killer app of Bitcoin really was, and that is a universal translator for money.”

For Youssef, unlike a majority of the current crypto participation and interest, Bitcoin is not an asset that nets thousands of dollars solely for those in the know. Instead, it forms a strong, wholly-decentralized means of exchange for people who are drastically underserved by banks and financial institutions.

Max Keiser, Bitcoin educatorSo I think we’re seeing that in the market is that gold is flatlining against Bitcoin, and the industry is moving to Bitcoin, sovereigns are moving to Bitcoin, and corporations are moving to Bitcoin.

“You know, the US dollar, as Paul Krugman says, is backed by violence. Bitcoin is backed by peace.”

What comes next for Bitcoin? Where is the Bitcoin market going ten years from now? How does the broader crypto space evolve? All that and MORE in the entire video, available for streaming right below.

The post Here’s why these 10 crypto personalities say Bitcoin is the BEST money appeared first on CryptoSlate.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) íà Currencies.ru

|

|