2020-9-6 00:50 |

Ethereum has dove lower over the past few days after reaching $490 at the start of the week. The leading cryptocurrency now trades at $335 as of this article’s writing, reaching as low as $315 just hours ago. ETH is down 15% in the past 24 hours, actually making it one of the worst-performing cryptocurrencies in the top 20. This isn’t too much of a surprise as it was one of the fastest rallying cryptocurrencies aside from smaller DeFi plays. Ethereum is ready to drop even lower despite the already brutal price action. Ethereum Has Room to Plunge After Falling As Low As $315

Analysts argue that Ethereum has room to extend to the downside, even after crashing over 30% in the span of around 48 hours.

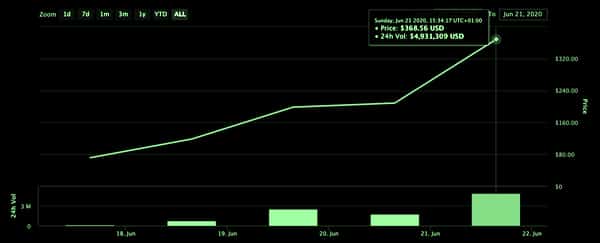

One trader shared the chart below, which shows that ETH yesterday lost a pivotal support level. At the time, he explained that if Ethereum lost the support level denoted on the chart, a move towards $290 could be had as that’s where macro support lies for the coin:

“#Ethereum has formed a broadening formation that normally has no preferred direction of a breakout. The bottom of the formation matches a long-term S/R level. If it is broken, the next potential target is at ~290$ – the second support and a 50% Fibonacci retracement.”

Chart of ETH's price action over the past year with analysis by crypto trader and chartist "CryptoHamster" (@CryptoHamsterIO on Twitter). Chart from TradingView.comOther analysts are eyeing $290, not just the one mentioned above.

One trader noted that on a macro scale, $295 is the level that Ethereum must hold to remain bullish.

“Truth of the matter is that our region around $295 is the strongest level of support we have on weekly plus timeframes, this would be a major buying region… Personally I have added here at $350, this was my first buy fill in the past few months, next bid $320!”

Chart of ETH's price action over the past year with analysis by crypto trader and chartist "CryptoHamster" (@CryptoHamsterIO on Twitter). Chart from TradingView.com Bitcoin Poised to BounceBoding well for the Ethereum bull case, analysts say that BTC is primed to bounce from here.

As reported by Bitcoinist, one analyst believes that since Bitcoin tapped the liquidity pool in the low-$10,000s, a rally may be had:

“Finally, liquidity at the lows taken. Reclaim of $10,000 would mean a S/R flip and a very probable chance we’ll look for liquidity above the range highs. That would suit a bounce towards $10,750-10,900 and majority of the markets bounce 25-40%.”

How exactly this translates into ETH price action, though, remains to be seen.

Featured Image from Shutterstock Price tags: ethusd, ethbtc Charts from TradingView.com Here's Why Ethereum May Crash Further After Dropping 30% in 2 DaysSimilar to Notcoin - Blum - Airdrops In 2024

Ethereum (ETH) на Currencies.ru

|

|