2026-2-9 22:30 |

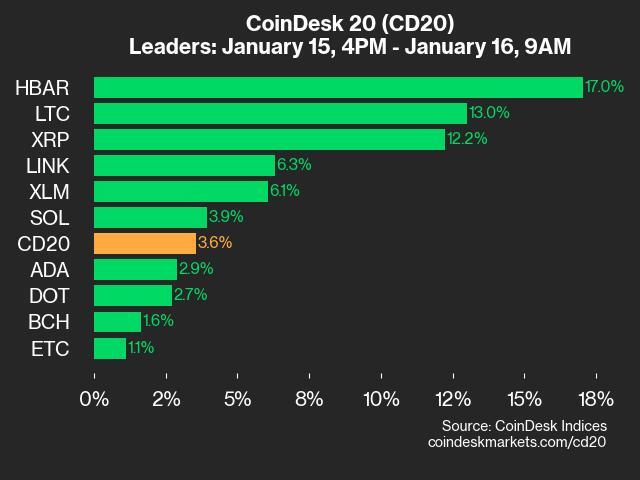

Hedera has been in that awkward spot lately where the chart looks rough, but the fundamentals keep giving bulls something to hold onto.

The HBAR price has been trending lower for most of the past few weeks, then suddenly it printed a sharp flush that felt like full-on capitulation. Now it’s trying to find its footing again.

The short-term structure still looks damaged, but ETF chatter, network upgrades, and real-world adoption stories keep the idea alive that HBAR might not be finished yet.

What the HBAR 4-Hour Chart Is Really ShowingOn the 4-hour chart, the HBAR price started this stretch closer to the $0.12 area, and from there it was mostly downhill. You can see the pattern clearly, every bounce got weaker, and sellers kept showing up fast.

The moment that stands out most is the Feb. 5 wick down into $0.07150. That wasn’t a normal dip. It looked like a liquidation-style flush, the kind of move that clears out stops and forces weak hands out of the market.

Source: CoinAnkWhat’s important is what happened next: price snapped back quickly. That kind of rebound often shows exhaustion on the sell side, like the market finally hit a wall.

Since then, the HBAR price has pushed back toward $0.09277, which is now acting like a key pivot zone. Price keeps stalling around that area, which tells the story pretty well — buyers stepped in, but they still need to prove they can actually follow through.

Momentum Clues From RSI, OBV, and VolumeThe indicators fit the “flush then stabilize” setup. RSI has recovered strongly off the lows, sitting back in the 50s and 60s, with one reading near 63.96. That’s usually what you see when a bounce has real energy behind it, not just a tiny dead-cat reaction.

Volume also lines up. The biggest spikes showed up during the selloff and then again during the rebound, which is typical when panic clears out leverage and dip buyers start taking shots. OBV is still beaten up from the broader downtrend, but the fact that it’s flattening out now hints that the heavy distribution pressure may finally be cooling off.

Why Fundamentals Still Matter for the HBAR PriceEven with the chart looking shaky, Hedera keeps showing up in institutional conversations. On the ETF side, multiple spot HBAR filings are floating around, and there’s even talk about a live product tied to the theme.

If more approvals come through over time, that could change how the HBAR price trades, because it opens the door for regulated capital exposure. On top of that, Hedera’s steady upgrade cadence, with mainnet improvements like v0.68 and v0.69, keeps the network’s enterprise pitch intact.

And then there’s the adoption angle. Government-level tokenization projects, like Georgia’s real-estate registry MoU, are exactly the kind of real-world volume drivers that could matter if the market starts rewarding utility again.

Read Also: This Major Hedera Upgrade Sparks “Insanely Bullish” Call on HBAR

Where the HBAR Price Could Go This WeekRight now, the HBAR price is sitting at a pretty clear decision point. If it can hold the $0.090–$0.093 zone and keep printing higher lows, the next upside test is near $0.096. A clean push through that opens the door toward the psychological $0.10 level, with $0.102 sitting as the next obvious resistance from late February.

But if the HBAR price loses $0.09 again, this bounce starts looking fragile fast. In that case, the first downside magnet sits around $0.084, and if that breaks, traders will start watching deeper support levels near $0.078, with the prior low at $0.07150 back in focus.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.

The post Here’s Where Hedera (HBAR) Could Be Headed This Week appeared first on CaptainAltcoin.

origin »Bitcoin price in Telegram @btc_price_every_hour

Hedera Hashgraph (HBAR) на Currencies.ru

|

|