2024-11-21 20:42 |

Cryptocurrency giant Grayscale Investments plans to introduce options trading on its spot Bitcoin ETFs on Nov. 20 as the debut of options on BlackRock’s spot Bitcoin EFT saw huge volumes.

Options tied to BlackRock’s iShares Bitcoin Trust (IBIT) saw almost $2 billion in notional exposure traded on day one, a feat some analysts described as “unheard of” for those metrics. This record-breaking activity propelled Bitcoin to a new all-time high.

Grayscale To Roll Out Options TradingGrayscale announced on X that it would launch options trading on the Grayscale Bitcoin Trust (GBTC) and the Bitcoin Mini Trust to “further [develop] the ecosystem around our US-listed Bitcoin ETPs.”

Grayscale is thrilled that Options trading on both $GBTC and $BTC will begin tomorrow – further developing the ecosystem around our US-listed #Bitcoin ETPs. pic.twitter.com/i7kFpOiogq

— Grayscale (@Grayscale) November 19, 2024After the Options Clearing Corporation’s (OCC) approval of Bitcoin ETF options, Grayscale swiftly submitted an updated prospectus for its Bitcoin Covered Call ETF on January 11.

Bloomberg’s ETF analyst Seyffart noted the speed of Grayscale’s filing following the OCC’s clearance, stating on Tuesday that the asset manager was “wasting no time.”

“They’ve filed an updated prospectus for their Bitcoin Covered Call ETF,” Seyffart posted on X. “The fund will offer exposure to $GBTC & $BTC while writing &/or buying options contracts on Bitcoin ETPs for income.”

Grayscale’s move follows the remarkable debut of BlackRock’s IBIT options, which racked up roughly $1.9 billion in notional exposure traded on its first day.

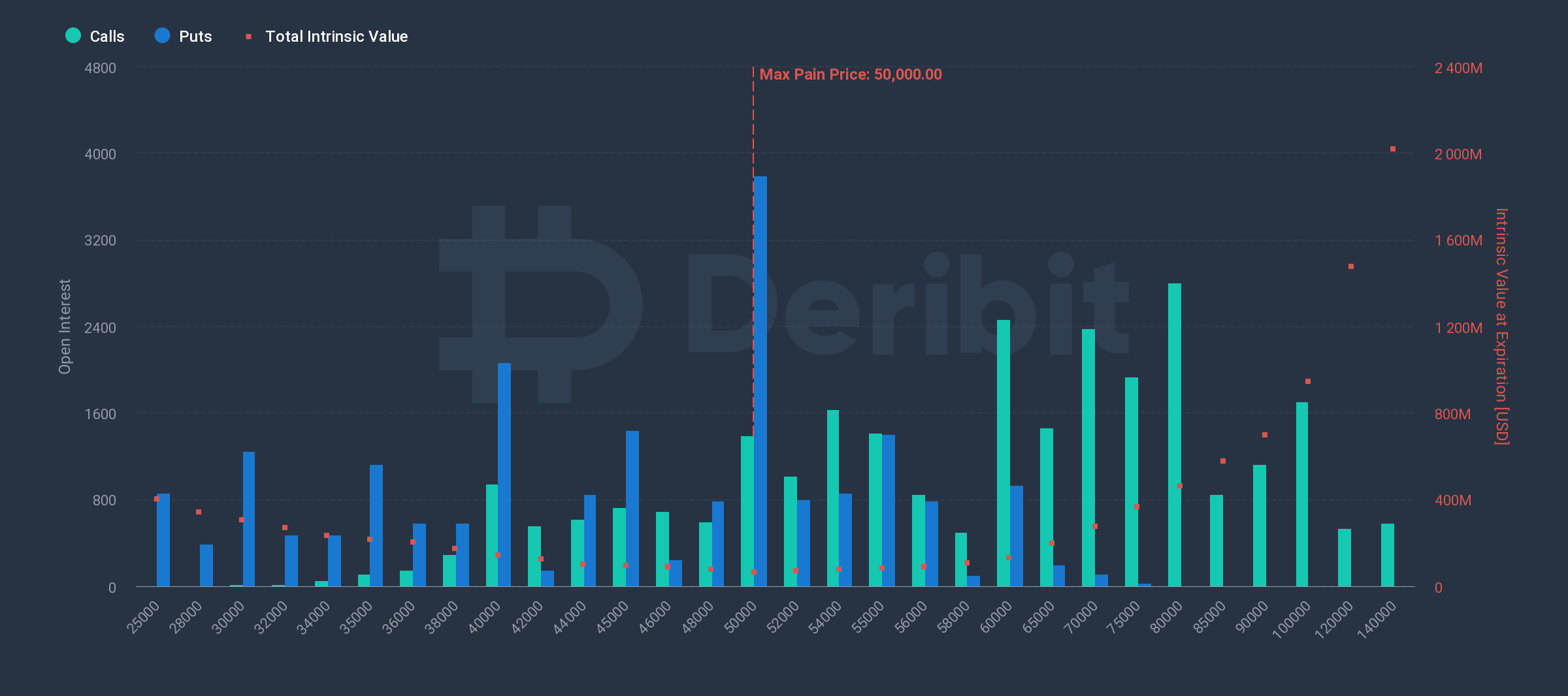

Seyffart revealed that 354,000 contracts were exchanged, including 289,000 calls and 65,000 puts, representing a 4.4:1 call-to-put ratio. The ratio suggests that a vast majority of investors placed bets on Bitcoin’s price upsurge (calls) compared to those hedging against a potential price correction (puts).

“These options were almost certainly part of the move to the new Bitcoin all-time highs today,” Seyffart summarized, referring to Bitcoin’s jump to $94,040 on Tuesday.

Ex-CNBC Africa host Ran Neuner also believes that the debut of the IBIT options on Nasdaq triggered the market rally.

“As traders buy these options, market makers buy the spot ETF to hedge the trade,” he posited. “The result is huge net buying of the ETF that causes huge net buying in spot BTC.”

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|