2020-6-25 16:58 |

This week, the price for the Grayscale Ethereum Trust has dropped more than 50% and nearly 60% since the June 4 high.

This drop came despite the price of Ether trending upwards. Now the premium on the product is down, but still at over 300%, which went as high as 800% to Ether prices earlier this month.

The collapse in premium is the result of the accredited investors, predominantly hedge funds, liquidating their holdings after their mandatory 12-month lock-up period for new placements into the trust has come to an end.

“This means that extremely inefficient situations can develop like the one we’ve seen recently,” Nic Carter, co-founder of researcher Coin Metrics, told Bloomberg.

“Bad news for retail investors that didn’t do their diligence.”

Source: TradingView – Grayscale Ethereum Trust ETHEThe shares of the trust are only available to institutional and accredited investors. Still, as we reported, retail investors are the ones that are buying these ETHE shares to get exposure to the second-largest cryptocurrency through their brokerage accounts or 401Ks.

So-called institutional investors are the ones that create these shares and resell at significant markups. A Grayscale spokesperson said,

“Grayscale does not control the prices at which our investment products trade in the public market but are instead subject to market forces.”

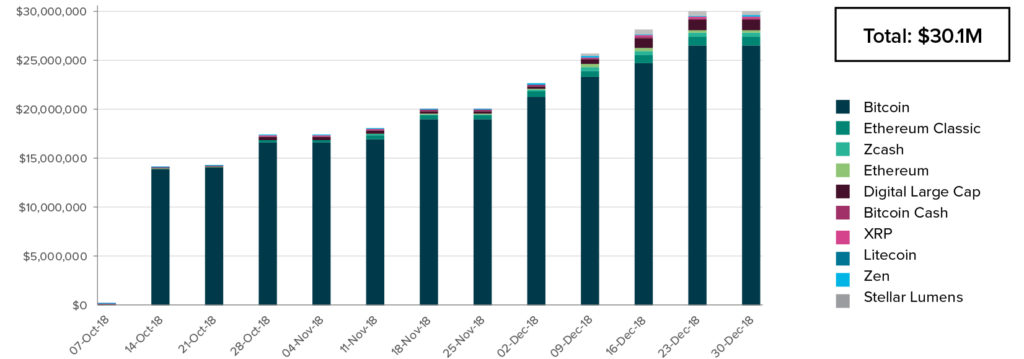

Providing downside protection to hedge fundsThe world’s largest asset manager also runs trust for other coins such as Bitcoin, Bitcoin Cash, Ethereum Classic, XRP, Stellar Lumens, Litecoin, Horizen, and Zcash.

Currently, Grayscale has $4.2 million net assets under management, out of which $3.6 belong to Grayscale Bitcoin Trust (GBTC). The institution charges a 2% annual fee.

Recently, crypto investment fund Three Arrows also became the biggest investor in GBTC, buying about $200 million of shares — a 6.5% stake in this publicly traded fund.

GBTC, where each share represents 0.00096070 BTC, is also trading at a premium of 14% just above 10,600, while BTC price on spot exchanges is about $9,300, at the time of writing. This premium, however, is continuously going down as it was more than 100% back in 2017.

This premium still provides the hedge funds downside protection, and they can sell their shares at a profit despite the bitcoin prices being down.

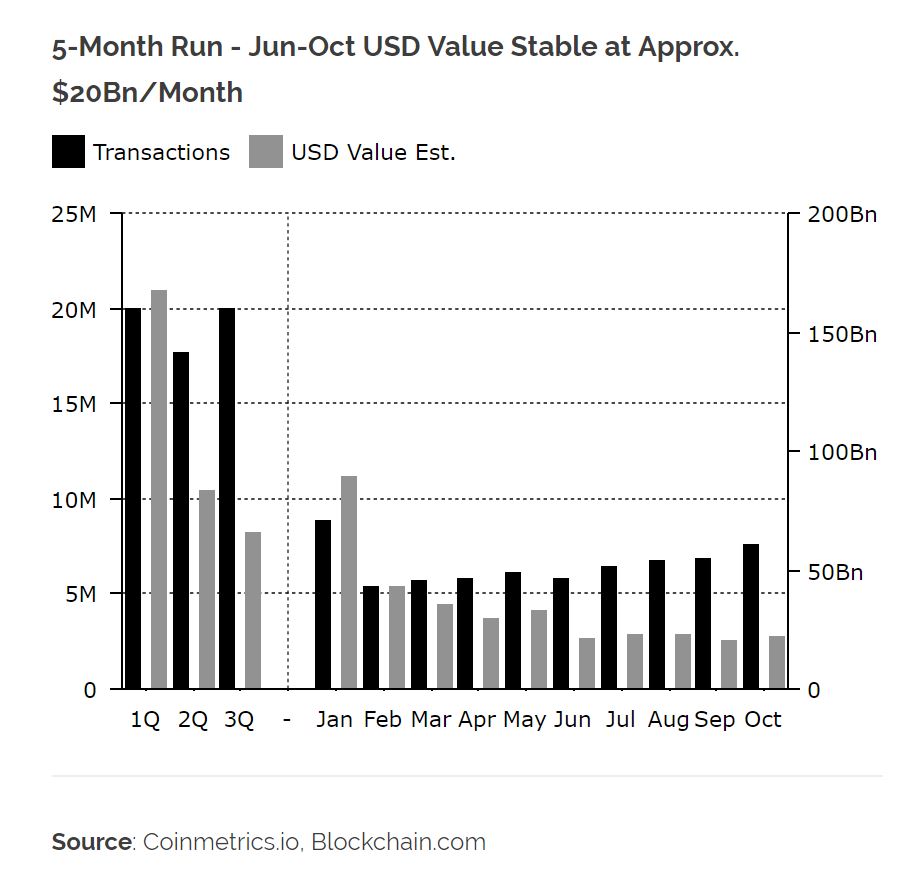

Moreover, the record-buying by Grayscale — BTC holdings increasing by 10,800 and ETH holdings by 88k in just one day, isn’t happening with only about 20% of the inflows are digital asset purchases and the rest are in-kind which is just institutional investors sending their BTC to create more shares.

Ethereum (ETH) Live Price 1 ETH/USD =$234.0699 change ~ -0.08%Coin Market Cap

$26.1 Billion24 Hour Volume

$1.42 Billion24 Hour VWAP

$23324 Hour Change

$-0.1824 var single_widget_subscription = single_widget_subscription || []; single_widget_subscription.push("5~CCCAGG~ETH~USD"); origin »Bitcoin price in Telegram @btc_price_every_hour

Ethereum Premium (ETHPR) на Currencies.ru

|

|