2024-3-9 17:34 |

Insights into the global Exchange Traded Products (ETPs) market reveal a remarkable leap in Assets Under Management (AUM), reaching a record $80.5 billion in February.

This represents a 55% increase from the previous $52 billion, Fineqia International research has shown.

This growth in ETPs, which include both Exchange Traded Funds (ETFs) and Exchange Traded Notes (ETNs) with digital assets as underlying collateral, has outpaced the 37% increase in the underlying crypto assets value, reaching approximately $2.37 trillion from $1.73 trillion.

BTC spot ETFs drive ETP market surgeThe substantial premium in ETP growth is largely attributed to the U.S. approval of Bitcoin (BTC) Spot ETFs, which began trading on January 11.

This development has led to $7.4 billion in net inflows into ten new BTC Spot ETFs, significantly influencing the ETP market.

Grayscale Bitcoin ETF (GBTC) leads with an AUM of about $26.5 billion, transitioning from a Trust to an ETF format despite experiencing $8.9 billion in outflows, which was offset by the total $16.3 billion inflows into the new ETFs.

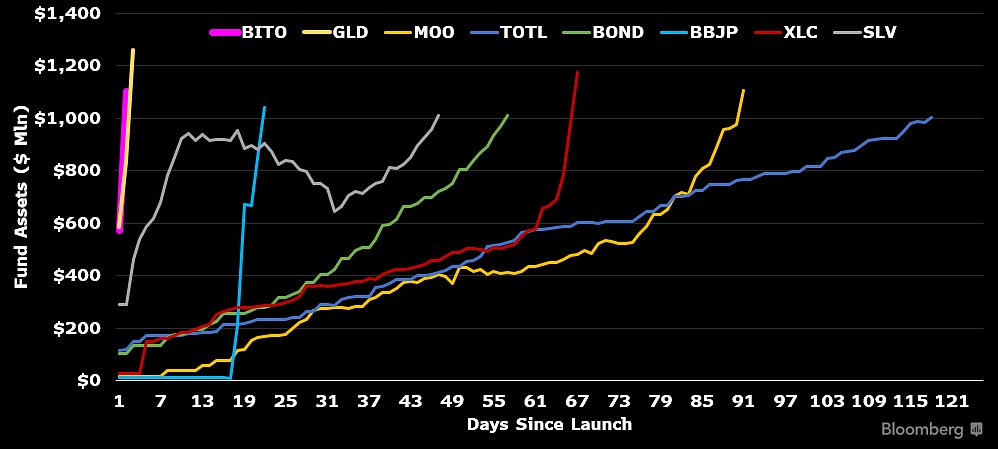

BlackRock’s Bitcoin ETF sets recordBlackRock’s Bitcoin ETF (IBIT) has achieved $10 billion in AUM within two months to March 1, setting a record as the fastest ETF to reach this milestone.

JUST IN: BlackRock #Bitcoin ETF is set to break $10 BILLION in total flows today.

Fidelity is a strong second place with $6 Billion.

Demand is strong and is set to grow as more investment platforms and banks allows these ETFs onto their platforms. pic.twitter.com/eNdNMTef8p

This growth was fueled by $8 billion in net inflows and an additional $2.3 billion due to Bitcoin’s price increase, highlighting an impressive daily AUM growth of almost $300 million over thirty-five trading days.

Bitcoin ETFs versus gold ETFsComparatively, BTC Spot ETFs have rapidly gained popularity among investors, being increasingly viewed as “digital gold”.

This contrasts with physical gold, whose price is tied to central bank reserves and industrial demand.

SPDR Gold Shares (GLD), the first Gold ETF in the U.S., took over two years to reach the $10 billion AUM milestone, underscoring the fast-paced adoption of Bitcoin ETFs.

Institutional demand for Bitcoin risingFineqia’s CEO, Bundeep Singh Rangar, emphasized the growing institutional interest in Bitcoin, stating, “The institutional race is on and it’s driving demand.”

This interest is evident as issuers of BTC Spot ETFs absorb available Bitcoin supply in the market, contributing to price increases.

In February alone, BTC’s price saw a 41.4% increase, significantly impacting the AUM of ETPs with BTC as the underlying asset.

Ethereum and Altcoins going strongEthereum (ETH) also experienced notable growth, with a 46.9% price increase in February.

Similarly, ETPs with ETH as the underlying asset saw a 46% rise in AUM to $14.0 billion.

ETPs representing alternative coins, including a dominant Solana (SOL) presence, showed significant growth, further illustrating the diverse interest in cryptocurrency investment products.

The post Global digital asset ETPs soar to $80.5 billion AUM, February sees 55% growth appeared first on Invezz

Similar to Notcoin - Blum - Airdrops In 2024

Global Currency Reserve (GCR) на Currencies.ru

|

|