2024-9-26 18:04 |

The latest data from CoinShares, a leading digital asset investment firm, reveals that major asset managers, including BlackRock, Bitwise, Fidelity, Grayscale, ProShares, and 21Shares, have all contributed to this positive momentum. This influx of capital comes on the heels of two consecutive weeks of net outflows, making the current rebound even more noteworthy.

James Butterfill, Head of Research at CoinShares, attributes this surge to the recent Federal Open Market Committee (FOMC) meeting. In his Monday report, Butterfill stated,

“This surge was likely driven by the Federal Open Market Committee (FOMC) comments last Wednesday, which took a more dovish stance than anticipated, including a 50 basis point interest rate cut.”.

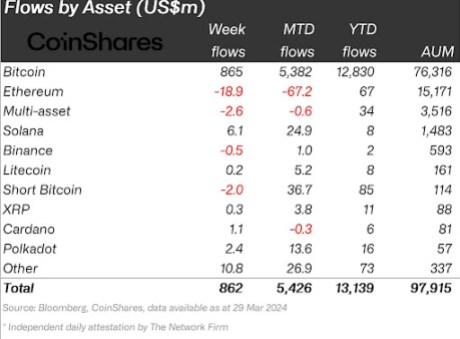

Crypto AUM Surges with Bitcoin DominanceThe influx of capital has profoundly impacted the total assets under management (AUM) in crypto funds. CoinShares reports a remarkable 9% growth in AUM, accompanied by a corresponding 9% increase in trading volume, which reached $9.5 billion for the week.

Bitcoin-focused investment products led the market, drawing $284 million in global net inflows last week. Bitcoin maintained continued strength as a central component of crypto investment strategies. Additionally, Bitcoin’s price rally spurred interest in short-bitcoin funds, which garnered $5.1 million in net inflows, revealing varied investment tactics within the sector.

Meanwhile, Solana-based funds sustained their upward momentum, gaining $3.2 million in net inflows. This growth aligned with major announcements at the Solana Breakpoint conference in Singapore, underscoring how ecosystem developments influence investor interest.

Ethereum Outflows Persist Amid Market GainsWhile the broader crypto investment landscape flourished, Ethereum-based products faced persistent challenges. Ether-based investment vehicles experienced $29 million in net outflows last week, marking the fifth consecutive week of negative flows. The total outflows for Ethereum products have now reached a substantial $187.7 million over this period.

CoinShares’ Butterfill points to a specific factor driving this trend: the ongoing outflows from Grayscale’s converted higher-fee incumbent fund, ETHE. Since trading began in July, ETHE has seen a staggering $2.8 billion in total net outflows. In contrast, the newly launched U.S. spot Ethereum ETFs have attracted $2.2 billion in net inflows, indicating a shift in investor preferences within the Ethereum investment space.

The geographical distribution of crypto fund flows reveals interesting patterns. U.S.-based funds maintained their dominant position, recording $277 million in net inflows overall. Switzerland emerged as a strong contender, with its registered investment products experiencing their second-largest weekly net inflows of the year, totaling $63 million.

However, not all regions shared the positive sentiment. Funds in Germany, Sweden, and Canada faced headwinds, with net weekly outflows of $9.5 million, $7.8 million, and $2.3 million, respectively. These regional disparities underscore the complex and nuanced nature of the global crypto investment landscape.

Market Performance and LiquidationsAs of September 23, 2024, the cryptocurrency market showed mixed signals. Ethereum outperformed Bitcoin in daily gains, climbing 3.28% to surpass $2,650, while Bitcoin rose 1.46% to reach $63,630, according to Brave New Coin’s Bitcoin and Ethereum Liquid Index. Ether’s weekly performance was particularly impressive, with a 15.80% surge that helped it recover from a bearish trend earlier in the month.

The trading activity also showed volatility, as seen in CoinGlass’s liquidation data. In the 12 hours before September 23, long positions faced greater liquidations than short ones, with $27.66 million in shorts compared to $31.49 million in longs. This likely mirrors the market’s response to the recent 50 basis point interest rate cut, which led to more trading.

While Bitcoin and Solana-related products continue to draw substantial interest, Ethereum continues to struggle. Similarly, the varied performance of funds across countries stresses the need to account for geopolitical and regulatory influences in crypto investment planning.

Similar to Notcoin - Blum - Airdrops In 2024

Emerald Crypto (EMD) на Currencies.ru

|

|