2024-10-9 01:15 |

The plan paves the way for the company to repay billions of dollars to its customers, utilizing up to $16.5 billion in recovered assets.

Dorsey of DelawareU.S. Bankruptcy Judge John Dorsey, presiding over the case in Wilmington, Delaware, lauded FTX’s successful restructuring efforts, calling it a “model case” for navigating the complexities of a Chapter 11 bankruptcy. The plan hinges on a series of settlements reached with FTX customers and creditors, U.S. government agencies, and liquidators overseeing FTX’s international operations.

These settlements prioritize the repayment of FTX exchange customers, giving them precedence over potential claims from government regulators. FTX aims to reimburse 98% of its customer base – those with account balances of $50,000 or less – within 60 days of the plan’s effective date, which is yet to be finalized.

The Fall of Sam Bankman-FriedFTX’s downfall, triggered by revelations of founder Sam Bankman-Fried’s misuse of customer funds to cover risky bets by his hedge fund, Alameda Research, sent shockwaves through the crypto world. Bankman-Fried was subsequently convicted of fraud and sentenced to 25 years in prison, a conviction he is currently appealing.

The company estimates that it will have between $14.7 billion and $16.5 billion available to repay creditors, ensuring that customers receive at least 118% of their account value as of November 2022, the date FTX filed for bankruptcy.

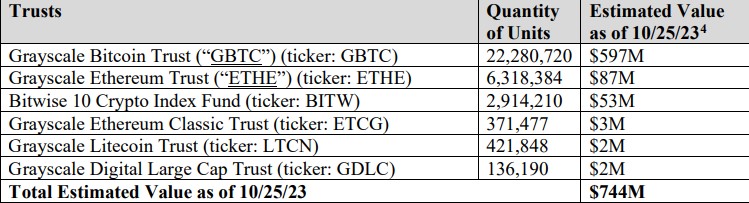

This achievement is partly attributed to FTX’s ability to recover substantial amounts of cash and crypto assets that had vanished during the company’s chaotic collapse. FTX also bolstered its funds by divesting other assets, including investments in tech ventures like the artificial intelligence startup Anthropic.

“Today’s achievement is only possible because of the experience and tireless work of the team of professionals supporting this case, who have recovered billions of dollars by rebuilding FTX’s books from the ground up and from there marshaling assets from around the globe,” stated FTX CEO John Ray.

Mixed ReactionsHowever, the plan has been met with mixed reactions from customers. While many acknowledge the significant progress in recovering funds, some express disappointment over missing out on the substantial rebound in crypto prices since the market’s low point in 2022. A number of customers have voiced their objections, demanding higher repayments that reflect the current market value of cryptocurrencies.

David Adler, representing four objecting creditors, pointed out that Bitcoin’s price, for example, has surged to over $63,000 from its November 2022 value of $16,000. Customers who deposited Bitcoin on FTX find it difficult to accept receiving a 100% recovery based on the significantly lower prices from two years ago, Adler argued.

FTX countered these objections by explaining that simply returning the original crypto assets is not feasible as they were misappropriated by Bankman-Fried. At the time of its bankruptcy filing, FTX.com held a mere 0.1% of the Bitcoin that customers believed they had deposited, highlighting the extent of the misappropriation.

Steve Coverick, one of FTX’s financial advisors, testified that it would be “exorbitantly expensive” to purchase billions of dollars worth of crypto assets on the open market to repay customers in the same cryptocurrencies they held before the bankruptcy.

Despite these challenges, the court’s approval of the bankruptcy plan represents a significant step forward in resolving the FTX saga and providing a measure of relief to its customers. The company continues to work out logistical details to ensure accurate and fair repayments across over 200 jurisdictions worldwide. While the exact timeline for repayments remains uncertain, the approval marks a crucial milestone in the long and complex process of unwinding FTX’s collapse.

Similar to Notcoin - Blum - Airdrops In 2024

FintruX Network (FTX) на Currencies.ru

|

|