2024-6-19 04:00 |

A local Chinese bank, the Bank of Huludao, has recently discovered an “intricate embezzlement” and money laundering scheme via crypto orchestrated by two of its top former executives.

The scandal, which has sent ripples through the financial community, involved the illicit transfer of a staggering 1.8 billion yuan (approximately $248 million). This discovery highlights the vulnerabilities within financial institutions and the methods individuals use to exploit these systems for personal gain.

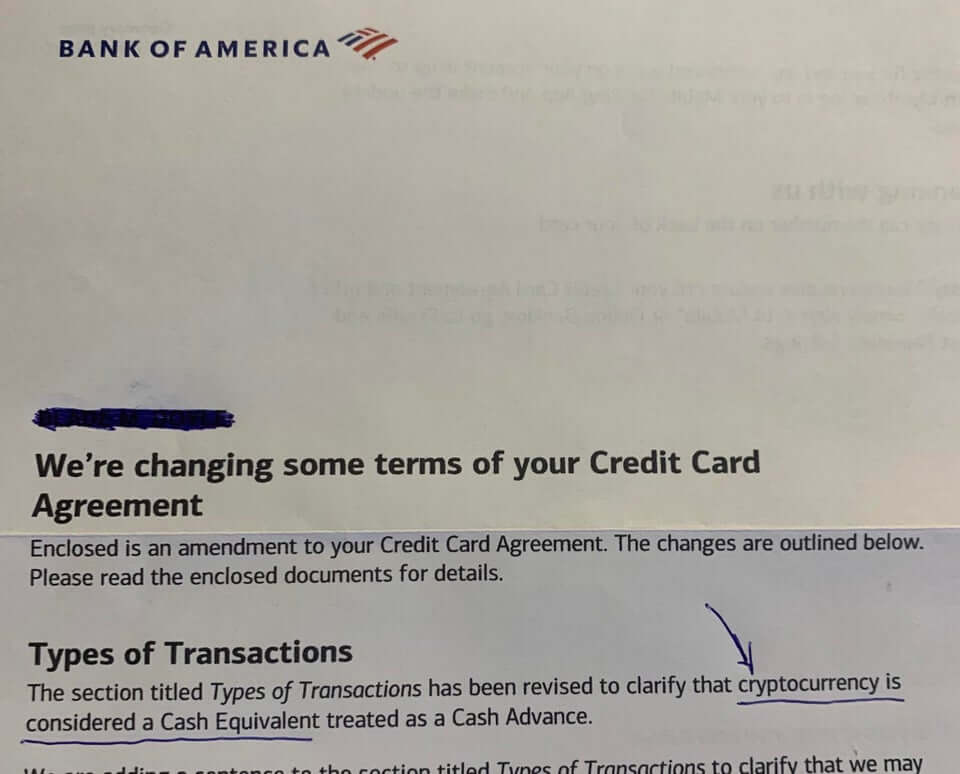

Cryptocurrency And Cross-Border LaunderingAs reported by the Chinese news outlet The National Business Daily, the scheme was not just confined to the misappropriation of funds but extended to “sophisticated laundering tactics” involving cryptocurrency.

Detailed investigations and court documents have revealed that the former executives, Li Yulin and Li Xiaodong, utilized their positions within the bank to embezzle funds initially earmarked for resolving non-performing assets.

In the months following the embezzlement, they and their accomplices converted these funds into foreign currency and funneled them into company accounts they controlled in Hong Kong. The subsequent steps involved a covert operation where the funds were invested in cryptocurrencies.

Through platforms like WeChat and various cryptocurrency trading groups, notably one named “Longmen Inn,” the accused purchased substantial amounts of cryptocurrency.

These digital assets were sold abroad, and the proceeds were laundered through US dollar transactions into Hong Kong-based bank accounts.

Such maneuvers appear to have camouflaged their illicit activities and capitalized on the regulatory ambiguities associated with cryptocurrencies.

Legal Repercussions And Broader ImplicationsAccording to the report, the court has already taken decisive action against one of the accomplices, a 44-year-old named Chen, sentencing him to over two years in prison and imposing a significant fine for his role in laundering part of the embezzled funds.

Notably, this case came when China intensified its crackdown on cryptocurrency-related crimes. Despite the country’s stringent anti-crypto regulations, the lure of digital currencies for masking illegal transactions remains high.

Recent months have seen several high-profile crackdowns. Last month, the country’s law enforcement disrupted a secretive banking network that used digital currencies for unauthorized currency exchanges totaling approximately 2.14 billion yuan ($295.8 million).

This network primarily facilitated the conversion of Chinese yuan into South Korean won, circumventing established currency exchange regulations.

Additionally, in the same month. The Chinese police dismantled a widespread underground banking operation accused of using Tether’s USDT stablecoin for illegal transactions. This extensive network, active across multiple provinces, reportedly handled transactions worth over $2 billion.

As reported by Bitcoinist, citing local media news reports, the Chengdu Municipal Public Security Bureau revealed that this underground scheme operated within 26 provinces and regions, leading to the arrest of 193 individuals and initiating 58 criminal cases by various public security departments.

Authorities have seized 149 million yuan linked to these illicit activities as part of their enforcement actions.

Featured image created with DALL-E, Chart from TradingView

Similar to Notcoin - Blum - Airdrops In 2024

Time New Bank (TNB) на Currencies.ru

|

|