2021-1-19 17:53 |

Stephen Harper, Canada’s former prime minister, believes that bitcoin (BTC) and CBDCs could constitute a basket of reserve currencies that will replace the US Dollar. He said this in an interview with Jay Martin, the CEO of Cambridge House, at the Vancouver Resource Investment Conference on January 18. While Harper believes that it would be hard to replace the US Dollar as the world’s leading reserve currency, he tabled a few suggestions, which, according to him, could be viable options.

In the interview, Harper, who served his country for nine years, noted that only large currencies such as the Chinese yuan or the Euro have a shot at replacing the US Dollar. However, he expressed doubt as to whether either of the fiats would be viable alternatives. The longstanding uncertainty over the value of the Euro would disqualify it. On the other hand, the arbitrary measures of the Chinese government would control the value of the yuan, rendering the currency an unsuitable option.

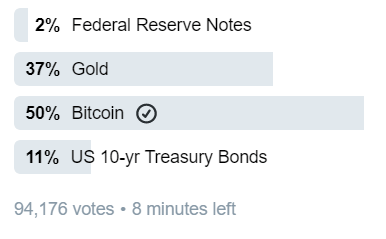

He said that it is hard to see what the alternative to the US Dollar as the world’s major reserve currency could be. However, gold and BTC can stand a chance, according to him. While the number of assets that the general public will use as reserves will increase in the future, the US Dollar will still be the most used asset.

The inevitability of CBDCsPer Harper, CBDCs are, to some extent, inevitable. However, the coins would be subject to monetary policy across the globe. Harper went on to express his worries about the impending reign of CBDCs, saying that it would make central banks general bankers instead of just financial monitors. Such a change would also affect the rollout of CBDCs.

Explaining his concerns, Harper said that the intentions that central banks have on CBDCs matters. If the central banks seek to use CBDCs to control inflation and create a stable currency and priceability, then digital currencies will be an evolution of the marketplace. However, if CBDCs are part of a series of wild experiments aimed at determining the role of central banks, then it leaves a lot to worry about.

This news comes as the Canadian crypto market continues to expand rapidly. For instance, 3iQ, a Canadian digital asset manager, unveiled that it had achieved another milestone after its QBTC fund reached a net asset value of CA$1 billion ($579.8 million) in market capitalization.

The post Former Canadian PM believes BTC is a potential reserve currency appeared first on Invezz.

Similar to Notcoin - Blum - Airdrops In 2024

Bitcoin (BTC) на Currencies.ru

|

|