2021-2-1 15:46 |

BeInCrypto breaks down some of the biggest altcoin movers and shakers from the previous week. Will their momentum continue?

During the week of Jan 25- Feb 1, the five altcoins that rallied the most were:

Dogecoin (DOGE) – 337% Voyager Token (BQX) – 162% XRP (XRP) – 137% Fantom (FTM) – 102% Pancake Swap (CAKE) – 95%.It should be noted that FTM also the top gainer in last week’s analysis.

Biggest Altcoin GainersDOGE increased considerably last week, reaching a new all-time high price in the process, but the pump could be artificial and the short-term move is entirely parabolic.

BQX and FTM have left massive upper wicks in the daily, a sign of selling pressure. Furthermore, the former is showing considerable signs of weakness in its technical indicators.

XRP is in the process of breaking out from an important resistance area. If successful, it could be the catalyst for the resumption of the upward move at an even more accelerated rate.

Similar to XRP, CAKE is in the process of moving above a crucial resistance area created by the all-time high.

DOGEDOGE increased massively last week, gaining 400% from the week’s opening price until close. At one point, DOGE had moved upwards by 820% in a span of just two days.

It seems that the pump was a result of coordinated buying from Redditors.

So far, DOGE has reached a high of $0.067, which is 200% higher than the previous all-time high price. Furthermore, it’s also more than 200% higher than the 4.61 Fib extension of the most recent increase, which often acts as a top.

Therefore, despite technical indicators still being bullish, the pump looks extremely unnatural.

If DOGE returns to validate the all-time high level near $0.0195 it could create some type of structure. For now, it looks completely parabolic in the short-term.

DOGE Chart By TradingView BQXBQX also increased considerably last week. The majority of the upward move transpired on Jan. 29-30 when it managed to reach a high of $4.71.

However, there are signs of weakness developing, visible by the bearish divergence in the RSI and the bearish cross in the Stochastic oscillator.

BQX has already reached the 4.61 external Fib retracement at $4.31 before decreasing.

Therefore, it is possible that BQX will continue decreasing until it manages to find some support, possibly at the previous resistance area at $1.47.

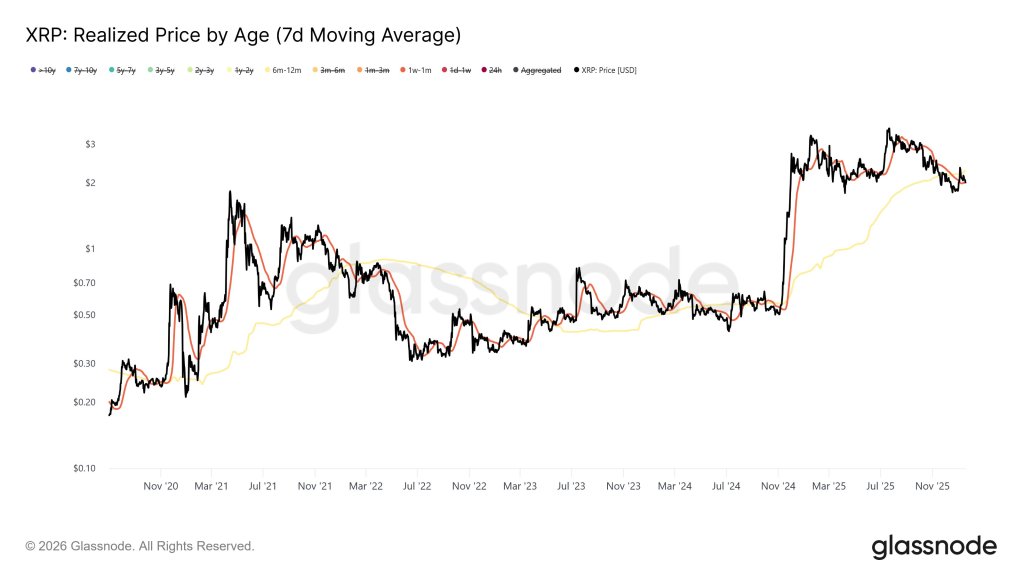

BQX Chart By TradingView XRPXRP has made the majority of its gains back over the past three days, having increased by 140%. It’s currently trading near the local high of $0.67. Throughout the increase, XRP managed to reclaim the $0.47 resistance area, which is now likely to act as support.

Despite the fact that XRP is trading very close to the $0.70 resistance area, technical indicators are firmly bullish, indicating that a breakout is expected to occur.

If it does, XRP could increase above $1 due to the lack of overhead resistance.

XRP Chart By TradingView FTMSimilar to XRP, the majority of the gains for FTM occurred on Jan.28-29, with a high of $0.26 being reached on Jan. 29.

However, unlike XRP, FTM has decreased considerably since. It closed with an upper wick of Jan. 29 measuring a decrease of 49%. Furthermore, the Stochastic oscillator has just made a bearish cross.

Considering FTM has already reached the 4.618 Fib extension level, it’s possible that it is now retracing.

FTM appears to have found support above the 0.618 Fib level at $0.107, so some consolidation around the area is expected before it resumes moving up.

FTM Chart By TradingView CAKECAKE is currently in the process of breaking out from the $2.40 resistance area. If successful, it could lead to a new all-time high price.

Technical indicators are bullish and support the likelihood that CAKE breaks out.

Due to the lack of overhead resistance, we would expect the rate of increase to accelerate if it breaks out.

CAKE Chart By TradingViewFor BeInCrypto’s latest Bitcoin (BTC) analysis, click here

The post Five Biggest Altcoin Gainers Last Week appeared first on BeInCrypto.

origin »Bitcoin price in Telegram @btc_price_every_hour

Five Star Coin Pro (FSCP) на Currencies.ru

|

|