2023-5-17 14:15 |

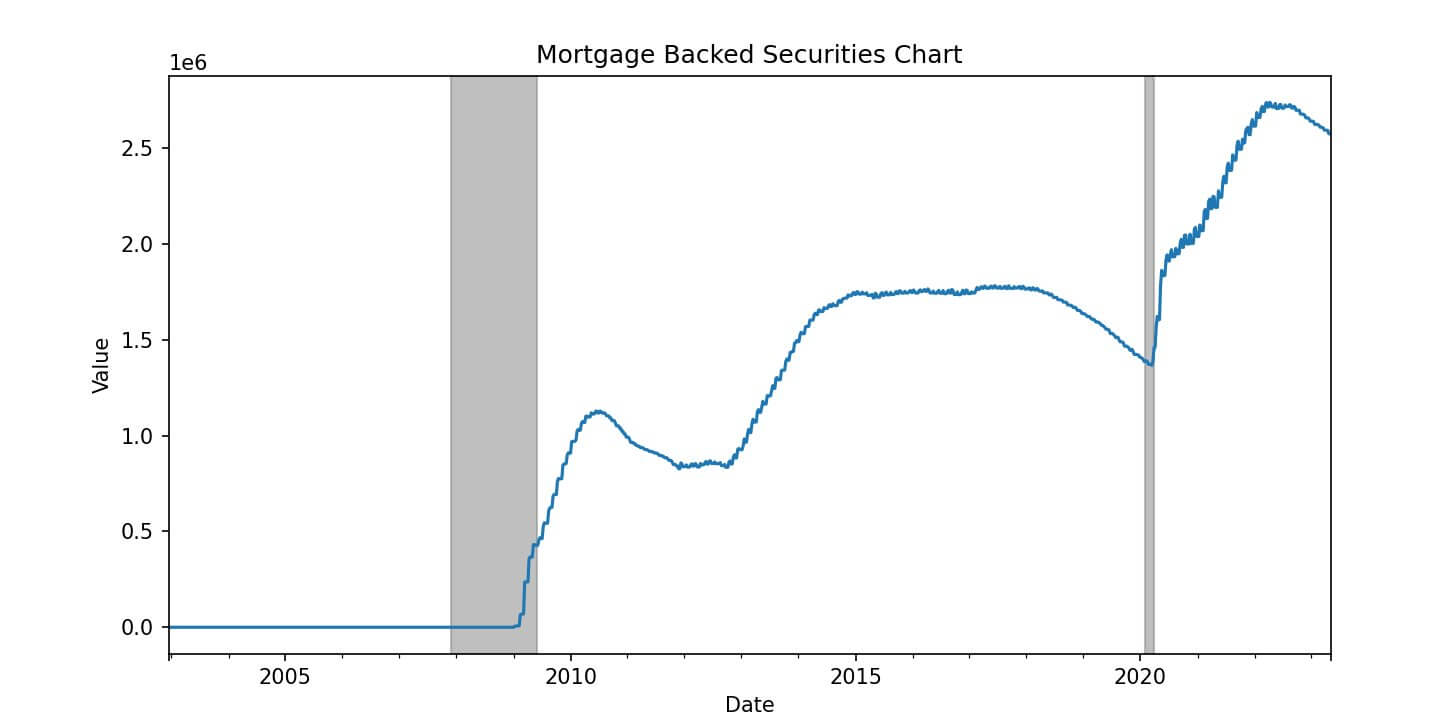

Quick Take “A mortgage-backed security (MBS) is an investment secured by a collection of mortgages bought by the banks that issued them. Mortgage-backed securities are bought and sold on the secondary market. An MBS is a type of asset-backed security”. 2008 during the GFC, the Federal Reserve had to step in and buy MBSs to support the economy, add liquidity to the market, and keep interest rates low. Fast forward 15 years, and FED now holds $2.6 trillion worth of MBS. These MBS will not be worth $2.6 trillion with rising interest and mortgage rates. Selling below par for the FED would see huge losses on their portfolio and “mark to market losses.” What would the new value of these securities be? Substantially less. It would make more sense for the FED to offload these securities before a higher % becomes more underwater. Each time the FED tries to offload these MBS, they have to keep buying them up over the long term. MBS: (Source: FRED)

The post Fed’s $2.6T MBS dilemma – rising rates could trigger massive portfolio losses appeared first on CryptoSlate.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin Interest (BCI) на Currencies.ru

|

|