2020-8-10 22:15 |

The U.S. Federal Reserve is expected to ramp up inflation by keeping interest rates low. As the U.S. dollar falls sharply and gold’s price soars, institutional investors are moving their money into alternative investments, including bitcoin.

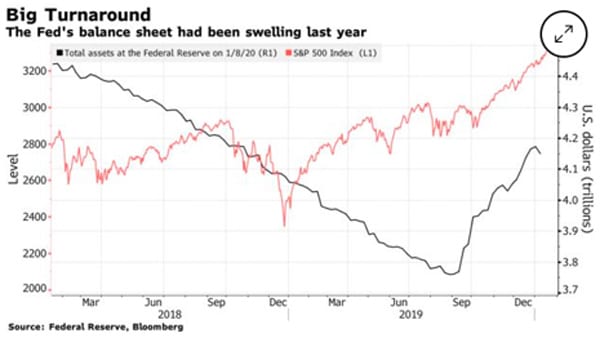

Fed Policies Drive Demand for BitcoinThe Federal Reserve is completing a year-long policy review and “is expected to make a major commitment to ramping up inflation soon,” CNBC reported last week. Investors have been making heavy bets accordingly as evidenced by record-high gold prices, the falling U.S. dollar, and increased demand for Treasury Inflation-Protected Securities (TIPS).

The Fed is expected not to raise interest rates until inflation and unemployment targets are hit. Supporting the Fed’s policies, President of the Federal Reserve Bank of Chicago Charles L. Evans said he would like to keep rates where they are until inflation gets up around 2.5%, the publication conveyed. However, it could take years for the Fed to hit its targets since inflation is currently closer to 1% and the unemployment rate is higher than it has been since the Great Depression.

“We believe that the Fed publicly would welcome inflation in a range of 2% up to 4% as a long-overdue offset to inflation running below 2% for so long in the past,” explained Ed Yardeni, head of Yardeni Research. He calls this approach “wildly bullish” for alternative asset classes.

Some institutional investors are shifting their strategies to reflect the new environment. Citing Federal Reserve Chairman Jerome Powell saying “we’re not thinking about raising interest rates and we’re not even thinking about thinking about raising interest rates,” the CEO of Nasdaq-listed Microstrategy Inc. (ticker symbol MSTR), Michael Saylor, said during the company’s Q2 2020 earnings call:

If you have large dollar values and you’re hoping for any kind of return on them, that’s faded. Gold, silver, and bitcoin are showing strength.

“The dollar, the DXY index is weakening. Faith in fiat currency across the market is fading and we’ve seen that in rallies in most asset classes during Q2,” he noted. “Accordingly, it wouldn’t be prudent to continue to hold a large portion of USD as our treasury strategy, and that’s prompted us to rethink this.”

Microstrategy CFO Phong Le told investors:

We will seek to invest up to another $250 million over the next 12 months in one or more alternative investments or assets which may include stocks, bonds, commodities such as gold, digital assets such as bitcoin, or other asset types.

“Publicly traded companies are starting to diversify their cash holdings into bitcoin,” commented Marty Bent, Editor in Chief of Marty’s Bent, a daily newsletter about Bitcoin. “Boardrooms across the country will begin to ask, ‘Should we be diversifying into bitcoin too?’ Hyperbitcoinization can happen faster than you can imagine. Be prepared.”

Meanwhile, some experts doubt the effectiveness of the Fed’s policies. Peter Boockvar, chief investment officer at Bleakley Advisory Group, remarked:

Just manipulating interest rates doesn’t mean you get to some finger-in-the-air inflation rate that you choose.

Regarding the Fed’s plan to crank up inflation amid record-high unemployment while the economic recovery is in jeopardy, he was quoted as saying: “It doesn’t make any economic sense whatsoever. The consumer is very fragile right now. The last thing we should be shooting for is a higher cost of living.”

What do you think about investors hedging Fed policies with bitcoin? Let us know in the comments section below.

The post Federal Reserve’s Expected Inflation Ramp-Up Drives Institutional Investors to Hedge With Bitcoin appeared first on Bitcoin News.

Similar to Notcoin - Blum - Airdrops In 2024

Global Currency Reserve (GCR) на Currencies.ru

|

|