2020-9-25 17:31 |

For some time now, the Federal Reserve Bank has been researching digital currency and its viability in the payment sector

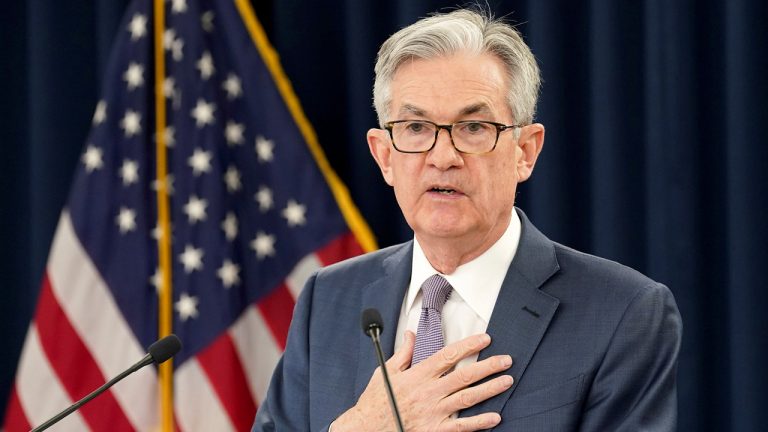

Yesterday, the President of the Federal Reserve Bank of Cleveland disclosed a few details of the research after a period of exploring the feasibility of the virtual currency. Loretta Mester pointed out that the bank had been considering the option of CBDC even before the coronavirus pandemic struck.

This comes only two weeks after the Bahamas Central Bank announced it was planning to launch a digital currency in October. Seemingly, the country will be the first to launch a sovereign CBDC ahead of some of the world’s superpowers. The Bahamas announced its ‘Sand Dollars’ will be instituted nationwide after a successful pilot program late last year.

Speaking in a keynote address, she noted that the concerned executives were “building and testing a range of distributed ledger platforms to understand their potential benefits and tradeoffs.”

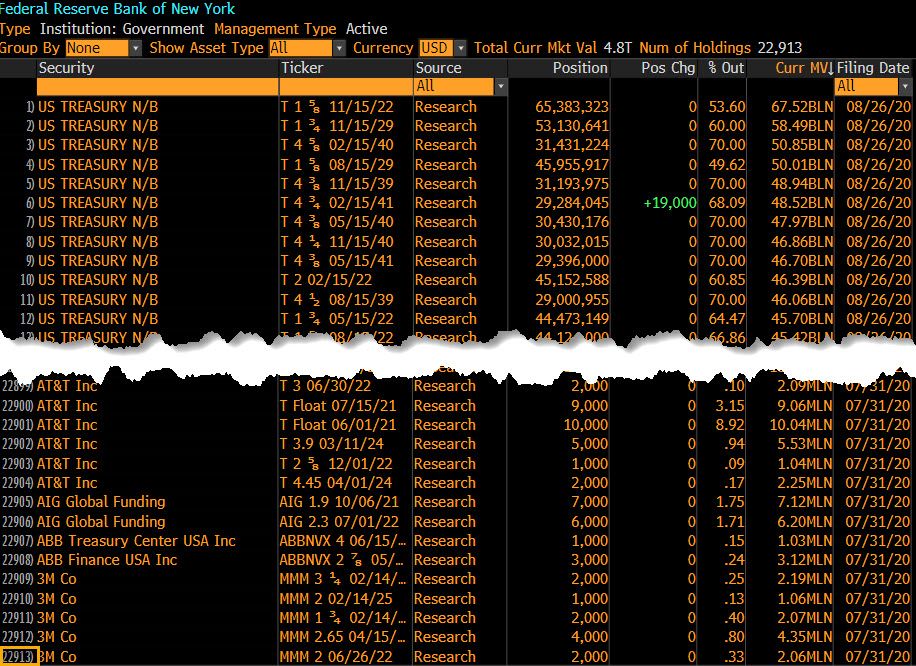

Mester further highlighted the efforts from some regional Federal Reserve branches. In particular, she recognised the multi-year deal between Boston Fed and the Massachusetts Institute of Technology and the partnership between the Bank for International Settlements and the New York Fed Branch.

The Cleveland Fed executive was, however, keen to indicate that the ongoing research didn’t guarantee the adoption of the CBDC alternative. She explained that there is a need to recognise and take on board concerns related to “financial stability, market structure, security, privacy, and monetary policy”

She also spoke of the effects of the pandemic and how it had ravaged the economy by disrupting the country’s most significant infrastructure including the payments sector. She drew attention to the specific impact on the payment sector i.e. massive changes to the volume of domestic transfers.

“The spread of COVID-19 heightened the reliance of businesses and individuals on digital services and faster connectivity, as many employees began to work from home and consumers turned to online shopping,” she said.

Mester insisted on “making necessary investments to ensure that the U.S. payments system remains resilient in the face of extreme stress events will need to remain a priority.”

The post Federal Reserve Bank discloses details of its CBDC research appeared first on Coin Journal.

Similar to Notcoin - TapSwap on Solana Airdrops In 2024

Global Currency Reserve (GCR) на Currencies.ru

|

|