2020-8-20 09:12 |

The Federal Reserve (Fed) released minutes for the most recent Federal Open Market Committee meeting (FOMC). The minutes detailed a host of strategy changes that weighed heavily on stocks, gold, and Bitcoin.

The meeting, held on July 28-29, was marked by a number of important perspectives on the economy. These included changes to interest rates, concerns over the lack of inflation, and questions regarding control of yield curves.

Interest Rates Remain UnchangedThe current guidance from the Fed regarding interest rates remains relatively unchanged. Currently set at 0%, the benchmark rate will likely remain unmoved as long as the COVID-19 crisis continues.

With regard to the outlook for monetary policy beyond this meeting, a number of participants noted that providing greater clarity regarding the likely path of the target range for the federal funds rate would be appropriate at some point.

The nebulous statement weighed on stocks, leaving investors uncertain over the reality of the apparent recovery. With the Fed remaining overtly cautious, the future for the economy remains murky at best.

Inflation Rates BustedInterestingly, in spite of massive liquidity flooding the market, inflation remained relatively low at under 1%. This left the Fed confused, given that the substantial influx of capital should have bolstered inflation.

The Fed has traditionally targeted 2% inflation, using benchmark rates and liquidity as opposing forces to stay in that band. However, low rates and liquidity seem to have had little effect on the current inflation levels.

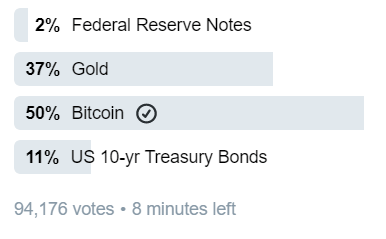

This low inflation scenario sent investors out of safe havens like gold and Bitcoin, and back into the dollar. The dollar rose sharply during trading, while both gold and Bitcoin saw substantial losses.

This scenario has led to a policy shift that allows for even greater freedom for inflation to run wild. The Fed hopes that the new policy will force inflation up closer to the 2% goal.

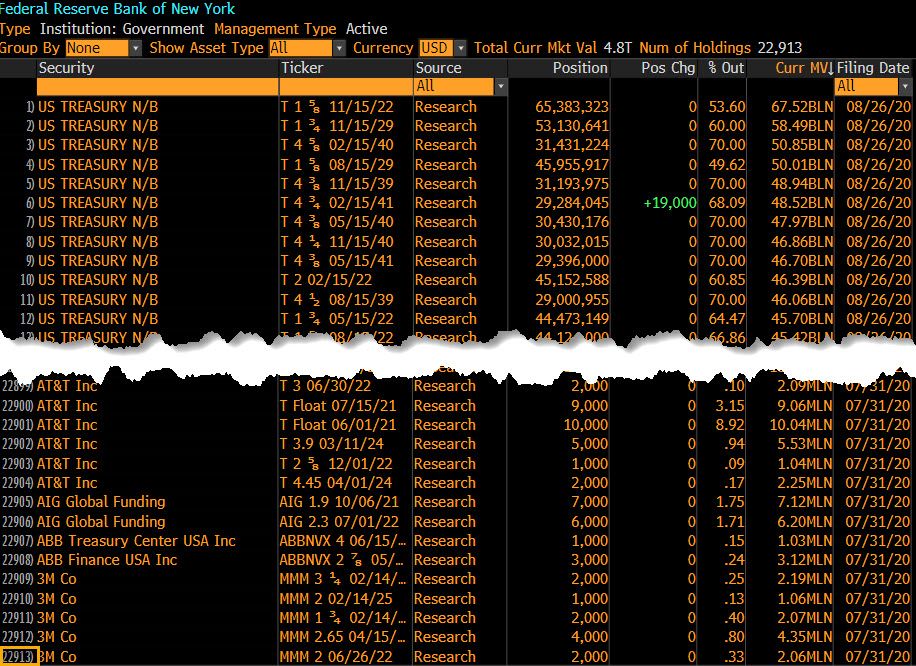

Lower the CurveFinally, the Fed considered controlling the yield curve for Treasuries by capping yields. This would ostensibly drive investors into the risk-averse asset.

This potential policy change sent yields on Treasuries up, while also having the reverse effect on gold and Bitcoin. Since Treasuries offer interest, investors will often seek them out during times of high-yield combined with low inflation.

However, the committee ruled against such activity. The reasoning included that currently, low benchmark rates have a similar effect on yields. Capping the yield to control the curve would likely have any additional benefits.

The post Fed Strategy Changes Push Dollar Up, Bitcoin and Gold Down appeared first on BeInCrypto.

origin »Bitcoin price in Telegram @btc_price_every_hour

Golos Gold (GBG) на Currencies.ru

|

|