2023-7-6 01:10 |

The Federal Reserve provided new details about the outcome of its mid-June meeting in a minutes document published on July 5.

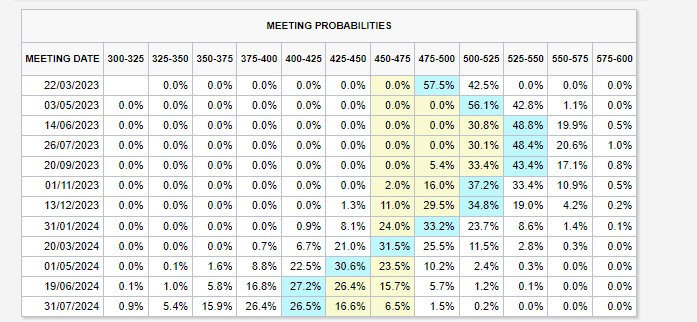

Those minutes reaffirmed that the group aims to keep the federal funds rate — or target interest rate — at 5% and 5.25% in the immediate future.

The Fed also said it aims to return the inflation rate to 2%, a goal that the latest publication says all members are “strongly committed” to.

In order to reduce interest rates, the Federal Reserve said it will take into account the cumulative tightening of monetary policy, the delayed effect of policy on economic activity and inflation, and other developments. It also said that the Federal Open Market Committee (FOMC) will reduce the Federal Reserve’s holdings of Treasury securities and agency debt and agency mortgage-backed securities.

While some of those outcomes were mentioned in earlier reports, the latest minutes gave additional context by noting that almost all participants found it “appropriate or acceptable” to leave the target rate at 5% to 5.25%.

Though members voted in unison to leave the interest rate at the current level, some participants favored a raise of 25 basis points for the federal funds rate or said that they could have supported such a raise. They supported this due to a tight labor market, momentum in economic activity, and few signs of a return to the Fed’s 2% target.

Future interest rate hikes could occurThe latest minutes report also described a survey of market participants. It said that median paths suggested no rate changes would take place in early 2024 but said that respondents saw a “clear probability of additional tightening at coming meetings.”

Respondents, on average, also estimated a 60% probability that the peak policy rate will be higher than the current target rate.

Separate reports from CNBC suggest that, within the Federal Reserve, 16 of 18 participants expected one additional hike could take this year.

Higher interest rates are generally believed to reduce investment in risk assets such as cryptocurrency. However, the latest news has not dramatically affected cryptocurrency: Bitcoin (BTC) and the rest of the crypto market are down just 1% over 24 hours.

The post Fed decided against rate hikes in June FOMC meeting, but left room for future increases appeared first on CryptoSlate.

origin »Bitcoin price in Telegram @btc_price_every_hour

Trident Group (TRDT) на Currencies.ru

|

|