2024-5-9 16:00 |

Europe’s securities regulator is seeking input from stakeholders on the potential inclusion of crypto assets in a potentially massive market. The European Securities and Markets Authority (ESMA), the regulatory authority responsible for overseeing financial markets within the European Union, has recently initiated a comprehensive review of the regulations surrounding the Undertakings for Collective Investment in Transferable Securities (UCITS) Eligible Assets Directive (EAD).

This move could potentially enable the integration of cryptocurrencies into a vast investment market valued at approximately €12 trillion (roughly $12.88 trillion). On May 7, 2024, ESMA released a Call for Evidence seeking input from various stakeholders to assess the viability and implications of allowing UCITS to include a broader array of asset classes, notably cryptocurrencies.

The UCITS framework, central to EU retail investment, accounts for around 75% of all retail investment in collective funds within the region. With its global reputation for strict regulation and investor protection, the inclusion of cryptocurrencies could represent a transformative shift in the investment landscape.

The Next Big Catalyst For Crypto?ESMA’s review aims to address the evolving financial landscape, where the number and variety of financial instruments have expanded significantly since the UCITS framework was established nearly two decades ago. This expansion has led to uncertainties in determining asset eligibility, causing divergent interpretations and applications of the directive across member states.

Sean Tuffy, a financial regulation expert, underscored the significance of this development to DL News, stating, “If ESMA is convinced, it would be the final step in mainstreaming crypto assets in Europe,” referring to it as a potential “game changer.” This sentiment is echoed by industry experts who believe that the inclusion of crypto assets could provide a robust alternative to traditional investment options, potentially enhancing portfolio diversification and returns.

The Call for Evidence targets a broad audience, including investors, consumer groups, UCITS management companies, self-managed UCITS investment companies, depositaries, and trade associations. These stakeholders are invited to share their insights on market practices, interpretative issues, and practical application concerns related to the eligibility criteria and other provisions of the UCITS EAD.

One of the critical areas of focus is the transversal consistency of key notions and definitions used in the UCITS EAD with other pieces of legislation in the EU Single Rulebook. This alignment is crucial to ensure that any new asset classes, such as cryptocurrencies, are integrated smoothly and consistently across all regulatory frameworks.

Andrea Pantaleo, a lawyer specializing in crypto regulation, highlighted several potential benefits and challenges. He told DL News, “UCITS funds have specific investment limitations depending on the type of assets. We won’t have a 100% crypto UCITS fund, but hopefully many investment funds could hold 1-2% of their liquidity in crypto.”

However, he also pointed out a significant obstacle: the coordination of custody regulations, which must align with the EU’s upcoming Markets in Crypto-Assets regulation (MiCA). MiCA is set to establish stringent rules for the segregation of assets and policies for their safekeeping, which will be pivotal in the custody of crypto assets.

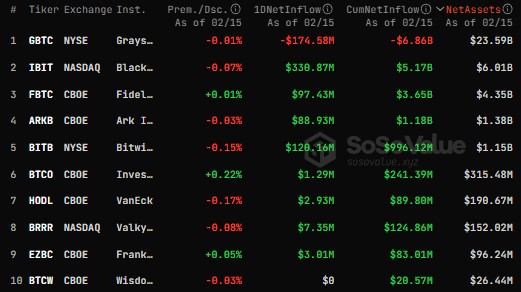

The potential inclusion of cryptocurrencies in UCITS comes at a time when other major economies, such as the US and Hong Kong, have begun integrating crypto assets into their financial products, notably through the approval of Bitcoin ETFs. These developments have not only validated the financial viability of cryptocurrencies but have also spurred significant investment inflows into the sector.

The ESMA consultation process is set to conclude on August 7, 2024, after which the watchdog will compile the feedback and develop its technical advice to the European Commission. This advice will play a crucial role in determining whether cryptocurrencies will be included in the UCITS framework, potentially heralding a new era for crypto investment in Europe.

At press time, the total crypto market cap stood at $2.202 trillion.

Similar to Notcoin - TapSwap on Solana Airdrops In 2024

Emerald Crypto (EMD) на Currencies.ru

|

|