2024-10-24 19:08 |

Cryptocurrency enthusiasts are filled with anticipation and or hope about Ethereum, currently the second most valuable digital currency, as market analysts forecast a notable surge in its value. They speculate that during this bull cycle, Ethereum could reach a new high of $10,000, reviving investor enthusiasm following a period of fluctuation.

Crypto analyst Tardigrade’s prediction is based on the analysis of Ethereum’s price trends, particularly noting the formation of symmetrical triangles along an ascending trendline—a pattern typically suggesting a phase of consolidation before a significant price movement.

Tardigrade elaborated on these observations, saying that Ethereum is poised on an upward trendline marked by symmetrical triangles, which may be indicative of an upcoming substantial price rise. He has documented that since 2022, Ethereum has developed three such triangles, with each leading to a major gain: the first breakout resulted in over 70% increase in value, and the subsequent one saw gains surpassing 140%.

Ethereum’s Breakout Patterns Suggest 280% SurgeAs Ethereum broke out of its third symmetrical triangle, Tardigrade’s analysis suggests that if this latest breakout continues its upward trajectory, a 280% increase is within reach. This upward trajectory would set the stage for Ethereum to touch the coveted $10,000 mark.

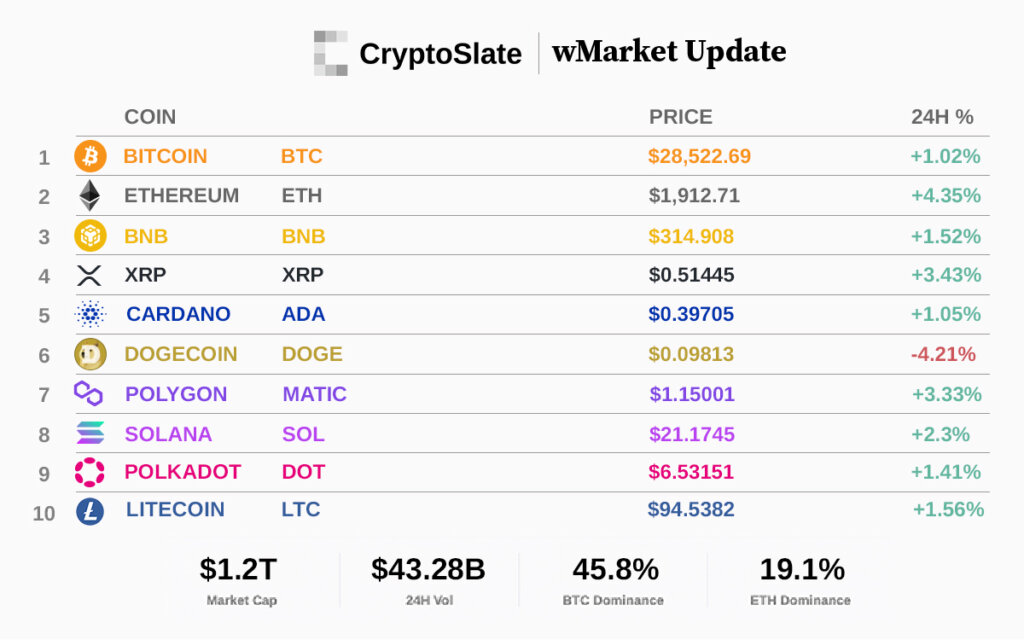

Despite Ethereum’s bullish sentiment, recent market trends have seen ETH’s price dip to around $2,600, reflecting a nearly 6% decline in the past three days, according to Brave New Coin’s Ethereum Liquid Index. The overall cryptocurrency market has experienced a pullback, which has cast a shadow over investor confidence.

Ethereum’s downward price movements this week have been closely correlated to those of Bitcoin. Source: Brave New Coin Ethereum Liquid Index

In the last week alone, Ethereum’s market cap and trading volume have decreased by about 2.65% and 13.83%, respectively. With a combination of historical performance patterns and current market dynamics, including increased institutional interest due to anticipated Ethereum exchange-traded funds (ETFs), there remains a solid argument for ETH’s potential surge.

Ethereum’s Bull Cycles Point to $10,000 MarkIn the broader context, Ethereum’s price trajectory mirrors patterns from previous bull cycles, particularly the fractals observed between January 2023 and March 2024. During this period, Ethereum consolidated between $1,500 and $2,000 before surging past $3,500. If current trends hold, ETH could replicate this movement and target the $10,000 mark as its final destination in this cycle.

Furthermore, macroeconomic factors such as M2 money supply growth are playing a critical role in shaping the market trend. Historically, both Bitcoin and Ethereum prices have correlated positively with expansions in global liquidity. This indicates that central banks might ease monetary policies in response to economic uncertainty.

According to several analysts, the formation of ETH ETFs could be a game-changer, as they have previously driven significant price increases for Bitcoin. Institutional inflows related to these ETFs are expected to commence soon, further bolstering Ethereum’s market position.

While Ethereum undoubtedly struggles to maintain momentum, the question remains whether it can break through critical resistance levels, particularly around the $3,500 mark. Analysts suggest that exceeding this level could trigger substantial short liquidations, potentially accelerating a price increase.

Similar to Notcoin - Blum - Airdrops In 2024

Market.space (MASP) на Currencies.ru

|

|