2023-3-28 15:30 |

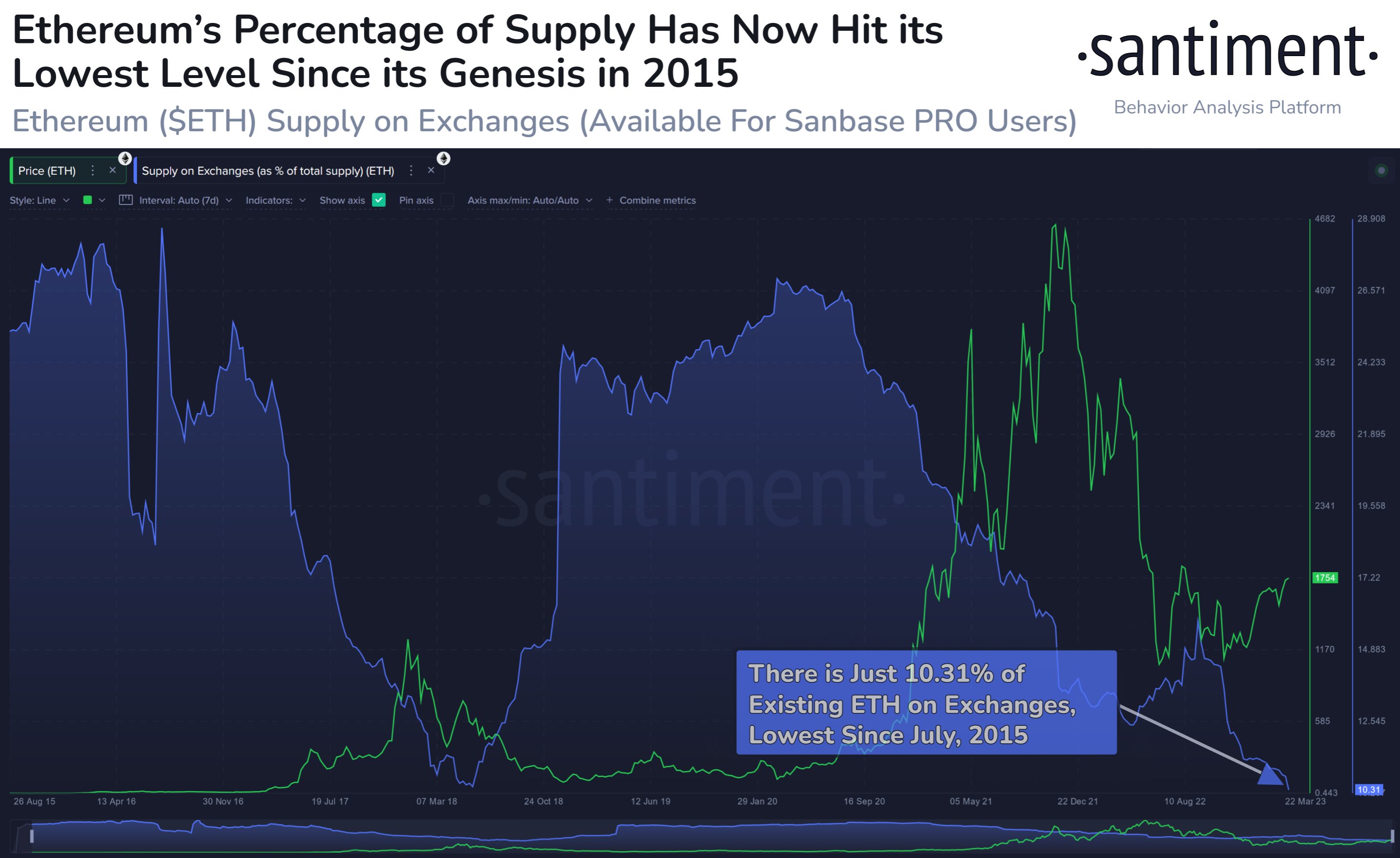

Ethereum supply on exchanges has continued to go down recently and has now touched a value of 10.3%, effectively a new all-time low.

Just 10.3% Of The Total Ethereum Supply Is Now Being Kept On ExchangesAccording to data from the on-chain analytics firm Santiment, the current ETH supply on exchanges is the lowest since the week the cryptocurrency was introduced almost eight years ago.

The “supply on exchanges” is an indicator that measures the percentage of the total Ethereum supply that’s currently being stored in the wallets of all centralized exchanges.

When the value of this metric goes down, it means some coins are being taken out of these platforms right now. Such a trend, when prolonged, may prove to be bullish for the asset’s price as it can be a sign that accumulation is going on in the market.

On the other hand, the metric’s value trending up implies investors are depositing their ETH to exchanges currently. As one of the main reasons why holders transfer to these platforms is for selling-related purposes, this kind of trend can have a bearish effect on the value of the asset.

Now, here is a chart that shows the trend in the Ethereum supply on exchanges over the last several years:

As displayed in the above graph, the Ethereum supply on exchanges had been on a constant downtrend since the start of the bull run of this cycle, until the middle of the bear market in 2022.

The indicator observed some growth during this period, suggesting that investors were depositing to these platforms then. This may have been a sign of capitulation, as holders who bought during the bull run tend to exit out of the asset when bear markets set in.

This uptrend that was building up, however, broke off around the time of the collapse of the cryptocurrency exchange FTX. The reason behind this was that, after seeing what went down with FTX, investors became more aware than ever of the risks of keeping their coins in central custody.

So, a large number of holders made withdrawals from such platforms to keep their Ethereum inside their personal wallets. Because of this movement, the supply on exchanges saw a sharp plunge.

Interestingly, as the rally has taken place this year, the metric still hasn’t reversed its trend and has rather kept on going down. Normally, deposits may be expected during periods with bullish trends as some holders would want to realize their profits.

The fact that the indicator has only continued the downtrend suggests that there is enough demand for withdrawing the asset that any deposits being made are getting outweighed.

Following the latest downtrend in the indicator, the percentage of the Ethereum supply on exchanges has dropped to just 10.3%. Santiment believes that this shows high confidence from the HODLers of the asset.

ETH PriceAt the time of writing, Ethereum is trading around $1,700, down 1% in the last week.

origin »Bitcoin price in Telegram @btc_price_every_hour

Supply Shock (M1) на Currencies.ru

|

|