2021-6-15 22:52 |

Today, Ethereum has reached a new milestone with over 25% of all ETH supply locked behind smart contracts, a notable increase over the 15% during last year.

As pointed out by ETHhub founder, Anthony Sassano, the current ETH supply percentage under smart contracts is similar to what it was during the DAO event in 2016.

The amount of ETH in smart contracts is now at a similar level to what it was during The DAO event (around 23% of all ETH).

Sassano notes that the percentage of ETH in smart contracts back in 2016 was around 23%. Since the coin was worth $13 then, the supply under smart contracts was worth about $230 million. The same amount is worth $63 billion today.

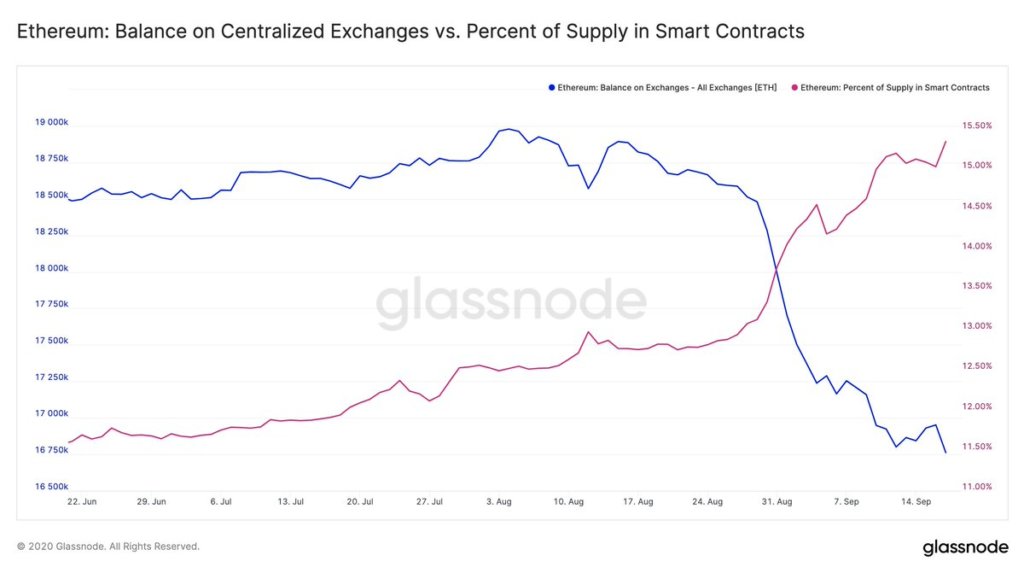

Here is a chart that shows how the ETH percentage in smart contracts has changed over the years:

Percent of supply in smart contracts has similar peaks in 2016 and 2021 | Source: GlassnodeThe spike in 2016 traces back to the launch of DAO, the first ever decentralized autonomous organization, based on the Ethereum blockchain. A crowdfunding campaign successfully backed the project, raising around $150 million in the process.

However, a cyberattack struck the organization later the same year, taking advantage of some security vulnerabilities in the system. Resulting in the huge, sudden drop-off on the chart.

A major consequence of the happening was the ETH blockchain hard fork between Ethereum and Ethereum Classic. The fork helped recover the stolen tokens.

It can also be evidenced from the chart that ETH has made some strong progress over the past year, where the percentage increase between 2020 to 2021 is around 10%. A big jump when compared to the 4% gap between 2019 and 2020.

One of the main reasons behind the increase can be attributed to the rise in DeFi protocols. Instead of passive holding, investors now prefer to get their returns by putting their money into smart contracts.

Related Reading | How DeFi Is Expanding Beyond Ethereum in 2021

Another interesting thing that Sassano points out is that there are over 1 million ETH in the Binance Smart Chain bridge contract.

ETH 2.0 StakingAs can be seen from the ETH 2.0 launchpad website, there are currently over 5.4 million ETH staked. This means that the Beacon Chain contract alone accounts for nearly 22% of the total ETH under smart contracts.

Staking rewards are at 6.7% right now, with over 165,430 validators. As stakers deposit more ETH into the Beacon Chain contract, the staking rewards go down. Below is a chart that shows how staking rewards go down:

Staking rewards follow the law of exponential decay | Source: Ethereum 2.0 LaunchpadRelated Reading | Up and Coming Staking Coins in 2021

Ethereum Price TrendAs of the time of this post, ETH is worth $2995, up 6.4% in the past 24 hours.

ETH shows a slight downwards trend | Source: ETHUSD on TradingView Featured image from Unsplash, Charts from TradingView, Glassnode origin »Bitcoin price in Telegram @btc_price_every_hour

SmartCash (SMART) на Currencies.ru

|

|