2020-12-29 16:32 |

Ethereum prices rose Monday as its on-chain fundamentals confirmed supply constraints across all the leading exchanges against rising demand.

The Ethereum-to-dollar exchange rate climbed by up to 8.72 percent to $740, a level it last tested in May 2018. Intraday-wise, the pair’s upside move came in the wake of a correcting Bitcoin, which, on Sunday, rose to a new record peak of $28,377.

Ethereum is consolidating higher in a Wedge-like pattern. Source: ETHUSD on TradingView.com Ethereum is consolidating higher in a Wedge-like pattern. Source: ETHUSD on TradingView.comSo it appears, traders preferred to sell the Bitcoin’s top to seek opportunities in a lowly-trading Ethereum, whose idiosyncratic fundamentals, including its blockchain protocol’s much-publicized upgrade to proof-of-stake, also pointed to a long-term bullish outlook. Some analysts agreed that the Ethereum price could close above $1,000 next year.

Ryan Watkins, the senior research analyst at Messari — a crypto-focused data platform, stated that institutions might start buying Ethereum in 2021 as they explore profitable crypto alternatives beyond Bitcoin.

“It’s a much easier jump from BTC to ETH from there,” he added.

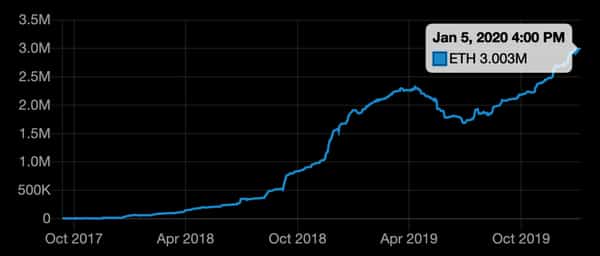

Ethereum Supply DeclinesThe primary fundamental behind Ethereum’s wild upside moves is the classic supply-demand model. Switching to proof-of-stake means more people would lock their ETH holdings into the Ethereum 2.0 smart contracts to earn attractive annual percentage yields, thereby removing a good supply from the market. And so it seems, that is already happening after the early December protocol upgrade.

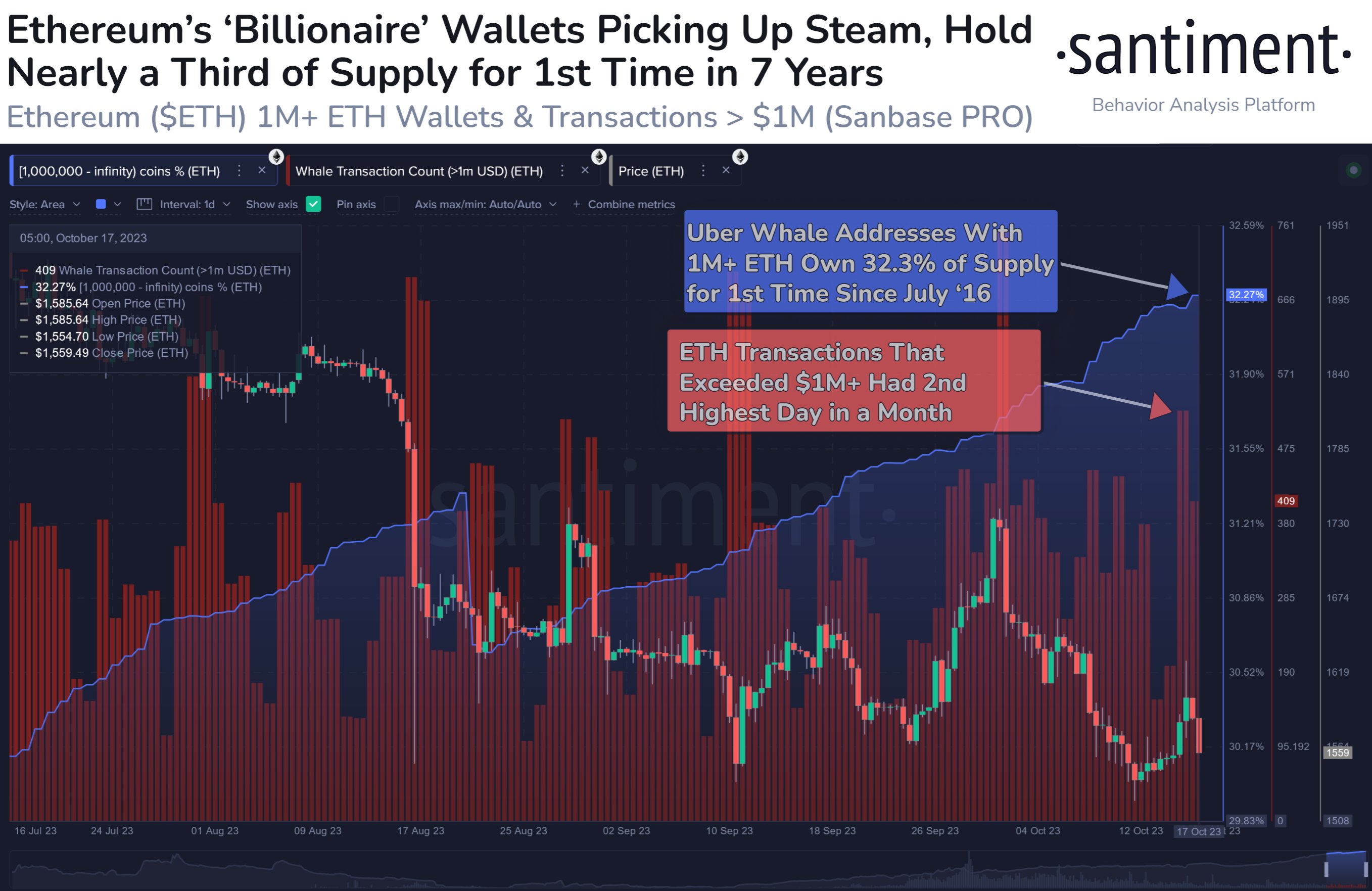

According to data analytics platform Santiment, the Ethereum balance on all the crypto exchanges has fallen to a 1.5 year low. It typically means fewer traders are looking to exchange their ETH holdings for other assets in the short-term.

Ethereum supply metrics. Source: Santiment Ethereum supply metrics. Source: SantimentMeanwhile, Ethereum miners’ balances have also crashed to levels last seen two years ago. It indicates a growing demand for the cryptocurrency in over-the-counter and retail markets.

“Both are great validators,” commented Santiment.

Technical SetupThe biggest bullish catalyst for Ethereum is not coming from the US dollar, but the bitcoin-pegged trades.

The ETH/BTC traders have expressed their conviction for a medium-term bullish bias as the pair looks to have bottomed out on its longer timeframe charts. Traditionally, it signals the beginning of a so-called “altcoin season,” wherein traders exit their Bitcoin positions to seek profitability in alternative cryptocurrencies.

The weekly close of Ethereum on the BTC pair signifies a bottom, as Michaël van de Poppe presented. Source: ETHBTC on TradingView.com The weekly close of Ethereum on the BTC pair is signaling a bottom, as presented by Michaël van de Poppe. Source: ETHBTC on TradingView.com“Closed above the crucial threshold of this range, indicating further upwards momentum [will] occur, and another HL is created,” noted Michaël van de Poppe, an independent market analyst, adding that it is a “good sign” for Ethereum.

Meanwhile, analyst Edward Morra spotted an inverse head and shoulder pattern on the ETH/BTC weekly chart. He noted that the technically bullish pattern could send the pair up by as much as 150 percent.

Ethereum inverse head and shoulder pattern, as presented by Edward Morra. Source: ETHBTC on TradingView.com Ethereum inverse head and shoulder pattern, as presented by Edward Morra. Source: ETHBTC on TradingView.comMr. Morra’s long-term price target for ETH/BTC is 0.05.

origin »Ethereum (ETH) на Currencies.ru

|

|