2020-9-6 01:14 |

After hitting record highs on the back of a booming DeFi sector and increased momentum in the broader crypto market, Ethereum (ETH) suffered a massive sell-off on Friday. ETH continued to crash on Saturday as it slipped further away from the $400 support zone. As this happened, tokens tied to Ethereum-based DeFi platforms crushed hard.

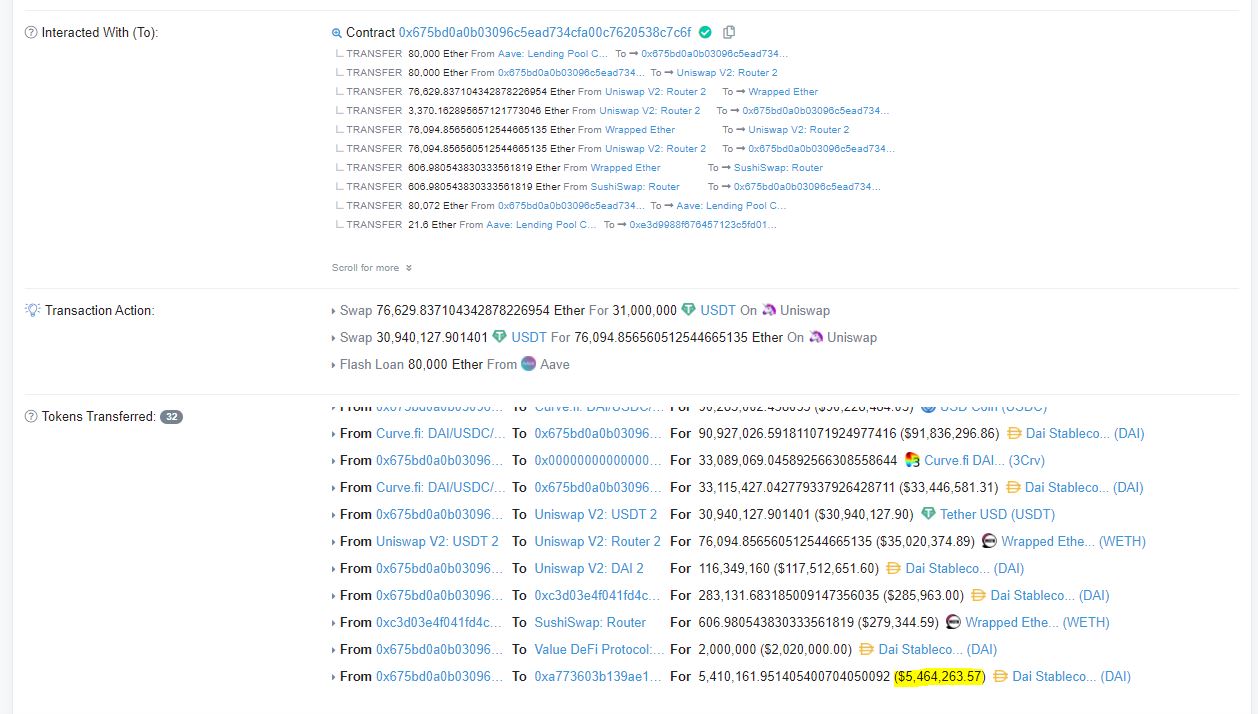

DeFi Tokens Correct SharplyIn recent weeks, yield farming has gained so much popularity with DeFi protocols like Aave, yEarn Finance, Compound, and SushiSwap fueling the DeFi craze. This saw the prices of DeFi tokens skyrocketing to historic highs, despite pundits like Ethereum creator Vitalik Buterin warning that DeFi carries high risks that he personally prefers to steer clear of.

DeFi tokens have not been left unscathed by the latest market pullback. yEarn Finance’s token, YFI, which has been on a tear over the past couple of weeks has fallen by circa 25.57% in the last 24 hours. The token is currently valued at $19,956.24. This marks a 50% depreciation from the recent high just shy of $40,000.

Chainlink (LINK) has also lost 23.41% at the time of publication. But perhaps the most severely affected token is SushiSwap (SUSHI) which has dumped 69.63% on the day. The token’s correction has been exacerbated by the revelation that the project head, Chef Nomi, had dumped all his tokens.

Indicators Say Ethereum Was Overdue For A PullbackUnfortunately, Ethereum (ETH) is one of the large-cap cryptos posting double-digit losses. At press time, the second-largest crypto by market capitalization has declined by around 17.96% to change hands at $318.45.

However, analysts are noting that ETH was showing signs of exhaustion and thus the correction was expected. Behavior analytics firm Santiment pointed out several key on-chain metrics that indicated ETH was headed for a pullback.

First, Santiment analysts posited that there has been a significant decrease in the daily active address as well as shrinking network growth. Secondly, ETH exchange wallets had soared to a six-month high, suggesting that ethereum was poised to correct.

2) DAA and network growth had been looking low for the mid-high $400's levels it was reaching. On top of this, exchange wallets exploded to a 6-month high of 1.09m ETH. (~$530m at the time) The next time you want a signal that it's time to profit take, read our article above! pic.twitter.com/aV2BOxPApD

— Santiment (@santimentfeed) September 5, 2020As things stand, it is difficult to tell how low ETH will go before bottoming out. However, given the increasing correlation to bitcoin, we can expect ether to continue plummeting if the BTC bulls don’t step in quickly.

Similar to Notcoin - Blum - Airdrops In 2024

Defi (DEFI) на Currencies.ru

|

|