2021-2-19 17:00 |

The joke is now becoming a reality as Binance Smart Chain records about double the transactions processed on the Ethereum network.

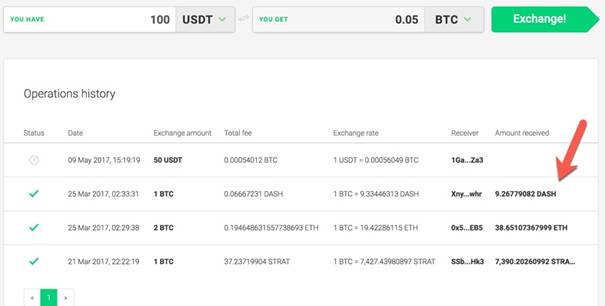

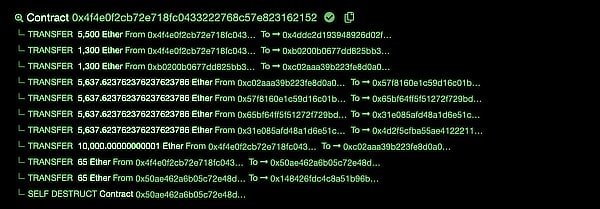

Extremely high fees on the Ethereum network have always been a headache that became glaring during the last summer when DeFi space exploded into popularity and usage.

While crazy high fees on the second largest network, the average fee is currently $20, is making it impossible to use for small users; even large users are complaining about it (cue Mark Cuban).

BSC come like a barbarian at the gate to Ethereum and rightfully so.

Because even millionaires can't keep paying $20 for one simple ERC-20 transfer.

— Arthur (@Arthur_0x) February 19, 2021

This has time and time again brought forth the conversation of ETH killers, but until now, this seems just a narrative that other blockchain networks used for advertising themselves. However, in the past few days, BSC is starting to capitalize on users’ frustration as the bull market continues to weigh on Ethereum network fees.

Even PancakeSwap, an AMM project built on the Binance Smart Chain, flipped the dominant DEX Uniswap’s volume. “Liquidity will leave the unicorn and flow into cakes leaving many investors on the sideline,” noted trader Moon Overlord.

“#BSC is centralized”

Like Hayden Adams can’t unplug the router in his apartment

— BIG DOG (@MoonOverlord) February 19, 2021

“There’s no need for the Ethereum community to be salty about BSC. Teams I know who moved from Ethereum to BSC by and large are treating BSC as a bandaid solution. They can’t ignore Ethereum’s network effect and will come back when L2s have proven themselves,” said Qiao Wang DeFi Alliance, who previously worked at Messari and Tower Research. “Or they move to Polkadot if you don’t get your shit together.”

This has the native token BNB’s value skyrocketing and becoming the 3rd largest cryptocurrency. However, it needs to be seen if BSC and DeFi projects built on it will be able to sustain this activity and low fees.

The takeaways from BSC’s rise are the user's preference for convenience over sovereignty, EVM’s network effects, and Binance’s continued dominance on the user experience, noted Ryan Watkins, a researcher at Messari.

1/ The next big boom seems quite obvious, but I think people are scarred from the years of "ETH killers" being a joke term.

ETH prices and gas are at a point where much of retail is priced out. Things like BSC are gaining a lot of traction.

— Avi (@AviFelman) February 18, 2021

Interestingly, it's’ not just Binance blockchain; other ETH killers have started to gain traction as well.

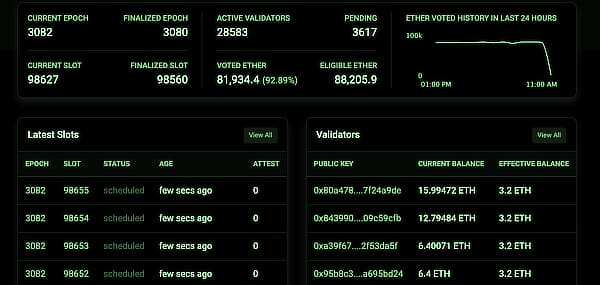

Polkadot (DOT) and Solana (SOL) are particularly gaining users’ interest as they boast of fast processing with very low fees. While the bull season has everyone concerned, Ethereum’s future is all based on ETH 2.0, which has only achieved its first stage.

While the full transition to proof-of-stake will take years, Phase 1 is anticipated to launch in 2021, and then shard chains will be integrated, which will become fully functional and compatible with smart contracts in Phase 2, which is scheduled, for now, to launch in 2021/22.

The post ETH Killers Gaining Traction; Second Largest Network Need to Get its sh—t Together first appeared on BitcoinExchangeGuide. origin »Bitcoin price in Telegram @btc_price_every_hour

GET Protocol (GET) на Currencies.ru

|

|