2023-10-30 16:30 |

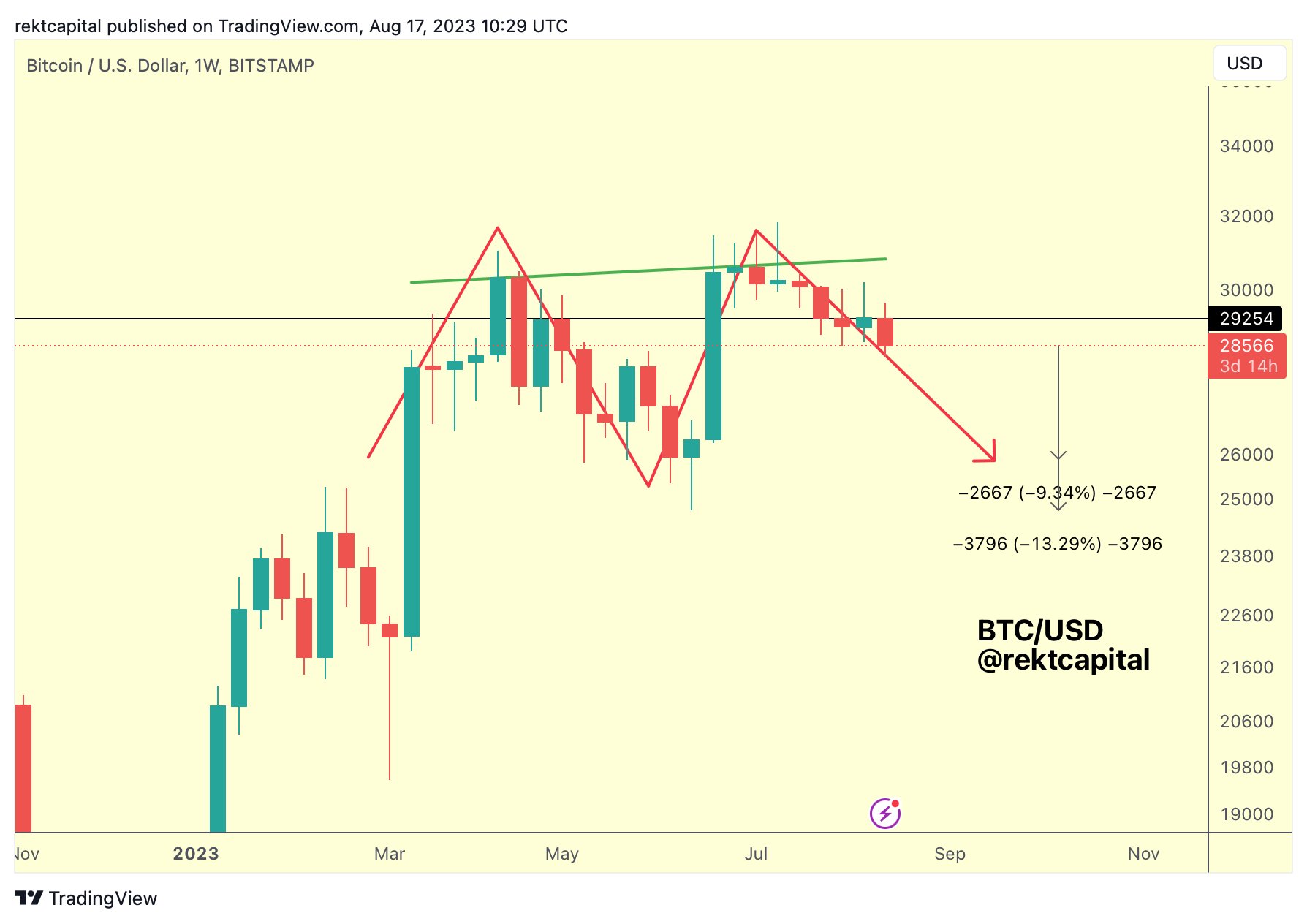

According to prominent crypto analyst Rekt Capital, the worst-case scenario for Bitcoin in the next 5.5 months leading up to the May 2024 halving event would be a revisit down to the ~$20,000 level.

From current prices of around $34,500, that would represent a 42% drop. However, Rekt Capital notes that worst-case scenarios rarely play out, as they typically have low probabilities.

Bitcoin put in a major bottoming formation around $20,000 earlier this year after the spectacular collapse from all-time highs. That zone represents the maximum pain point reached during the recent crypto winter.

For Bitcoin to retest those lows now after a relief rally, a dramatic shift in market structure would need to occur. Multiple key support levels between $30,000 and $20,000 would have to break down.

With the next block reward halving now just 5.5 months away, Bitcoin is entering a historic pre-halving period. The 2020 halving began a parabolic bull run that peaked at $69,000.

If past halving cycles are any indicator, Bitcoin tends to consolidate sideways or upward in the months preceding a halving event before breaking out dramatically in the 12–18 months after.

While the ~$20,000 area remains feasible as a macro-higher timeframe support zone, a swift revisit there from current levels seems unlikely. It would take a major black swan event or global economic shock to trigger such a drop in the short term.

As Rekt Capital notes, worst-case scenarios rarely play out in the expected fashion. Rather, they exist as tail risks with low probabilities.

Read also:

Shiba Inu Eyes 500% Gain As SHIB Bulls Take Control Dogecoin Faces Resistance at $0.07, but This DOGE Indicator Confirms a ‘Buy Signal’ October in Focus: Injective, Solana, and InQubeta Emerge as the Biggest WinnersA return to ~$20,000 worst-case lows can’t be fully ruled out but seems unlikely over the next 5 months considering prevailing market conditions, according to crypto analyst Rekt Capital. However, prudent risk management means always preparing for less-expected scenarios while focusing probability on higher-likelihood outcomes.

We recommend eToro 74% of retail CFD accounts lose money. Visit eToro Now Active user community and social features like news feeds, chats for specific coins available for trading.Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.

eToro offers staking for certain popular cryptocurrencies like ETH, ADA, XTZ etc.

The post Elite Bitcoin Analyst Lays Out the Worst Case Scenario For BTC appeared first on CaptainAltcoin.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|