2019-12-15 00:10 |

As the overall economic picture continues to remain fuzzy, investors are seeking new and better ways to protect capital. As the market begins to waiver, many have turned to commodities or Bitcoin as a possible hedge.

Commodities are often seen as being inflation hedges because they have real value. Moving funds out of cash-based investments and into tangible assets protects value from inflationary pressures. Hedge fund founder @jessefelder touches on this in a tweet.

'These improvements are classic signs of a bearish to bullish reversal in Copper and the mining space and suggest that we’ve shifted from an environment where we want to be selling rips, into one where we want to be buying dips.' https://t.co/ad4ivfkghu pic.twitter.com/lOpJKhzoet

— Jesse Felder (@jessefelder) December 12, 2019

Bouncing Commodities…The movement away from other instruments and into the commodities market has seen things turn from bear to bull. Precious and semiprecious metals, in particular, have seen a bounce that appears to be a bottom.

This is a strong indicator that the wider market is beginning to sense a top to the strong growth under Trump. This point of inflection also lends itself to movement out of over-bought investments and into stability.

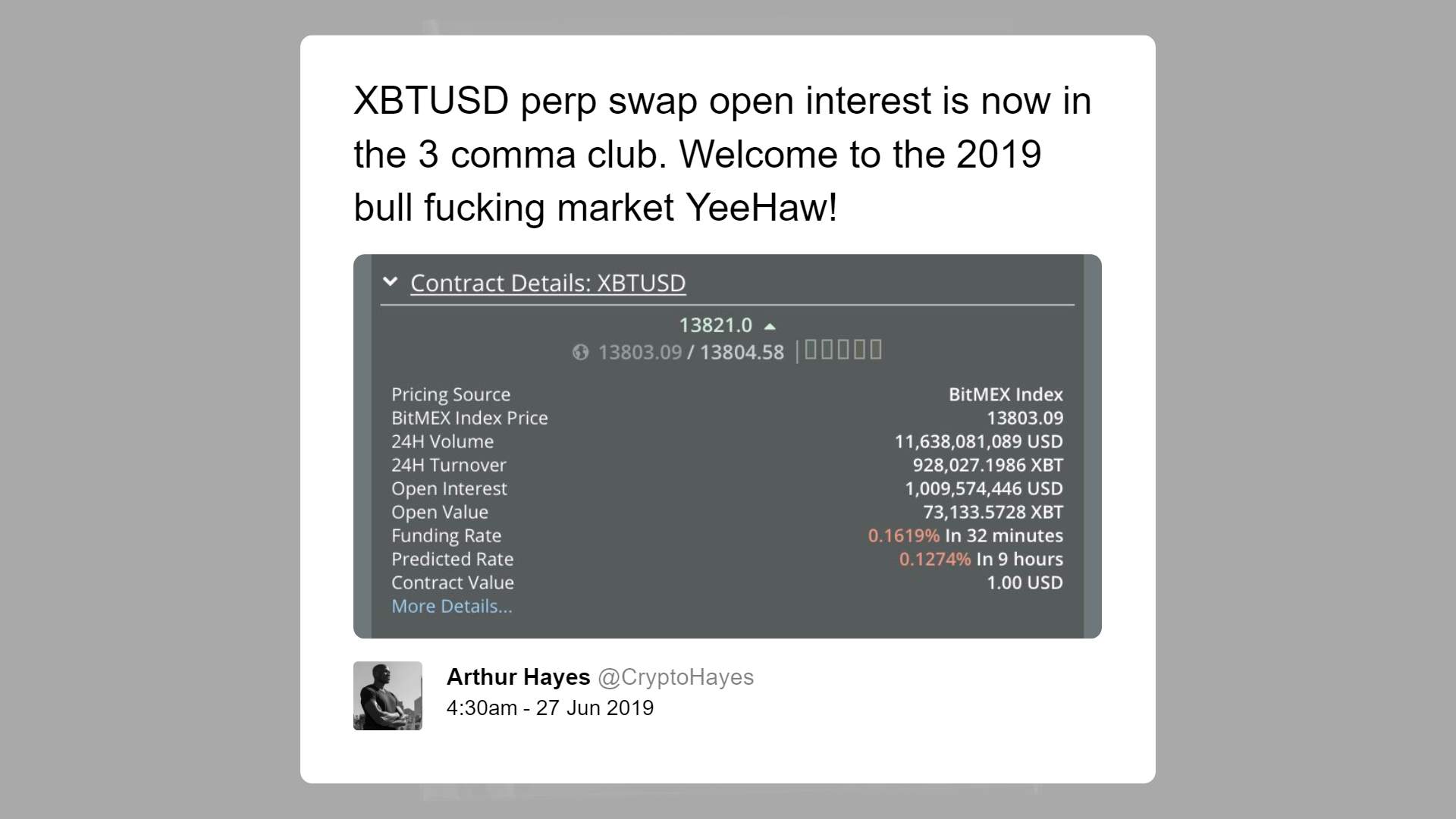

…And Bitcoin, TooBitcoin, like commodities, represents an investment that is distinct from fiat currencies and therefore safe against inflation. Because no government or external firm can create more, or change it, it is the ideal hedge.

The mathematical scarcity of Bitcoin also creates something of a boon over against commodities as well. Bitcoin is not like precious metals in that new deposits cannot be found.

Of course, others would argue that Bitcoin’s very nature makes it valueless. It is not a physical commodity and therefore has no tangible value apart from an agreement of its worth.

However, this argument falls somewhat short when considered against fiat currencies. While governments can provide some backing for currency, they are not foolproof. When nations move into dark economic waters, their currencies follow as a function of consensus.

Bitcoin, on the other hand, is not moved by national success or failure. Instead, it exists independent of any nation. It is, therefore, a unique and stable commodity, of sorts, and a functional currency at the same time. As the economy continues to stagnate, investors will seek instruments like Bitcoin for asset protection.

Images are courtesy of Twitter, Shutterstock.

The post Economic Stagnation Can Drive Investors to Commodities, Bitcoin appeared first on BeInCrypto.

Similar to Notcoin - Blum - Airdrops In 2024

Bitcoin (BTC) на Currencies.ru

|

|