2024-10-25 14:30 |

Dogecoin has enjoyed a sharp 16% rally during the past week. Here’s how this analyst’s “Risk Indicator” is looking for DOGE after this run.

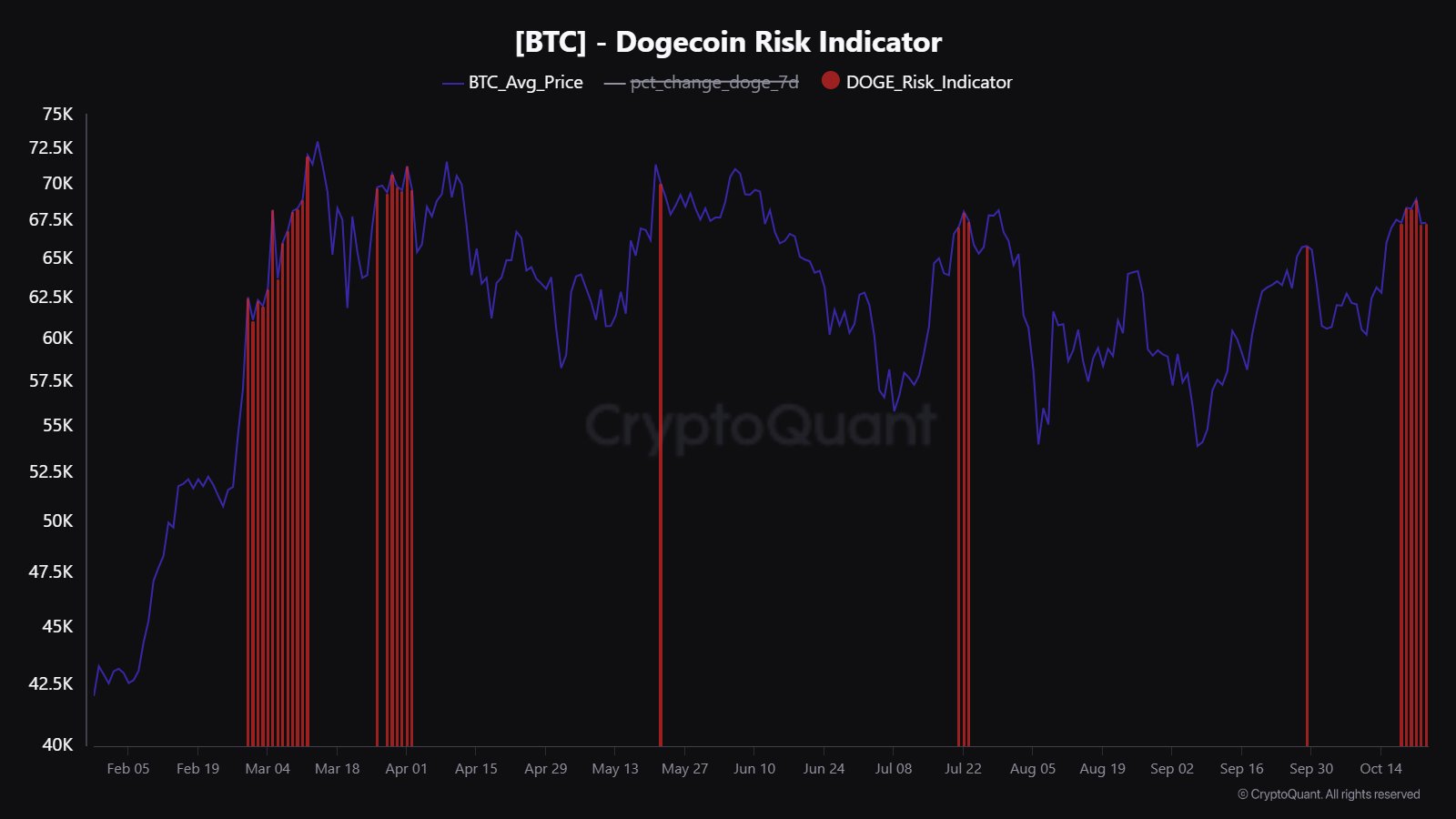

Dogecoin Risk Indicator Has Given A Red Signal RecentlyIn a new post on X, CryptoQuant community manager Maartunn has shared a “Risk Indicator” for Dogecoin. As for what the metric does, the analyst has explained,

I calculated the percentage change over the last 168 hours (one week). When the percentage change exceeds a specific threshold, it indicates a potential risk zone.

The risk here is toward Bitcoin and since the rest of the sector usually follows in its lead, it would also be toward cryptocurrencies as a whole. Below is the chart for the indicator posted by Maartunn.

As is visible in the above graph, the Dogecoin Risk Indicator has been giving a signal during the past week or so as the DOGE price has registered a notable jump of 16%

From the graph, it’s also apparent that each time the indicator has lit up in the past few months, the price of Bitcoin has probably hit some top.

Indeed, since the latest signal has appeared, the BTC rally has been derailed, which implies fast growth in the memecoin’s price may once again have proven to be a bad omen for the sector.

Now, why does this pattern exist? The reason is that whenever memecoins break away from Bitcoin and the company, it’s usually a sign that greed is taking over the market.

Historically, cryptocurrencies have tended to move in the direction that the crowd expects, so excessive greed often leads to a bearish outcome.

Investors have recently been speculating on memecoins like Dogecoin, seeking fast returns. Still, if this previous pattern is to go by, DOGE and others may have to slow down if the market has to continue its uplift.

In some other news, the market intelligence platform IntoTheBlock has shared an update on how the average holding time compares between the major cryptocurrency networks in an X post.

As displayed in the above table, Bitcoin is leading in this metric, with cryptocurrency investors holding for an average period of 4.4 years before transferring their coins.

Ethereum, Dogecoin, and Shiba Inu are all tied for second, with the figure at 2.4 years for each. Thus, while the memecoins do get a lot of speculative activity, they have still managed to establish a userbase that’s as stubborn as that of Ethereum.

DOGE PriceThe Dogecoin rally has slowed in the last few days as the coin’s price is still trading around $0.142.

origin »Bitcoin price in Telegram @btc_price_every_hour

Dogecoin (DOGE) íà Currencies.ru

|

|