2021-3-2 09:13 |

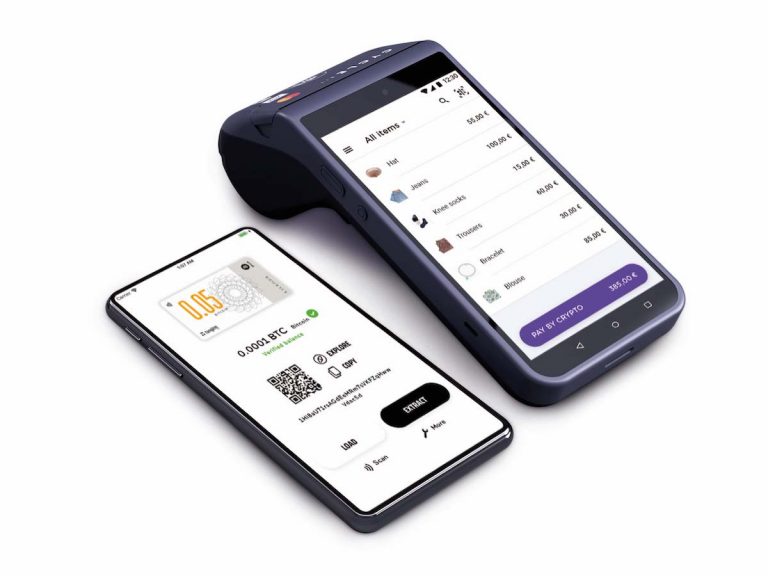

Crunchfish is a technical pioneer within digital payments with its novel Digital Cash solutions that settle physical payments in two steps, first offline and then online, making digital payments robust and also preserves the payer’s integrity. Digital Cash is extremely flexible and interoperable with all types of payment services, even cross-border and cross-schemes. Today Crunchfish announces that its Digital Cash solutions can solve Central Bank Digital Currency, CBDC implementation issues swimmingly easy, without any additional infrastructure. This promises to have a major impact on the whole CBDC industry and accelerate Central Bank implementations.

Crunchfish’s Digital Cash makes it swimmingly easy to implement CBDC, as there is no need for additional infrastructure. Central Banks may just use existing digital payment rails to distribute CBDC. This is a tremendous simplification that will accelerate CBDC roll-outs in the world.

Central Banks in numerous countries are experimenting with Digital Currency using `tokenized value instruments‘ that represent physical banknotes in digital form. Digital Cash by Crunchfish, on the other hand, use `tokenized transaction instruments‘ instead, which may be compared to banker’s cheques. Whereas a banknote is a representation of `money’, a banker’s cheque represents a `money transfer’ between two parties.

Digitizing `money transfers’ instead of `money’ simplifies CBDC implementations tremendously, as it does not require any additional infrastructure. The `tokenized transaction instrument’ approach suggested by Crunchfish as Digital Cash provides all necessary properties of physical cash; robustness, ease of use and preserves the payer’s integrity in relation to banks. To issue its fiat currency, the Central Bank may simply deposit it into a centrally held bank account and invite commercial banks to access and distribute it by means of regular transactions on the existing digital payment rails.

Cash is king of digital payments. It always works, it’s easy to handle and it safeguards personal privacy. Crunchfish preserves these features when cash goes digital. The transformation will be profound as digital cash will be present in all mobile wallets in the future”.

It is worth mentioning that Crunchfish’s flexible Digital Cash solutions with its patent-pending two-tier settlement architecture may be integrated with any payment scheme – Card, Real-Time Payments, Closed-Loop Wallets, Cryptocurrency as well as CBDC. It is therefore certainly still possible to be integrated with any of the current CBDC solutions based on `tokenized value instruments’, e.g. Digital Symmetric Cryptography from Crunchfish’s partner eCurrency or Distributed Ledger Technology blockchains.

origin »Bitcoin price in Telegram @btc_price_every_hour

Digital Rupees (DRS) на Currencies.ru

|

|