2020-9-1 15:00 |

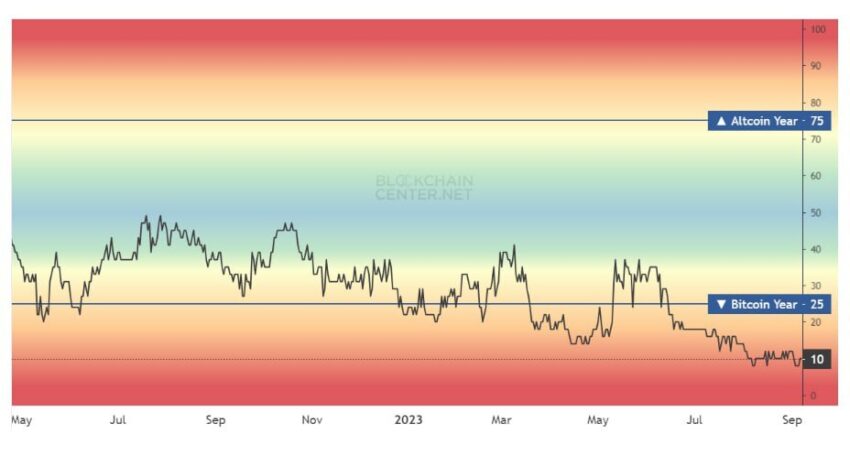

As Bitcoin has consolidated between $11,000 and $12,000 over the past month, altcoins have surged. Many top altcoins have gained dozens of percent, resulting in a drop in the DeFi dominance. The gains have been centralized in DeFi-centric altcoins, which have easily outperformed BTC. Decentralized finance, as DeFi is also known, has become the industry’s latest trend as capital has flooded into this space en-masse. There are some that say DeFi is taking away Bitcoin’s ability to rally. But according to one trader, there’s a good opportunity that growth in decentralized finance will fuel a massive “Bitcoin pump.” Bitcoin Pump Could Be Fueled by DeFi

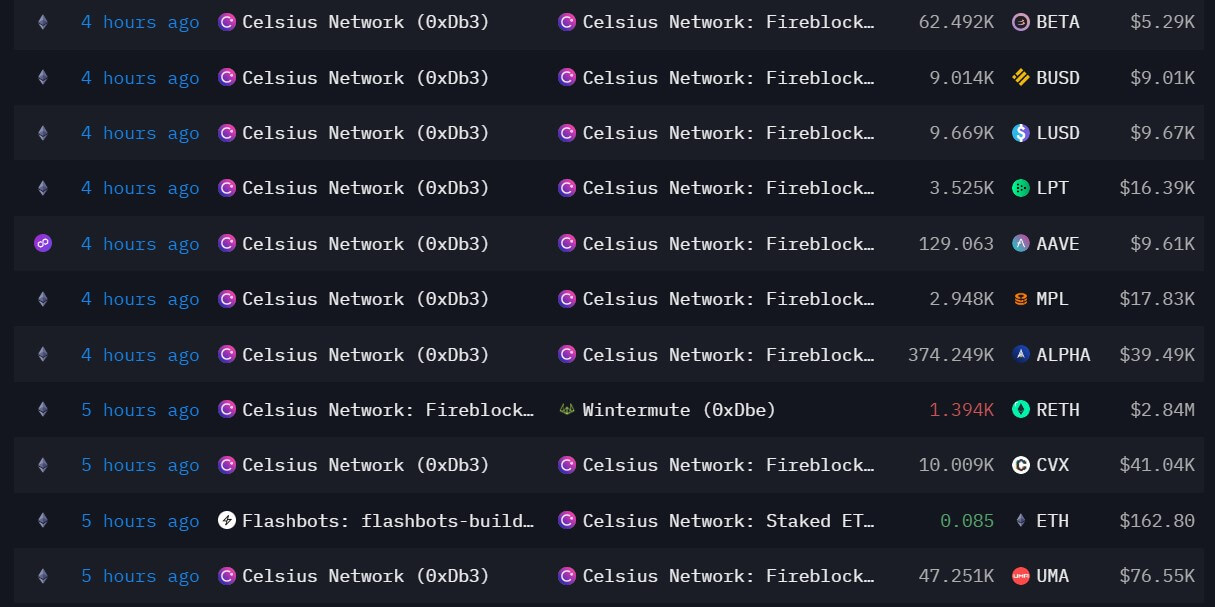

Not following Bitcoin, decentralized finance coins have seen extremely strong rallies over recent weeks, generating billions of dollars worth of crypto market value. The most evident example of this is Yearn.finance, which has surged from literally $3 from its July launch to $35,000 as of this article’s writing.

Some analysts think that this may actually fuel a Bitcoin rally though, as confusing as this may sound.

One trader commented that BTC remains the “king” in the current macroeconomic setup. He added that the vast amount of capital locked in DeFi, there could be a rush for the doors in this crypto market sector for Bitcoin, which will induce a strong pump:

“I still think #Bitcoin is the king here. I see all of this Defi stuff as kindling for the BTC pump that nukes half of these projects. All of this Ponzi exposure likely means everyone is underexposed to BTC. The FOMO will be incredible.”

To put the potential rally into context, there was a

Many agreed with the sentiment put forth by the trader.

Over recent days, as the DeFi market has reached frothy levels, there’s been much hating on Bitcoin. This is often when the crypto market trend reverses in favor of BTC and against altcoins, as seen in certain points in 2017 and in the middle of 2018.

Not NecessaryAlthough a flood of capital from DeFi back into Bitcoin would inevitably boost the cryptocurrency, that flow is not needed for BTC to move higher.

For one, Fidelity Investments was revealed last week to have launched its own Bitcoin-only fund for institutional clients. Bloomberg wrote on the matter:

“The passively-managed, Bitcoin-only fund will be made available to qualified purchasers through family offices, registered investment advisers and other institutions, according to a person familiar with the matter. Fidelity Digital Assets will custody the fund, the person said. The minimum investment is $100,000.”

Analysts have also gauged strong retail interest in Bitcoin once again, driving the price of digital assets higher.

Featured Image from Shutterstock Price tags: xbtusd, btcusd, btcusdt Charts from TradingView.com DeFi Boom May Be "Kindling" For "Bitcoin Pump" That Nukes Altcoins: AnalystSimilar to Notcoin - Blum - Airdrops In 2024

Defi (DEFI) на Currencies.ru

|

|