2021-10-12 16:12 |

Into the Block covers Bitcoin’s (BTC/USD) growing dominance as it records positive on-chain data, reaching new four-month peaks. They share an analysis with interesting patterns and indications of unexpected growth potential.

Growing demand to transact in Bitcoin and Ethereum blockchainsThe two top cryptos by market cap both registered double-digit increases in fees, which indicates demand to transact in their blockchains is on the rise. About $100 million worth of Bitcoin left centralized exchanges, which indicates holding tendencies. Last week, $750 million worth of Ethereum (ETH/USD) was withdrawn compared to deposits of $306 million worth of Ether into exchanges.

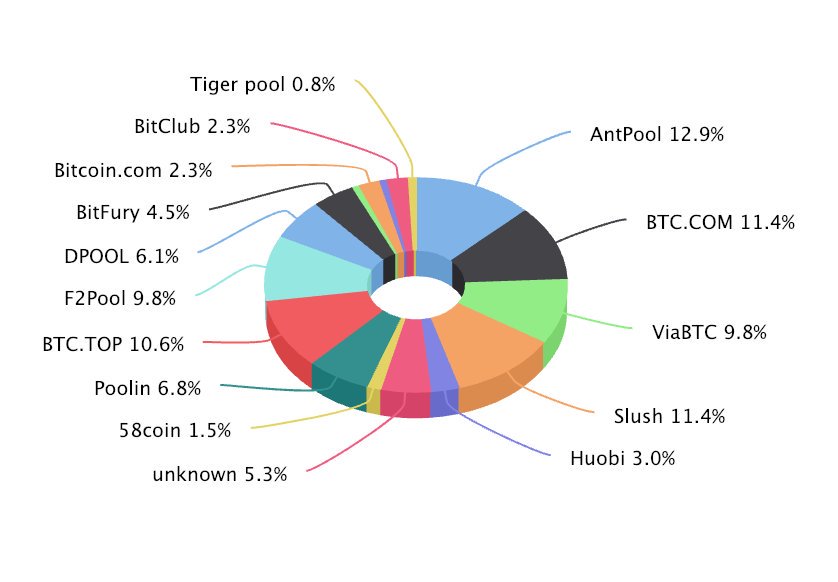

Bitcoin market dominance reaches 45%Over the past week, Bitcoin outdid all other cryptos in the top 10 by market cap. Its dominance is now 45%, the highest it’s been since August according to data of CoinMarketCap. The recent rise is motivated by increasing institutional interest as shown by derivatives and on-chain data. Large transactions with Bitcoin have never been more numerous in the past four months. For three consecutive days, more than $240 billion per day has been transferred. According to Into the Block, this shows institutional investors’ appetite is growing.

75% chance of Bitcoin ETF being approved by end-OctoberOptimism about the prospect of a Bitcoin ETF being approved in October is growing. Eric Balchunas, Senior ETF Analyst at Bloomberg, believes there’s a 75% chance of this happening considering four futures-backed Bitcoin ETFs are awaiting a decision by the end of the month.

Funding rates on popular exchanges reach peak since MayThe most popular crypto derivatives, perpetual swaps, use a funding rate to create an artificial peg between spot prices and prices of perp contracts. Positive funding rates means swaps are priced at a premium and long holders owe short holders a fee. Funding rates across the three most popular exchanges reached a peak since May. This indicates positive price expectations.

SHIB triples within past weekMeme token SHIBA INU (SHIB/USD) lost a quarter of its value on Thursday, but still registered triple growth within the past week. An analysis of on-chain data shows the SHIB community is hiking the price up.

Fantom token hits monthly highThe number of transactions with Fantom’s (FTM/USD) token on Ethereum hit record highs for the month on Thursday. The token processes most transactions on its own blockchain.

The post Data behind Bitcoin’s growing dominance appeared first on Invezz.

Similar to Notcoin - Blum - Airdrops In 2024

Streamr DATAcoin (DATA) на Currencies.ru

|

|