2021-3-19 20:50 |

Bancor, the automated market maker, accounting for 5% of the decentralized exchange (DEX) volume, saw its TVL (total value locked) doubling to $1.66 billion and breaking into the top 10.

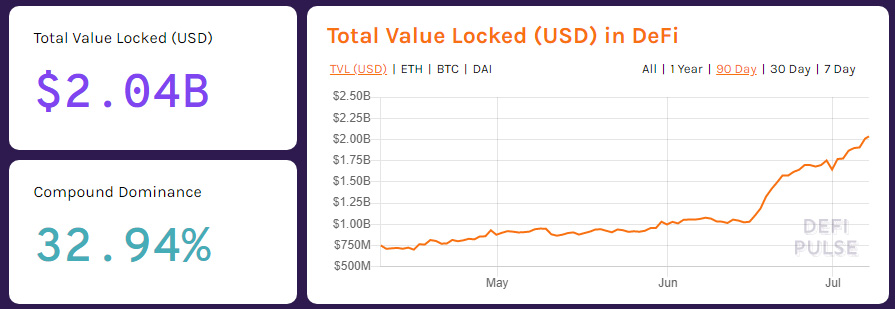

Maker is at the top spot with more than $7 billion in TVL, followed by Compound and Aave at $6.7 billion and $5.17 billion, respectively, as per DeFi Pulse.

The DeFi project is now planning to have phase two of Vortex out by introducing a flat protocol fee that uses swap fees to buy and burn vBNT. Each vBNT represents a BNT token locked in the protocol forever, which will create upward pressure on price. 5% of swap fees will be used for this.

The token BNT is currently trading around $7.82, up more than 500% YTD.

The full Vortex roll-out is expected to be done in the next two weeks.

On Thursday, Bancor’s Twitter account posted another development, a Swiss private bank Maerki Baumann with over $9 billion in assets under management, is now accepting BNT along with other cryptocurrencies including BTC, LTC, ETH, BCH, XRP, and USDT. And just recently listed a poll on their Twitter asking which crypto should be next, with options of Polkadot (DOT), Uniswap (UNI), Cardano (ADA), or Stellar Lumens (XLM). The bank offers both trading and custody services.

“The ability to participate in DeFi through a bank may be closer than we think,” read the tweet.

Give The Market Leaders A “Run For Their Money”According to Deribit's latest market research, Bancor is a “dark horse” which, despite Uniswap’s success and rise of similar competitors, continues to iterate on its original product.

“With the Bancor v2.1 release in Oct 2020, the combination of single-sided liquidity provision and IL insurance seemed to be the USP needed to make a breakthrough in the fiercely contested DEX arena,” it said.

Bancor’s new model is facilitated by a new elastic BNT supply mechanism d, which brings BNT burn into the picture. Elastic BNT supply also creates the possibility of protocol IL insurance.

Through its origin pools, shadow token stablecoin pools, Layer 2 scaling, cross-chain expansion along with UI overhauls and additional improvements in on-chain governance (gasless voting), Bancor can give the market leaders Uniswap & Sushiswap “a good run for their money.”

This research on Deribit came from members of DeFi investment fund DeFiance Capital, which took a position in BNT. They will be used to provide liquidity and earn yield from swap fees and liquidity mining.

“Extremely excited to support Bancor as one of the most interesting and innovative AMM liquidity protocols in this space,” said Arthur of DeFianceCapital.

Bancor/USD BNTUSD 7.9649 $0.10 1.31% Volume 44.74 m Change $0.10 Open$7.9649 Circulating 166.31 m Market Cap 1.32 b baseUrl = "https://widgets.cryptocompare.com/"; var scripts = document.getElementsByTagName("script"); var embedder = scripts[scripts.length - 1]; var cccTheme = {"Chart": {"fillColor": "rgba(248,155,35,0.2)", "borderColor": "#F89B23"}}; (function () { var appName = encodeURIComponent(window.location.hostname); if (appName == "") { appName = "local"; } var s = document.createElement("script"); s.type = "text/javascript"; s.async = true; var theUrl = baseUrl + 'serve/v1/coin/chart?fsym=BNT&tsym=USD'; s.src = theUrl + (theUrl.indexOf("?") >= 0 ? "&" : "?") + "app=" + appName; embedder.parentNode.appendChild(s); })(); var single_widget_subscription = single_widget_subscription || []; single_widget_subscription.push("5~CCCAGG~BNT~USD"); The post “Dark Horse”: BNT Burn Is Around the Corner As A Swiss Bank Embraces Bancor first appeared on BitcoinExchangeGuide. origin »Bancor (BNT) íà Currencies.ru

|

|