2023-8-1 14:40 |

Key Takeaways Crypto had moved in line with stocks and other risk assets throughout the interest rate tightening cycle This relationship weakened in June amid the crypto regulatory crackdown The correlation has recently picked up again, however Going forward, relationship may change again as the market anticipates the tightening cycle is coming to a close

We know that within the digital asset space, the different cryptocurrencies are highly correlated. As a generalisation, it is fair to say that many altcoins tend to trade like levered bets on Bitcoin.

Going beyond the asset class and assessing correlations with other asset types becomes more interesting. One of the most intriguing trends to track is the correlation between Bitcoin and stocks. If we want to assess Bitcoin through a macroeconomic lens, its relationship with other asset classes is of vital importance.

The last eighteen months have thrown this relationship into a new light, as correlations have been extremely high amid one of the fastest interest rate tightening cycles in recent history. With liquidity sucked out of the economy, risk assets were hammered last year, including Bitcoin.

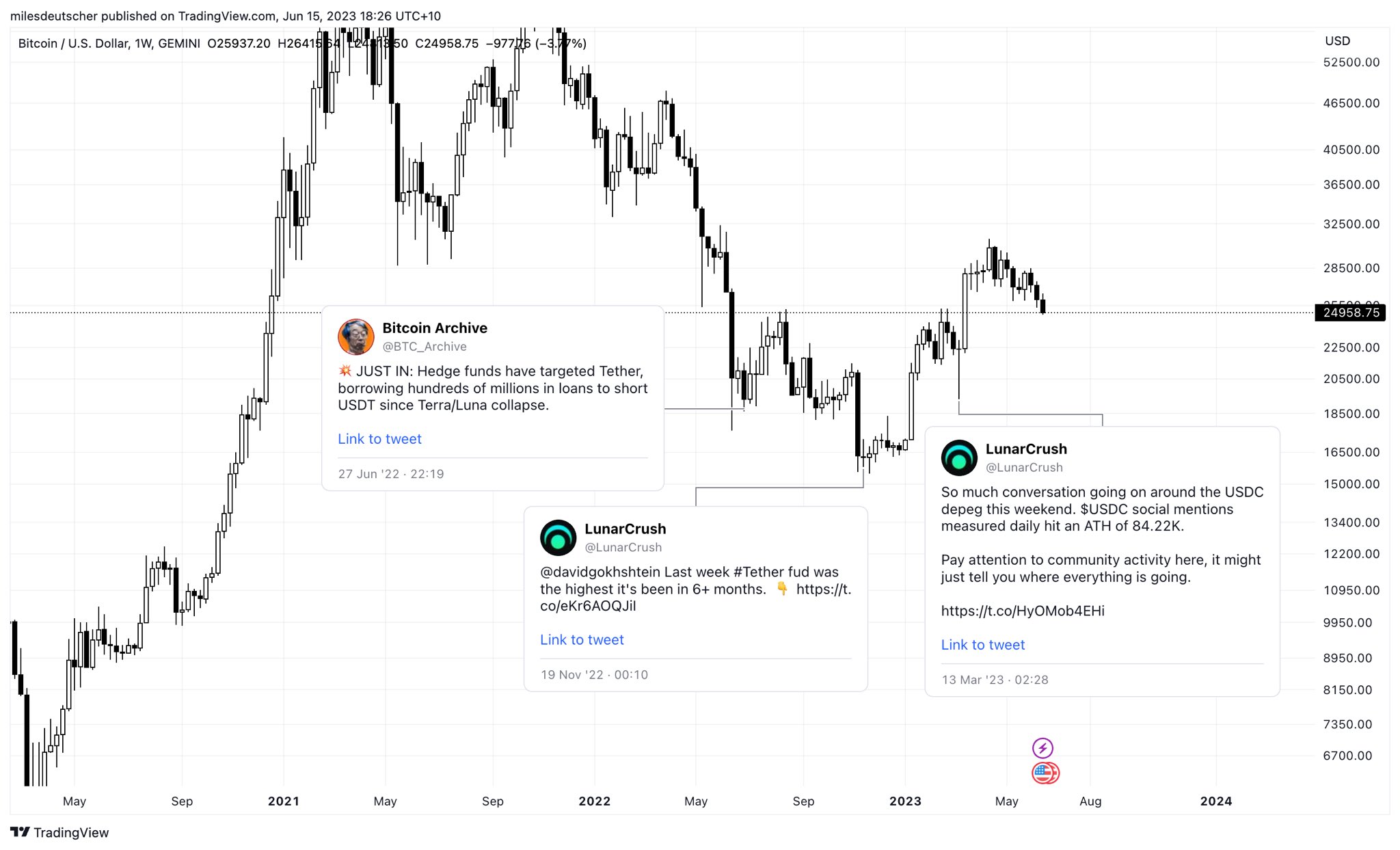

Compared to the tech-heavy Nasdaq, Bitcoin’s correlation has been persistently high throughout this period, bar a few noticeable instances. As displayed on the below chart from an analysis we compiled six weeks ago, the collapses of Luna, Celsius and FTX saw deviations in this relationship.

These explain themselves, as dramatic crypto-specific episodes that had no effect on stocks. However, the more recent deviation was bigger than any: coming in June amid the regulatory crackdown (chart is taken from June 15th, a week after the Binance and Coinbase lawsuits).

In fact, this deviation brought the Nasdaq’s correlation with Bitcoin to a five-year low. If we now re-run this chart, we see the correlation has picked back up again, rising to 0.5 and trending upwards.

This highlights what we already knew: the deviation is only temporary. It came following a month where the Nasdaq jumped 10% off softer forecasts around the future path of interest rate hikes, while Bitcoin fell 9% over the same time period as lawmakers tightened their squeeze on the industry, suing the two largest exchanges and confirming several tokens constituted securities.

The climate has picked up for crypto since. Ripple won an important case (or, partially won, but the result was undoubtedly positive for the space), while a slew of spot ETF applications have also served to increase optimism.

While the deviation was always going to be temporary, going forward in the medium-term, things could get more interesting. This is because, finally, the market is anticipating that the majority of interest rate hikes are in the rearview window, with perhaps only one more still to be endured, if even.

This could release the shackles which have been around Bitcoin’s ankles, and it remains to be seen how the asset will henceforth move in relation to the stock market. We know that the correlation picked up as soon as the Federal Reserve began hiking interest rates; correlations go to 1 in a crisis, and there is a flight to quality – risk assets suffer in that scenario, and that is exactly what we saw.

There is every chance that both stocks and Bitcoin will continue to trade in tandem, but if/when this tightening cycle ends, it will at least give the market a fresh opportunity to trade them whilst global liquidity is not being pulled off the table.

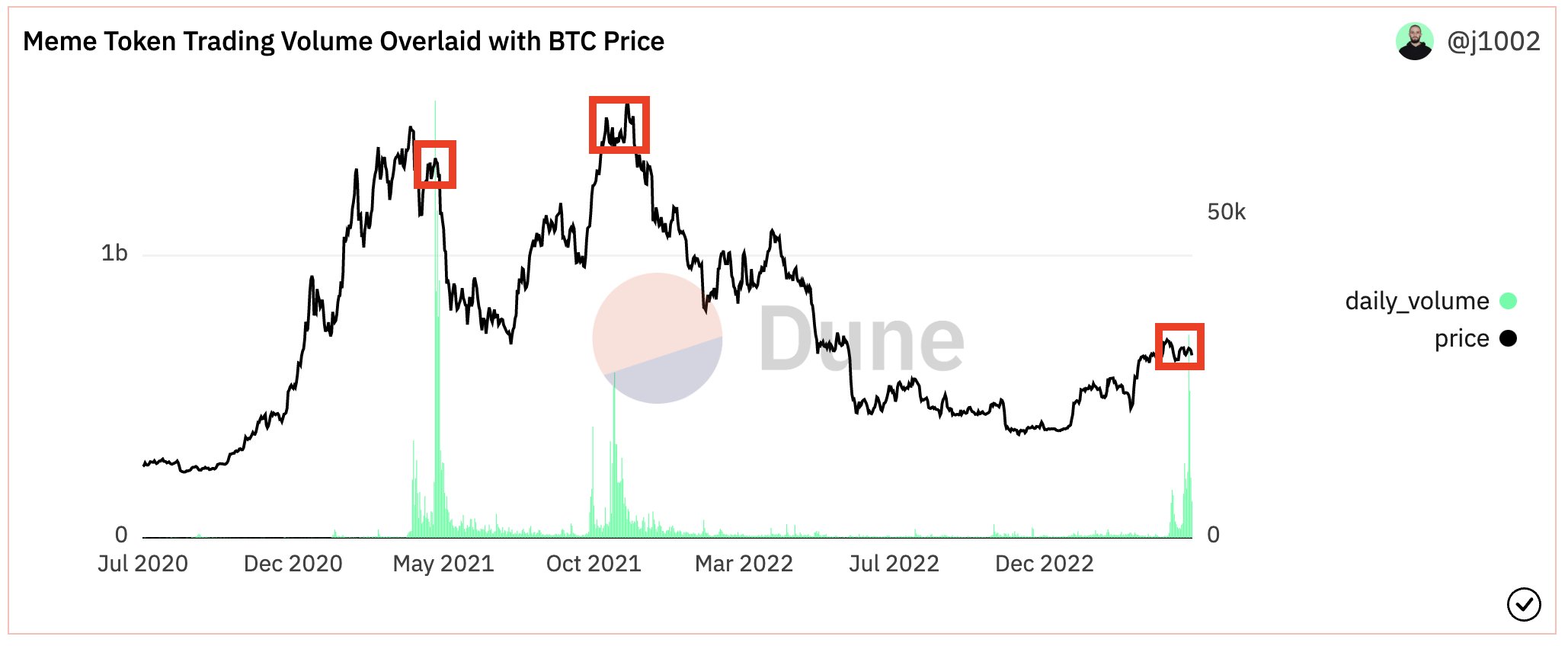

Regardless of the relationship between the duo, the below chart shows just how dependent Bitcoin has been on yields – the two-year treasury yield, plotted on an inverse scale, has moved exceptionally closely with Bitcoin, ever since the latter’s all-time high in November 2021.

How will Bitcoin’s relationship with gold change?

It is Bitcoin’s relationship with gold that provides an equal amount of intrigue, given the former’s designs on becoming some sort of digital equivalent of the latter. Should Bitcoin become a store of value, it will need to become a little more boring with regard to price movements – something gold is well known for.

However, correlation between the two assets has dipped, moving in the opposite direction to that of stocks. From rising markedly this year, it has fallen sharply in the last month.

If Bitcoin is to achieve what so many want to do – become an uncorrelated asset capable of offering a portfolio hedge properties – it must flip the script here. Its relationship with stocks will need to loosen, while it will need to get closer to the way gold trades.

Having said that, Bitcoin has been around only 14 years, and has traded with reasonable liquidity for far less than that. It is still finding its feet, and it remains early – certainly compared to gold, which has been around for thousands of years.

The post Crypto’s correlation with stocks rising again following temporary deviation appeared first on CoinJournal.

origin »Bitcoin price in Telegram @btc_price_every_hour

Emerald Crypto (EMD) на Currencies.ru

|

|