2021-4-10 17:03 |

2020 was a chaotic and unpredictable year by all means. However, even with all the uncertainties that were in the cryptocurrency market, 2020 remains famous for the record-breaking prices of tokens and unprecedented industrial news.

Coming to 2021, blockchain technology and cryptocurrencies set off at a fast pace by adopting great institutional interests to spur industrial growth.

The future looks great for investors, and investment gurus are hoping for a massive revolution in the cryptocurrency arena. Here are some trends to watch out for in 2021, thereby benefiting accordingly.

What’s with the CBDCs Craze?In 2020, several central banks were considering introducing digital currencies in their roots. Experts drawn from reputable central banks around the globe who sit in The Central Bank Group board are currently evaluating the pros and cons of using digital currencies as alternate financial instruments.

These central bank gurus are financial experts sourced from Germany, Japan, Canada, and England. They work in hand with The Bank for International Settlements (BIS) to ensure a global financial representation.

The Central Bank Group is using a holistic approach to evaluate the effects of the proposed CBDCs. They will evaluate the proposed CBDCs on cross-border acceptance, economic impact in the transacting countries, and the general functional & technical issues related to CBDCs.

China has already taken the initiative by distributing its digital RMB to 4 major cities, and many more countries are following suit.

Blockchain-Based Fintech SolutionsWhen a global pandemic strikes, the demand for contactless financial transactions increases. Most businesses are searching for Fintech solutions for their business processes.

A perfect solution for contactless transactions is the adoption of Blockchain technology and incorporating it into the financial systems. With Blockchain-based solutions, Fintech companies have facilitated easier retrieval, issuance, and verification of digital certificates, hence promoting contactless transactions.

Bitcoin UptrendAt the end of 2020, Bitcoin’s market capitalization crossed the $500 billion mark outdoing key players like PayPal, Mastercard, and even Visa.

Since 2021 dawned, BTC’s uptrend has persisted, reaching a high of $61k and has maintained a low of $50,000. The purchase by institutional investors and hedge funds may have caused the performance.

BTCUSD Chart By TradingViewAdditionally, reputable companies like Square and PayPal have included BTC as a transacting option, boosting retail traders’ confidence. When the big players invest in a digital asset, it boosts the appeal of that digital asset and ultimately heightens further investment.

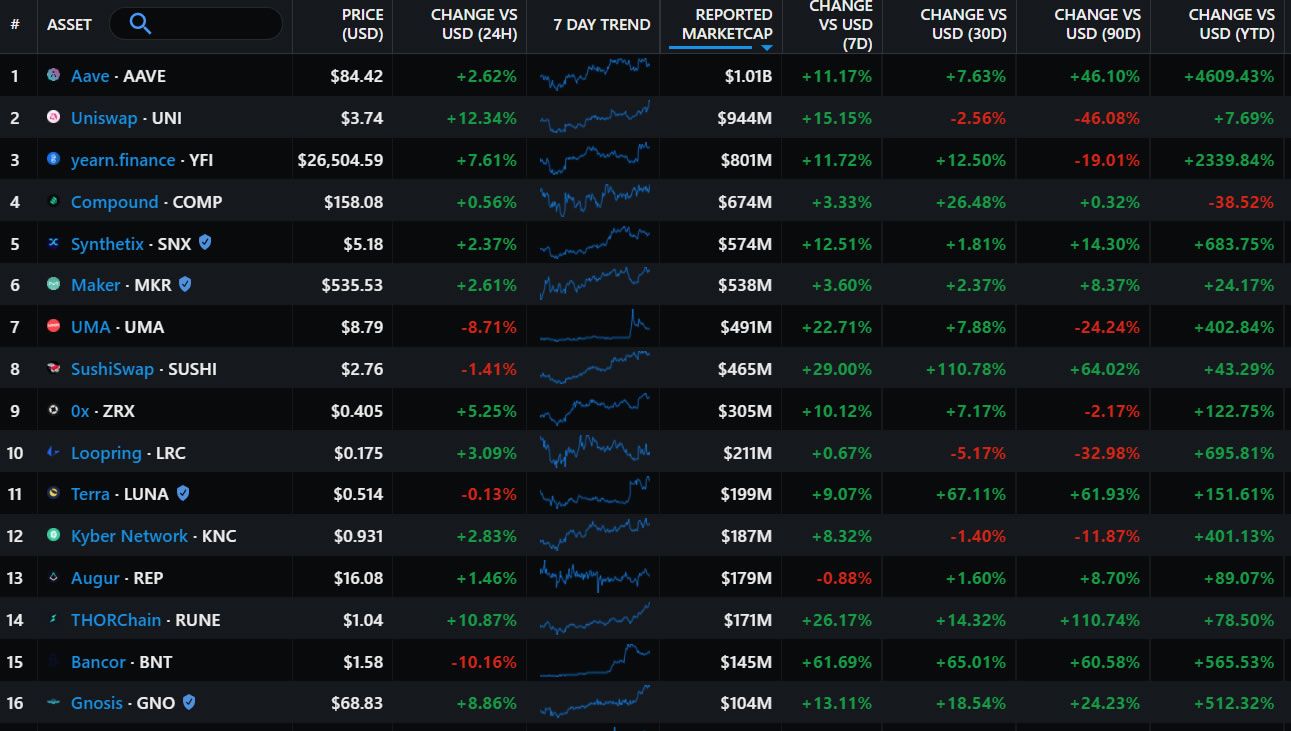

Decentralized Finances (DeFi)DeFi uses Blockchain technology to eliminate “go-betweens” when dealing with financial instruments or executing financial transactions. DeFi uses smart contracts, a Blockchain-based system, promoting peer-to-peer interaction between borrowers & lenders, and buyers & sellers to interact peer-to-peer.

Additionally, one had to go through intermediaries such as banks, brokerages, and exchanges to acquire a financial instrument. However, the process has been simplified, thanks to DeFi.

At the beginning of 2020, DeFi’s locked assets were worth $683 million, but by the end of the year, the value had increased to $14 billion, a growth rate of over 2000%. Even with criticism in some quarters, renowned investors like Elon Musk have played a vital role in popularising DeFi.

The Future of EthereumEthereum is the digital currency that’s expected to gain the most from the prevalence of smart contracts. DeFi is Ethereum-based, which means that Ethereum becomes more popular as DeFi’s popularity increases.

Investors should keep their eyes on Ethereum, thanks to several reasons, including the enhanced features coming to Ethereum 2.0. With the upgrade, transactions will be processed faster and securely, beating all the other cryptocurrencies. With such improvements, it’s bound to appeal to users.

ETHUSD Chart By TradingViewEthereum began the year on an uptrend and the price hit an all-time high of $2000. The price upsurge coupled with the above-mentioned advantages earns it a slot for a trend to watch out for in the space.

Key TakeawayUnderstandably, most cryptocurrency investors get carried away with Bitcoin and its performance, overlooking other cryptocurrencies.

However, there are more lucrative opportunities in the cryptocurrency space. Opportune trends, including the above-mentioned, have begun shaping up and any investor worth their salt should be on the lookout.

origin »Bitcoin price in Telegram @btc_price_every_hour

Allion (ALL) на Currencies.ru

|

|