2018-7-14 19:14 |

Finance

Shrimpy cryptocurrency portfolio management is a platform that helps investors curate a portfolio with automated investment strategies.

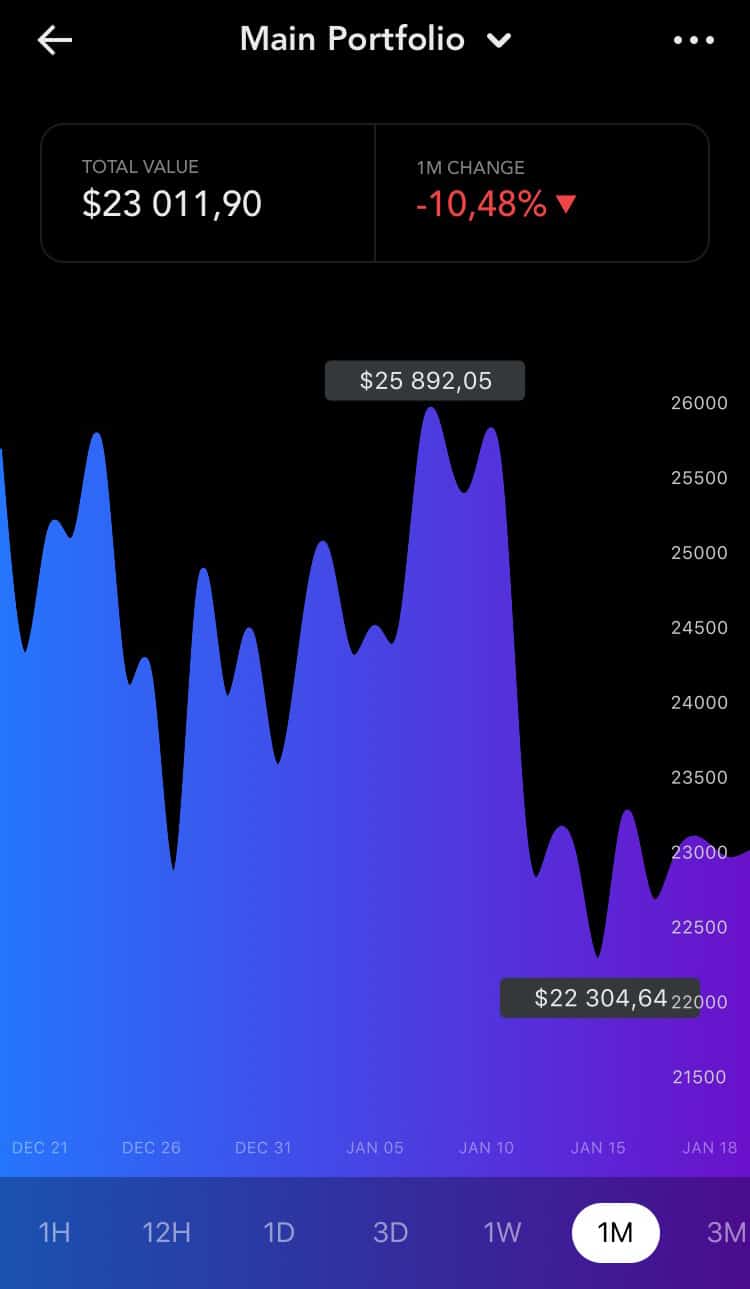

With the company’s portfolio experience, the Shrimpy team published a study that gives an informative technical analysis comparing two types of cryptocurrency investment methods: rebalance against holding (hodl).

Another form of investment that some cryptocurrency proponents use is called ‘rebalancing’ which involves a portfolio rebalance only when the asset allocation has dropped below a predetermined threshold.

“The second relation is that decreasing the rebalance period (increasing rebalance frequency) increased the performance of a portfolio.

Ten Asset Portfolio With a 1-Hour Rebalance Period Outperformed Hodl by 234%

Shrimpy’s experiment also compared portfolios that hold ten assets but have a different rebalance period, which showed some interesting statistics.

Bitcoin price in Telegram @btc_price_every_hour

Global Cryptocurrency (GCC) на Currencies.ru

|

|