2020-7-11 15:00 |

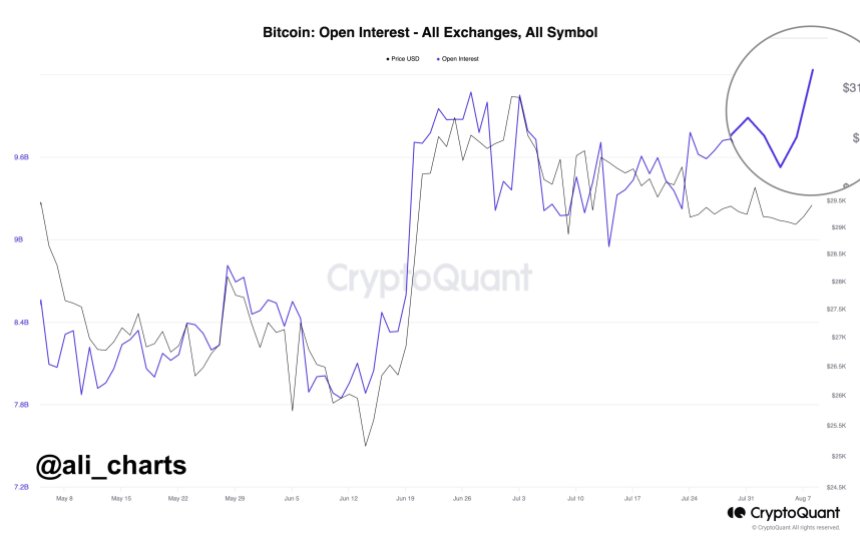

When analyzing Bitcoin, many investors cast aside fundamentals and only focus on the price action. Hence, as the cryptocurrency market has stalled over the past two months, data has shown that the market has grown increasingly bearish. The funding rate of BTC futures markets, which shows the sentiment of the market, is once again negative. Looking at the fundamentals, though, research firms and funds are extremely bullish. The head of trading at one prominent blockchain fund is so optimistic that he said in May that the “macro case for Bitcoin has never been more obvious.” Weiss Crypto Ratings’ 3 “Big” Reasons to Be Bullish on Bitcoin The crypto arm of markets research giant Weiss Ratings — Weiss Crypto Ratings revealed three “big” reasons they’re bullish on BTC. They are as follows: “QE Infinity” monetary policy: Earlier this year, to combat the economic effects of the pandemic, the Federal Reserve announced extremely easy monetary policies. In a statement or two, the term “unlimited” or “limitless” was used to describe the central bank’s intents. Weiss Crypto Ratings analysts wrote that Bitcoin will benefit from an influx of fiat money into the economy: “To this end, it recently printed $2.9 trillion in new paper money in the space of just 13 weeks. That works out to about $22 million a minute. Historically, investors pour into gold as a safe haven when they lose confidence in paper money. This time, they’re going to pour into Bitcoin as well.” Institutional money is entering the Bitcoin and crypto markets: Grayscale’s Bitcoin Trust (GBTC) has seen a strong influx of investment over recent weeks. Some reports say that there are more coins going into that single fund than there are coins mined. Also, through other vehicles like futures and crypto funds, it is clear that institutions want Bitcoin and blockchain investments. The stock to flow model predicts BTC will rally to $70,000: Weiss Crypto Ratings’ own take on the stock to flow model indicates that Bitcoin will hit $70,000 by the middle of 2021. Bloomberg’s Mike McGlone Lists Many More Factors Bloomberg senior commodity analyst Mike McGlone has identified a confluence of other factors implying that Bitcoin is poised to rise. One of those is the increasing number of active BTC users after the bear market that was seen in 2018 and 2019. He said on the matter last week: “The number of active Bitcoin addresses used, a key signal of the 2018 price decline and 2019 recovery, suggests a value closer to $12,000, based on historical patterns. Reflecting greater adoption, the 30-day average of unique addresses from Coinmetrics has breached last year’s peak.” McGlone has also identified as Bitcoin’s increasing correlation to gold and the CME’s uptick in Bitcoin open interest as reasons to be bullish. Featured Image from Shutterstock Price tags: xbtusd, btcusd, btcusdt Charts from TradingView.com Crypto Research Firm Identifies 3 "Big" Bitcoin Bull Run Catalysts

Similar to Notcoin - Blum - Airdrops In 2024

Market.space (MASP) на Currencies.ru

|

|