2021-5-18 18:00 |

Investing in the crypto market isn’t for the faint-hearted, and with the gazillions of new apps, dApps, and protocols launching nearly every day, it’s hard to keep track of where and how to invest.

Egalitarian investingCrypto investment platform Launchpool is trying to change that. The project’s a pre-IDO (initial DEX offering) tool that allows its community to invest into upcoming projects and protocols via simply staking the LPOOL tokens and reaping the benefits of an allocation, at premium (private) prices.

Roxana Nasoi, Head of Community at Launchpool told CryptoSlate:

“We entered a second crypto bull-run, yet it feels like we haven’t learned our lesson for the most part. There are still a lot of gamble and lottery-type opportunities in the crypto industry. If we want to change that, we need to teach people what an investment cycle is all about. The risks, the returns, the process. We can’t do that unless we provide the context and the instruments. Launchpool is an investment instrument, with clearly defined rules, requirements, and prerequisites, that opens up allocations in digital assets at prices that funds would typically get early-on. Same vesting schedules apply, encouraging investors to think long-term rather than from a “get rich scheme” or a classic “pump-and-dump”. A work in progress, but 3 months in, and the community response has been positive, which encourages us to continue improving the product”.

Here’s how it works: Funds provide a portion of their deal flow to the Launchpool platform on exactly the same terms they receive as early investors. $LPOOL holders stake $LPOOL to access a related portion of the deal on offer.

This allows project tokens to be obtained at the same price that large crypto investment funds get them, promoting equality among stakeholders.

Launchpool, under its ‘Egalitarian Investing’ ethos, believes project stakeholders are as important as each other, and hence offers more sophisticated market participants the opportunity to get in on private round sales.

Six projects that have been offered and launched via the platform so far: exchange ecosystem Unizen, DeFi strategy optimizer Mixsome, staking aggregator Unifarm, community-led loans project Greenheart CBD, AI-powered DeFi portfolios tool SingularityDAO, and Bitcoin-to-Ethereum bridge BTC Proxy. Launchpool aims at offering 8 Allocation Mining Events for the community to explore on a monthly basis, with a goal to achieve a $1million liquidity pool at any given time.

Mini-VCs are coming to LaunchpoolComing next for Launchpool—apart from even more projects for the 30,000 member-strong community—is the upcoming incubator project, one that takes community investing to the next level and allows participants to act as ‘mini-VCs.’

“We are developing our own Launchpool incubator to find and develop founders and crypto projects from their nascent stages until launch,” said Launchpool CEO Richard Simpson in a quarterly update letter.

He added:

“That means for the first time, our community will be able to act like a mini-VC, investing early in projects, taking on the risk and potential reward of seed round prices.”

The Launchpool incubator will allow LPOOL holders to stake their tokens in the Lab ‘Pool Up Pools’ (Lab PuPs) to mine pre-seed allocation. These rounds are, by definition, small, carry most risk, but are the earliest and lowest token prices.

“With Launchpool Labs our community will be able to invest financially, and emotionally, in projects at early stages of development, taking on both the risk and the reward of thinking and acting like a mini-VC,” the firm said in the release.

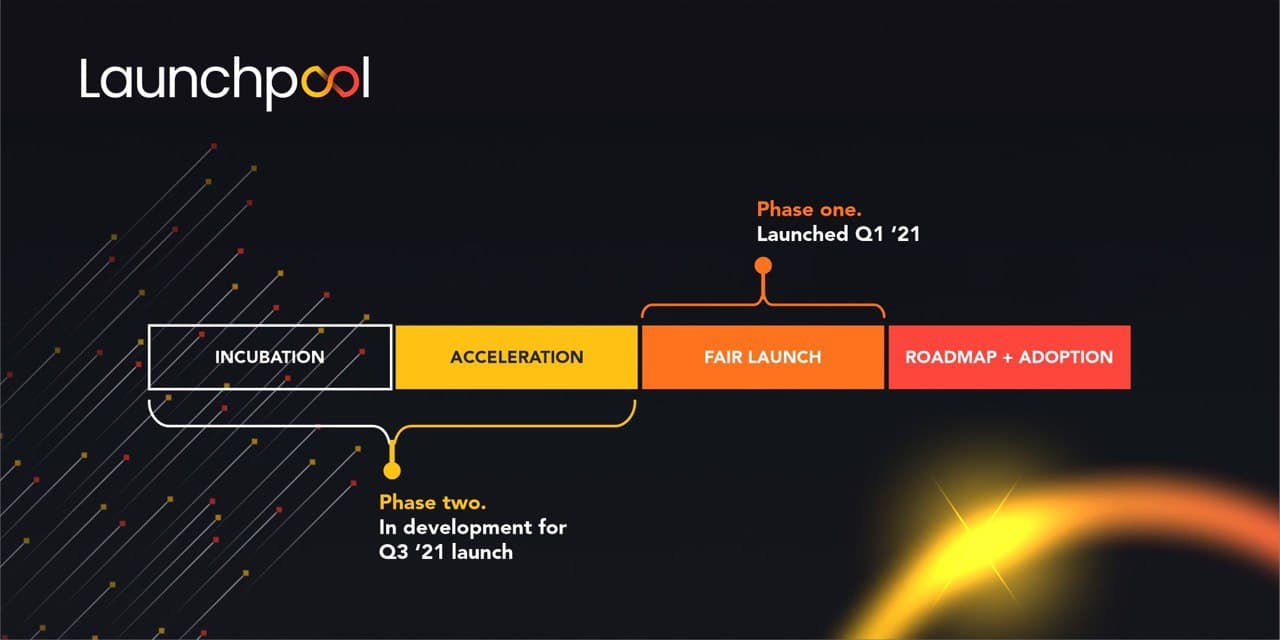

One of the key takeaways for LPOOL holders is that the incubator is created as a reward for the Launchpool community. The move’s in line with the second phase of the broader Launchpool roadmap, as the below image shows.

Launchpool investors include crypto fund heavyweights like Alphabit, and 11 other top tier funds – FBG Capital, Jun Capital, to name a few. LPOOL is valued at over $40 million (by market cap) at press time.

The post Crypto investment platform Launchpool wants users to ‘be their own VC,’ Introduces Launchpool Labs Incubator appeared first on CryptoSlate.

origin »Bitcoin price in Telegram @btc_price_every_hour

Emerald Crypto (EMD) íà Currencies.ru

|

|