2018-12-13 22:29 |

Could Some Exchanges Be Manipulating Their Trading Volume?

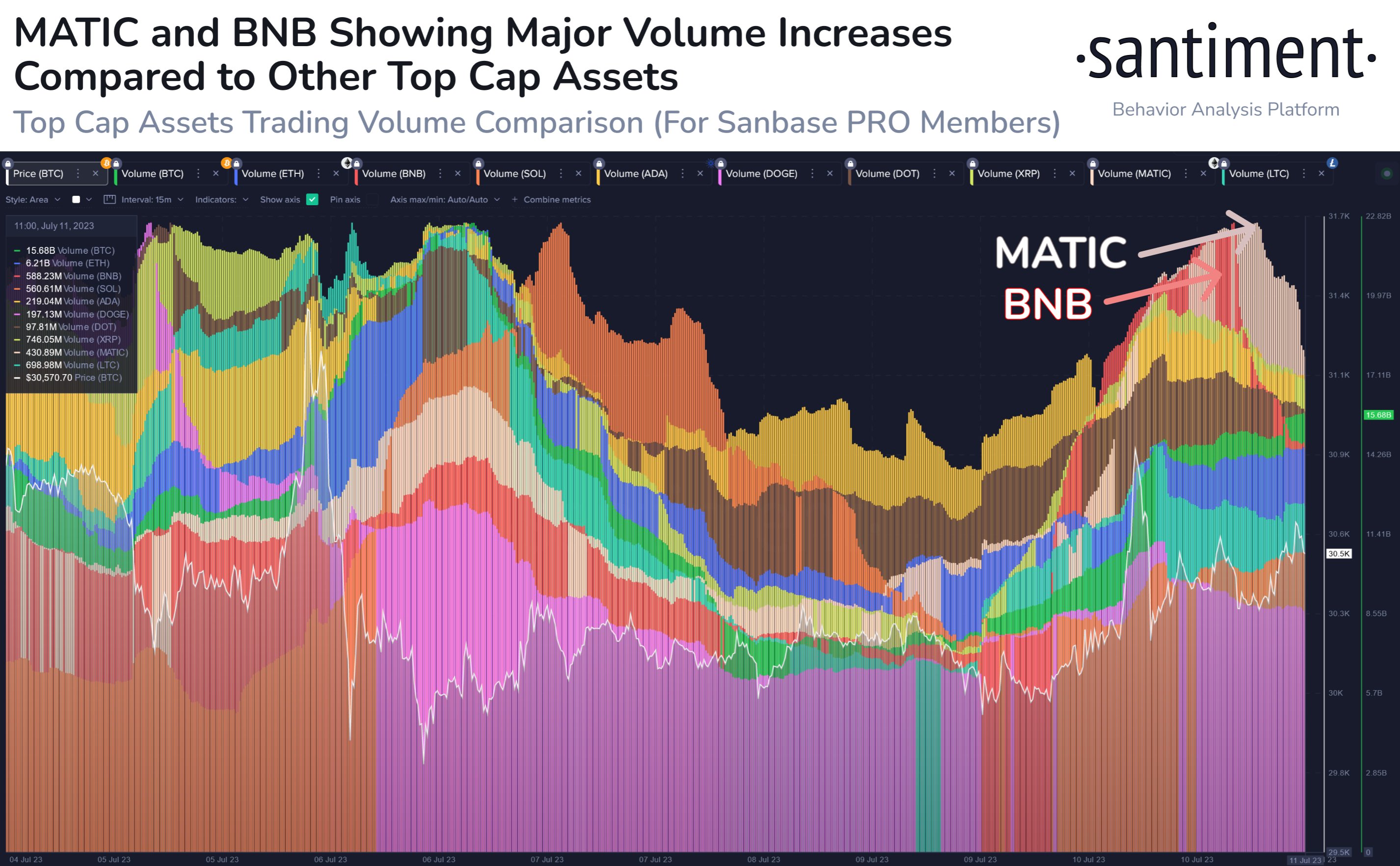

In a recent article released by The Block, the crypto analyst Larry Cermak and other team members behind the site analysed trading volume in different exchanges in the market. The main intention behind it was to understand whether trading volume was being faked in some platforms or not.

Back in August, the Blockchain Transparency Institute released a research report in which they show that around $6 billion dollars in trading volume are currently being faked. That means that the industry could be experiencing an important level of fraud. Furthermore, the report shows that 67% of daily volume was also being wash traded.

In order to have a better overview of this issue, The Block analyzed website traffic in the largest exchanges and compared it to their trading volume. The data gathered by the analysts was provided by SimilarWeb.

Analysts selected 18 different exchanges and were able to analyse their traffic in November. Of all these exchanges, Binance registered 32 million visits in November. The second one was Coinbase with around 25 million visitors.

They have also analysed the trading volume in each of this exchanges. As expected, Binance registered the largest trading volume, close to $22 billion. Other exchanges such as OKEx, or Huobi managed more than $10 billion in trading volume.

Furthermore, when they divided the trading volume by the number of estimated visitors, the results were surprising. There are some exchanges that have a larger amount of funds invested per visit than others. The two exchanges with the highest volume per visit were Digifinex and ZB.com.

This situation leads to different answers and possibilities about what’s happening. It is possible that some exchanges are faking their volume. But it is also possible for some exchanges to have larger traders. There are other issues that could have a smaller impact on the number of funds transacted by a user such as trading via API or bad data processed by SimilarWeb.

The report released by The Block has also analyzed where traffic comes from. The United States is the country with the largest number of traders with 22.33 million visits. The US is followed by Russia, Turkey, Vietnam, Brazil, China and Ukraine.

Larry Cermak wrote as follows about the information gathered:

“The overall analysis shows that traffic and volume are not always correlated. The volume per one visit could potentially be a significant metric in identifying faked volume but could indicate a different target group of customers (retail vs. large clients).”

There is little clarity about the traffic that exchanges have. However, it is possible to see that not necessarily the most popular exchanges in terms of visit handle the most volume.

Similar to Notcoin - TapSwap on Solana Airdrops In 2024

Open Trading Network (OTN) на Currencies.ru

|

|