2023-5-22 15:33 |

Coinspeaker

Crypto Exchange Hotbit Suspends Operations after Five Years of Service

Hotbit, a centralized cryptocurrency exchange (CEX), has suspended its business operations. The company announced the decision on May 22, 2023, citing several factors including the change in crypto market trends, the depegging of stablecoins from their $1 benchmarks, and the deterioration of operating conditions.

Hotbit was founded in 2018 and quickly became one of the most popular exchanges in the industry. The firm offers users various options to trade digital assets, including meme tokens such as SHIB, KSM, and GRIN.

Centralized Exchanges Are Becoming Increasingly CumbersomeIn addition to spot trading options, the exchange provides staking services allowing users to earn passive income from their crypto holdings. However, the company’s success was not without its problems. In April 2022, the exchange was involved in legal disputes when law enforcement investigated its former staff for possible violations of criminal laws.

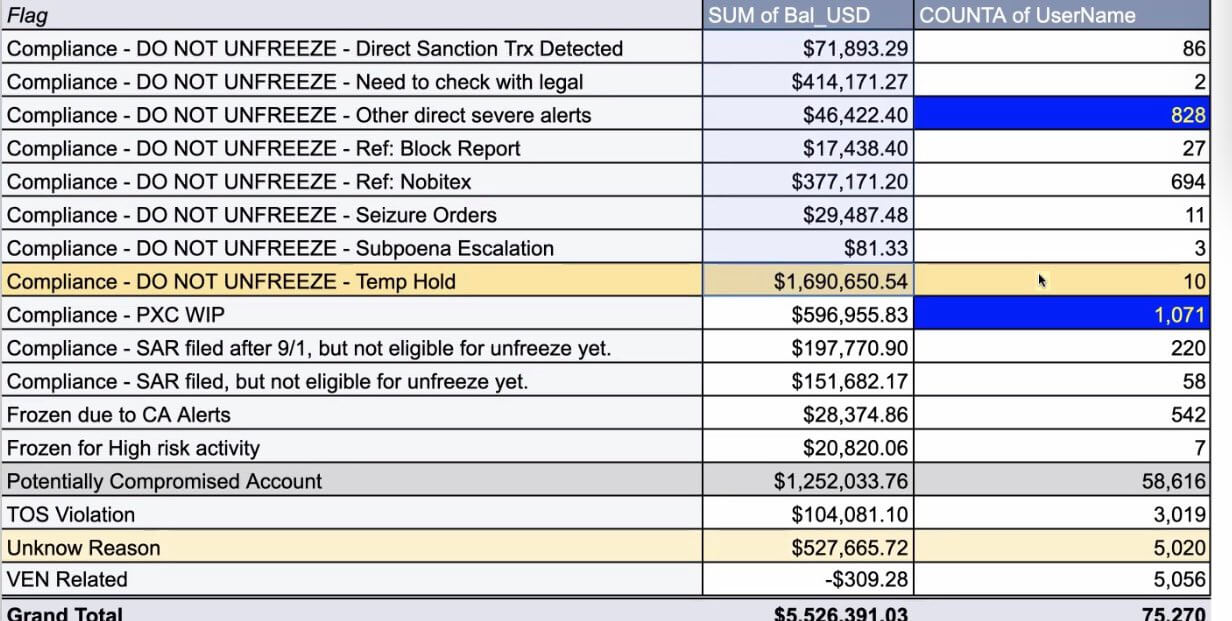

The incident took a toll on the company’s business as authorities froze its assets, forcing it to halt operations such as deposits, withdrawals, and funding functions for weeks.

The company also blamed changes in market trends for its closure, noting that the collapse of centralized exchanges has caused the industry to either embrace regulations or become more decentralized.

Hotbit believes that “centralized exchanges are becoming increasingly cumbersome, with highly complex and interconnected businesses that are difficult to comply with, whether for compliance or decentralization and are unlikely to meet long-term trends.”

Aside from the change in market trends and deterioration of operating conditions, Hotbit encountered numerous setbacks, such as cyber security theft and exploitation of project defects by malicious actors, contributing to its decision to shut down operations.

The exchange, which boasts of millions of users, has urged its customers to withdraw their assets from the platform. Hotbit said it will continue supporting the withdrawal until June 21, 2023, after which all accounts will be closed.

Other Crypto Companies That Have Exited the MarketHotbit has been one of the many crypto companies to exit the market in recent months. In April, Paxful, a peer-to-peer (P2P) crypto exchange servicing the African region of Nigeria, suspended its operations. The company’s CEO, Ray Youssef, cited regulatory hurdles and staff departure as reasons for its closure.

That same month, another digital assets service provider Bit4You halted its operations after its partner CoinLoan, which holds its customers’ assets, declared bankruptcy in an Estonian court.

The crypto industry is in flux, and many companies struggle to weather the storm. Hotbit, Paxful, and Bit4You closures are signs of the challenges facing the emerging economy as the market continues to tumble. However, It remains to be seen how many more companies will be forced to exit the market in the coming months.

nextCrypto Exchange Hotbit Suspends Operations after Five Years of Service

Similar to Notcoin - Blum - Airdrops In 2024

Hotbit Token (HTB) на Currencies.ru

|

|