2022-11-12 16:44 |

What a week for crypto.

The collapse of one of the industry’s key exchanges, FTX, has thrown the entire market into disarray (deep dive here). With a hole on the balance sheet of reportedly up to $8 billion, the markets have wobbled again.

It is the biggest event in crypto since May, when Luna, the former top 10 coin, death spiralled to zero alongside the UST stablecoin. Plotting the price of Bitcoin over the course of the year shows how these two episodes pulled the price down in both instances.

I have done a lot of work on the correlation between Bitcoin and the stock market this year, most recently this deep dive. I plotted the correlation and noticed that it picked up markedly in April of this year – right when we transitioned to a new interest rate regime.

As this recent report by Bitfinex indicates, the correlation began to fall in October – also reflected in the above chart. The report also indicated that performance of Bitcoin and Ethereum this year was better than tech stocks such as Meta and Snap.

In the past week, however, we have seen a large divergence. Of course, this is due to the FTX debacle. Indeed, had FTX not imploded, it is interesting to fantasise about where Bitcoin may have been. A positive inflation reading caused the stock market to rocket upwards, with the Nasdaq jumping 7.5% and the S&P 500 adding over 5%.

While Bitcoin did rebound, plotting the prices over the course of the year show that this is the third big deviation between the two asset classes: the first being the Luna collapse (May 8th) and Celsius suspending withdrawals, signalling their collapse (June 12th).

The data paints an interesting picture. While Bitcoin has been following crypto all year, it remains prone to huge idiosyncratic risks. Its volatility is also a cut above the stock market, to put it mildly. Look no further than the chart I plotted below of the daily price change of both asset classes.

In conclusion, Bitcoin very much remains prisoner to the uncertain macro climate we find ourselves in. Inflation readings and the actions of the Federal Reserve remain key, who have been hiking interest rates at unprecedented speed.

However, crypto does still retain idiosyncratic risks – as the events of this week indicate. Prior to FTX, we also saw the Luna collapse and Celsius incident send crypto markets tumbling while the stock market carried on as usual.

IT will be interesting to track the correlation and volatility in the long run, but for the moment – and at least the foreseeable future – crypto remains a significant cut above when it comes to risk.

The post Crypto deviates from stocks for third time this year appeared first on Invezz.

Similar to Notcoin - Blum - Airdrops In 2024

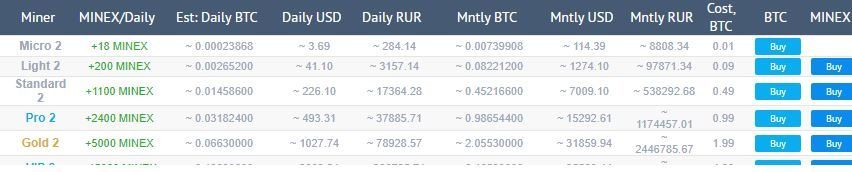

Emerald Crypto (EMD) на Currencies.ru

|

|