2020-11-28 16:02 |

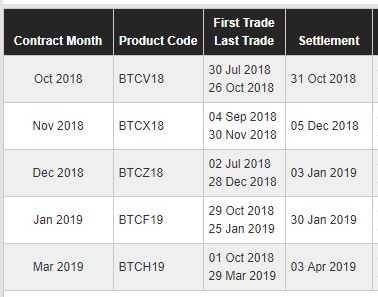

Cryptocurrency derivatives exchange Bybit said it is launching BTC/USD quarterly futures contract. According to the announcement, the futures contract will go live on November 30, with two contracts offered at the launch. Both contracts – BTCUSD1225 and BTCUSD0326 – will start on December 20, 2020, and March 26, 2021, respectively.

The exchange also announced the introduction of a wide range of products and features on its exchange platform. The company’s online trading platform has been operating for two years, and there are more features to come as it enters its third year.

The plan is to include quarterly futures contracts as well as sub-accounts, as it tries to integrate the MetaTrader foreign exchange trading platform into the exchange’s portal.

No funding fee for the futures contractAccording to Bybit, there is no funding fee charged to the new futures contract. That means investors and traders in the platform can hold their positions without any charges throughout the contract.

Bitcoin futures enable the trader to transact digital currencies at a specific future date and a set price, just as it is with the conventional futures contract.

Offering quarterly Bitcoin futures contracts is not a new phenomenon in the Bitcoin (BTC) and crypto industry, as Bybit is not the first to offer such contracts. Malta-based exchange Binance has been providing such contracts since January this year. Other top exchanges have offered similar contracts. The idea is to give traders more trading options with multiple tools and features.

Strengthening the exchange’s value propositionCo-founder and Chief Executive Officer of Bybit Ben Zhou has commented on the development. He said the company has always thrived to improve its service offerings to traders on its platform. “At Bybit, we are continually looking at ways we can improve the services we offer,” he said.

Zhou further reiterated that the introduction of the features and products will increase its value proposition and take crypto derivatives trading to the next level.

According to the exchange, traders can make use of hedge mode or one-way mode, with locked positions that are not subject to fees or charges.

The post Crypto derivatives exchange Bybit rolls out quarterly Bitcoin Futures appeared first on Invezz.

Similar to Notcoin - Blum - Airdrops In 2024

Filecoin [Futures] (FIL) на Currencies.ru

|

|