2020-1-16 19:31 |

Voyager Digital, the cryptocurrency brokerage company has just registered three new stablecoins. While making the announcement on Wednesday, the company also mentioned that it would soon make it possible for its clients to earn interest in their crypto assets.

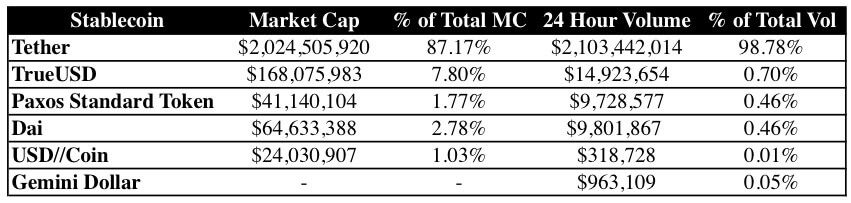

The company stated that its support of true USD (TUSD), USD Coin (USDC), and tether (USDT), meant that its clients were now better placed to fund their trading accounts as well as get to manage risks without having to visit a banking institution.

As of today, Tether (USDT), USD Coin (USDC), and True USD (TUSD) are available on Voyager with interest coming Feb. 1.

Learn more: https://t.co/viRnnoadDu

— Voyager (@investvoyager) January 15, 2020

Stephen Ehrlich On the New ListingVoyager CEO and co-founder Stephen Ehrlich spoke about these new listings and had the following to say about them:

“Adding these three new stablecoins to our platform gives our customers an alternative funding mechanism and another means to hedge their risk in the crypto market.”

The cryptocurrency brokerage company makes it possible for both its institutional and retail traders to engage in commission-free trading activities on various crypto exchange platforms. Investors can use a single account when trading.

According to the company spokesperson, Voyager has invested in the latest tech innovations meant to ensure that their clients get access to the best crypto prices available. The company is able to earn money by taking a spread from trading orders that have been finished at better closing levels than when the trading submissions were made.

Stephen Ehrlich was formerly the E*Trade Chief Executive Officer. He started Voyager together with the former CTO of Uber, Oscar Salazar during the summer season of 2018. Voyager started to offer interest on three percent APR on BTC at the start of November 2019. This was after it has acquired Ethos, the wallet startup sometime in early 2019.

While still on the new listings, Stephen Ehrlich went on to note that:

“Voyager customers will also be able to earn interest on these stablecoins, giving them another way to grow wealth in the crypto industry.”

Withdrawals and deposits for the three newly registered stablecoins began officially on Wednesday, 15th January 2020. It’s expected that clients will start to earn interest on their holdings as from 1st February.

Similar to Notcoin - Blum - Airdrops In 2024

Voyager Token (VGX) на Currencies.ru

|

|