2023-6-7 19:48 |

The U.S. Securities and Exchange Commission (SEC) today sued Coinbase just a day after cracking down on Binance.

The regulatory body alleges in the new lawsuit that Coinbase failed to register as a broker, national securities exchange, or clearing agency despite providing these services to customers. The SEC also alleges that a number of tokens offered by the crypto exchange qualify as securities.

SEC Sues Coinbase For Alleged Securities ViolationsThe SEC has dropped the hammer on Coinbase, a day after the regulator took similar action against Binance, the world’s largest crypto exchange by market capitalization.

According to the official case file, Coinbase had operated as an unregistered security broker since 2019, nearly two years before the company became the first publicly traded cryptocurrency exchange in April 2021.

The SEC also alleges that the cryptocurrency exchange “made available for trading, crypto assets that are being offered and sold as investment contracts, and thus as securities.”

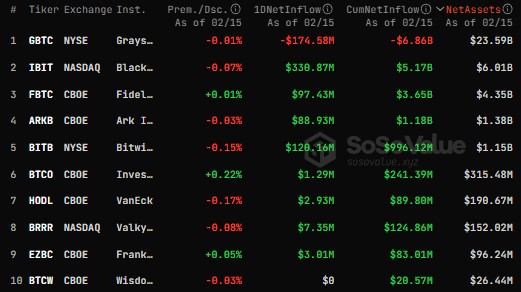

Tokens powering Solana, Cardano, Polygon, The Sandbox, Filecoin, Axie Infinity, Chiliz, Flow, Internet Computer, Near Protocol, Voyager Dash, and Nexo have all been identified as securities by the SEC.

Back in March, the securities watchdog served Coinbase with a Wells Notice to hint that it would soon bring an enforcement action against the company. Coinbase responded to the Wells Notice in April.

“Coinbase has elevated its interest in increasing its profits over investors’ interests, and over compliance with the law and the regulatory framework that governs the securities markets and was created to protect investors and the U.S. capital markets,” the filing today reads.

The SEC also pointed to Coinbase’s staking service, alleging that it includes five stackable crypto assets, making the program an investment contract and, therefore, an area where the exchange violated securities laws.

Commenting on the charges against Coinbase, SEC chair Gary Gensler noted that the crypto trading platform denied its clients’ essential protections that prevent fraud and manipulation and evaded proper disclosure and safeguards against conflicts of interest.

The SEC wants the defendants — Coinbase, Inc. and Coinbase Global, Inc. — to be “permanently restrained and enjoined” and no longer able to do business within the U.S. Notably, unlike the Binance lawsuit, the SEC has not named founder and CEO Brian Armstrong or any other executive.

Still, this is not Coinbase’s first time locking horns with the American regulator. Last year the exchange, helmed by Brian Armstrong, petitioned the SEC to come up with new rules tailored to digital assets. In April, already under a publicly-acknowledged probe by the agency, Coinbase took a gamble and sued the SEC, hoping to force the agency to respond to its petition.

Coinbase Targeted By State RegulatorsCoinbase is also facing scrutiny from a task force of ten U.S. state securities regulators after getting sued by the SEC on the same day.

State regulators from Alabama, California, Illinois, Kentucky, Maryland, New Jersey, South Caroline, Vermont, Washington, and Wisconsin have issued a “show cause order” against Coinbase and its parent corporation Coinbase Global alleging that they broke the law by offering the staking rewards program “Earn” to state residents.

Coinbase has 28 days to explain why it should not be directed to cease and desist from selling unregistered securities in Alabama.

origin »Bitcoin price in Telegram @btc_price_every_hour

Safe Exchange Coin (SAFEX) на Currencies.ru

|

|